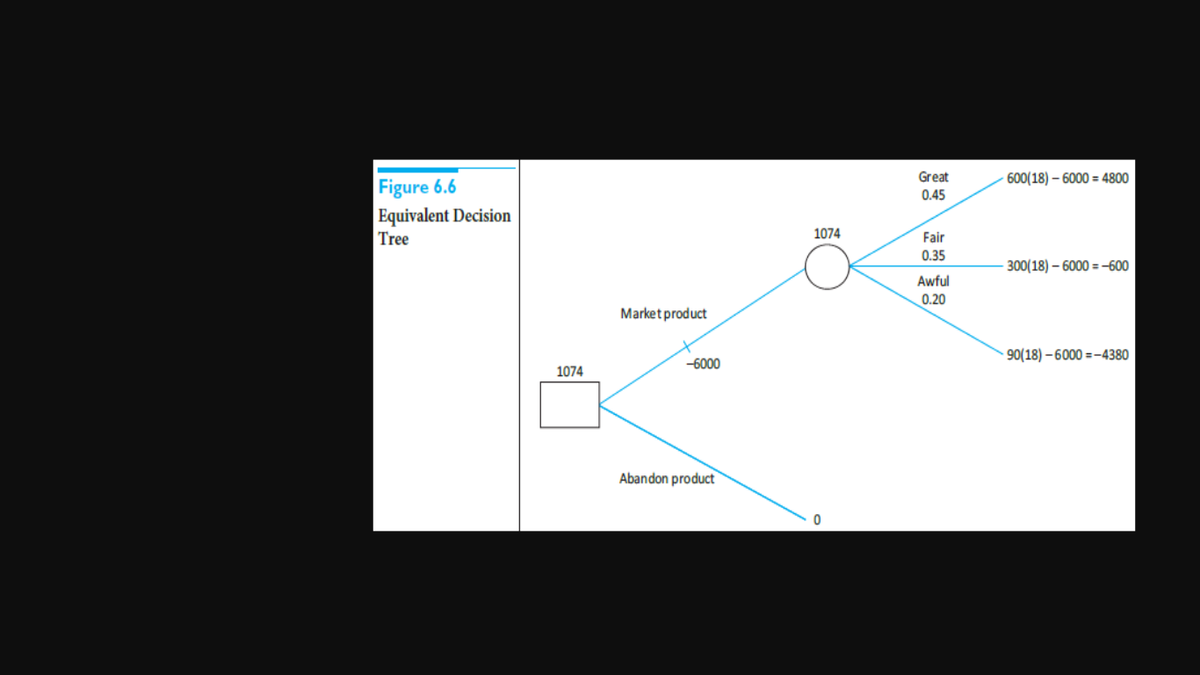

Great - 600(18) – 6000 = 4800 Figure 6.6 Equivalent Decision Tree 0.45 1074 Fair 0.35 - 300(18) – 6000 = -600 Awful 0.20 Market product - 90(18) – 6000 =-4380 -6000 1074 Abandon product

Great - 600(18) – 6000 = 4800 Figure 6.6 Equivalent Decision Tree 0.45 1074 Fair 0.35 - 300(18) – 6000 = -600 Awful 0.20 Market product - 90(18) – 6000 =-4380 -6000 1074 Abandon product

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section9.5: Multistage Decision Problems

