0.997738 Coefficient Intercept Interest Rate -1.61538 14.88462 1. Are there factors other than interest rate charged for a loan that the finance manager should consider in predicting future car sales? 2. Is interest rate charged for a loan the most important factor to be considered in predicting future car sales? Explain your reasoning.The dealership's vice- president of marketing has requested a sales forecast at the prevailing interest rate of 7%. 3. As finance manager, what reasons would you convey to the vice-president in recommending this forecasting model? 4. Is the prediction of car sales at 7% a reflection of the current downturn in the economy? How might this impact the dealership's business?

0.997738 Coefficient Intercept Interest Rate -1.61538 14.88462 1. Are there factors other than interest rate charged for a loan that the finance manager should consider in predicting future car sales? 2. Is interest rate charged for a loan the most important factor to be considered in predicting future car sales? Explain your reasoning.The dealership's vice- president of marketing has requested a sales forecast at the prevailing interest rate of 7%. 3. As finance manager, what reasons would you convey to the vice-president in recommending this forecasting model? 4. Is the prediction of car sales at 7% a reflection of the current downturn in the economy? How might this impact the dealership's business?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter4A: Problems In Applying The Linear Regression Model

Section: Chapter Questions

Problem 1E

Related questions

Question

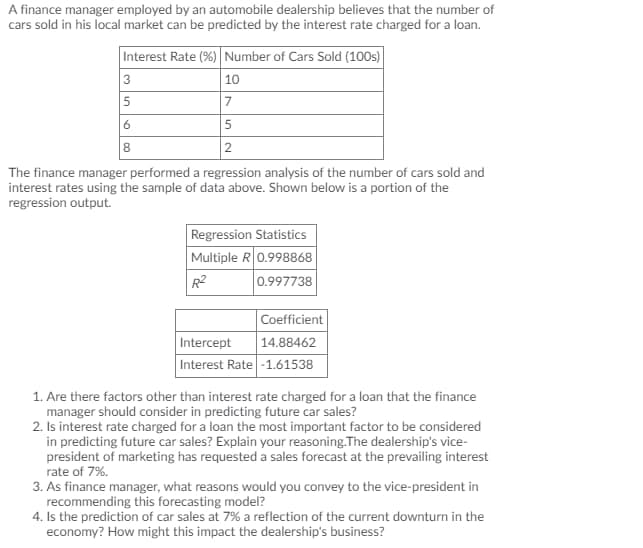

Transcribed Image Text:A finance manager employed by an automobile dealership believes that the number of

cars sold in his local market can be predicted by the interest rate charged for a loan.

Interest Rate (%) Number of Cars Sold (100s)

3

5

10

7

8

2

The finance manager performed a regression analysis of the number of cars sold and

interest rates using the sample of data above. Shown below is a portion of the

regression output.

Regression Statistics

Multiple R0.998868

R2

0.997738

Coefficient

|14.88462

Interest Rate -1.61538

Intercept

1. Are there factors other than interest rate charged for a loan that the finance

manager should consider in predicting future car sales?

2. Is interest rate charged for a loan the most important factor to be considered

in predicting future car sales? Explain your reasoning.The dealership's vice-

president of marketing has requested a sales forecast at the prevailing interest

rate of 7%.

3. As finance manager, what reasons would you convey to the vice-president in

recommending this forecasting model?

4. Isthe prediction of car sales at 7% a reflection of the current downturn in the

economy? How might this impact the dealership's business?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning