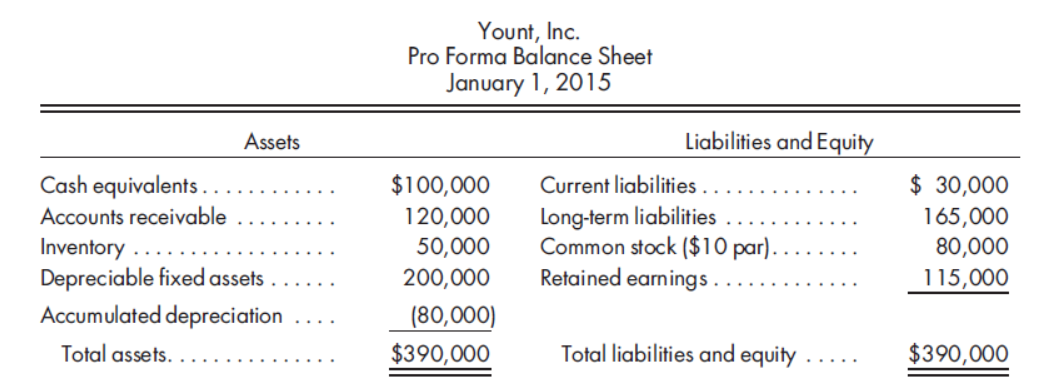

Yount, Inc. Pro Forma Balance Sheet January 1, 2015 Assets Liabilities and Equity $ 30,000 165,000 80,000 115,000 Cash equivalents . $100,000 120,000 50,000 Current liabilities . Long-term liabilities Common stock ($10 par). Retained earning s. Accounts receivable Inventory Depreciable fixed assets Accumulated depreciation 200,000 (80,000) $390,000 Total assets. Total liabilities and equity $390,000

Moon Company is contemplating the acquisition of Yount, Inc., on January 1, 2015. If Moon acquires Yount, it will pay $730,000 in cash to Yount and acquisition costs of $20,000.

The January 1, 2015, balance sheet of Yount, Inc., is anticipated to be as attached:

Fair values agree with book values except for the inventory and the

which have fair values of $70,000 and $400,000, respectively.

Your projections of the combined operations for 2015 are as follows:

Combined sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $200,000

Combined cost of goods sold, including Yount’s beginning inventory, at book value,

which will be sold in 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120,000

Other expenses not including depreciation of Yount assets . . . . . . . . . . . . . . . . . . . . . . . . 25,000

Depreciation on Yount fixed assets is straight-line using a 20-year life with no salvage value.

1. Prepare a value analysis for the acquisition and record the acquisition.

2. Prepare a pro forma income statement for the combined firm for 2015. Show supporting calculations for consolidated income. Ignore tax issues.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images