Problem 18P

Related questions

Question

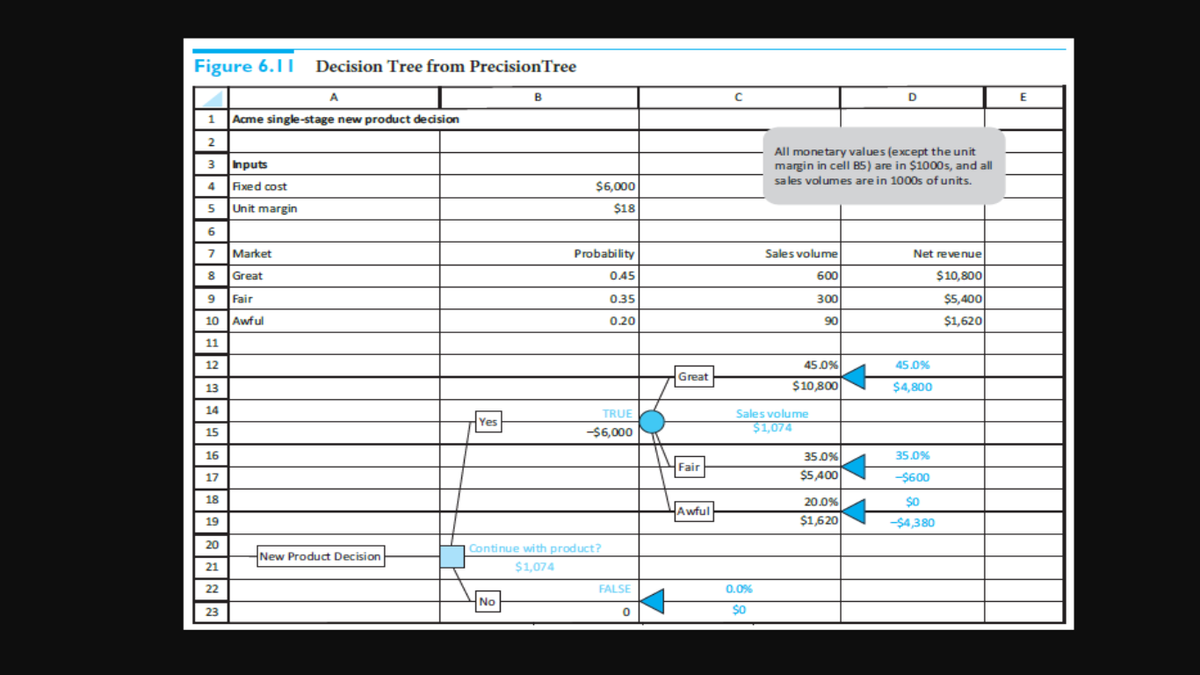

Explain in some detail how the PrecisionTree calculations in Figure 6.11 for the Acme problem are exactly the same as those for the hand-drawn decision tree in Figure 6.6. In other words, explain exactly how PrecisionTree gets the monetary values in the colored cells in Figure 6.11.

If your answer is negative number, enter "minus" sign.

| Market | EMV | |

| Great | ( $18 × - $ ) = $ | |

| Fair | ( $18 × - $ ) = $ | |

| Awful | ( $18 × - $ ) = $ | |

| Total | 0.45 × __ $ + 0.35 × ___$ + 0.20 × ___ $ = ___ $ |

Transcribed Image Text:Great

600(18) – 6000 = 4800

Figure 6.6

Equivalent Decision

0.45

Tree

1074

Fair

0.35

300(18) – 6000 = -600

Awful

0.20

Market product

90(18) – 6000 =-4380

-6000

1074

Abandon product

Transcribed Image Text:Figure 6.11

Decision Tree from PrecisionTree

A

B

1

Acme single-stage new product decision

2

All monetary values (except the unit

margin in cell B5) are in $1000s, and all

sa les volumes are in 1000s of units.

3 Inputs

4 Fixed cost

5 Unit margin

$6,000

$18

6

7 Market

8 Great

Probability

Sales volume

Net revenue

600

$10,800

$5,400

0.45

9 Fair

10 Awful

0.35

300

0.20

90

$1,620

11

12

45.0%

45.0%

Great

13

$10,800

$4,800

14

TRUE

Sales volume

$1,074

Yes

15

-$6,000

16

35.0%

35.0%

Fair

17

$5,400

-$600

18

20.0%

Awful

19

$1,620

-$4,380

20

Continue with product?

New Product Decision

21

$1,074

22

FALSE

0.0%

No

23

$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,