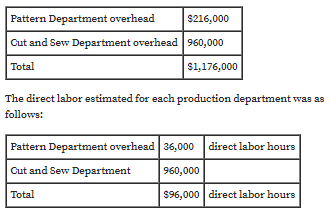

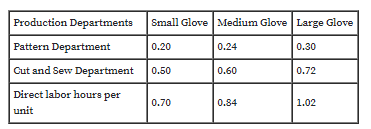

Pattern Department overhead $216,000 Gut and Sew Department overhead 960,000 Total $1,176,000 The direct labor estimated for each production department was as follows: Pattern Department overhead 36,000 direct labor hours Cut and Sew Department 960,000 Total $96,000 direct labor hours Production Departments Small Glove Medium Glove Large Glove Pattern Department 0.20 0.24 0.30 Cut and Sew Department 0.50 0.60 0.72 Direct labor hours per 0.70 0.84 1.02 unit

multiple production department factory i=

perfomance Gloves,Inc. produces three size of sports gloves:small,medium and large.A glove pattern is first stenciled onto leather in the Pattern Department,where the gloves is cut and sewed together.

Perfomance Gloves uses the multiple production department factiey overhead rate methid of allocating

The direct labor estimated for each production department was as follows:

Direct labor hours are used to allocate the production department overhead to the products.The direct labor hours per unit for each product for eacg production department were obtained from the engineering records as follows:

a) Determine the two production department factory overhead rates.

b) Use the two production department factory rates to detrmine the factory overhead per unit for each product.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images