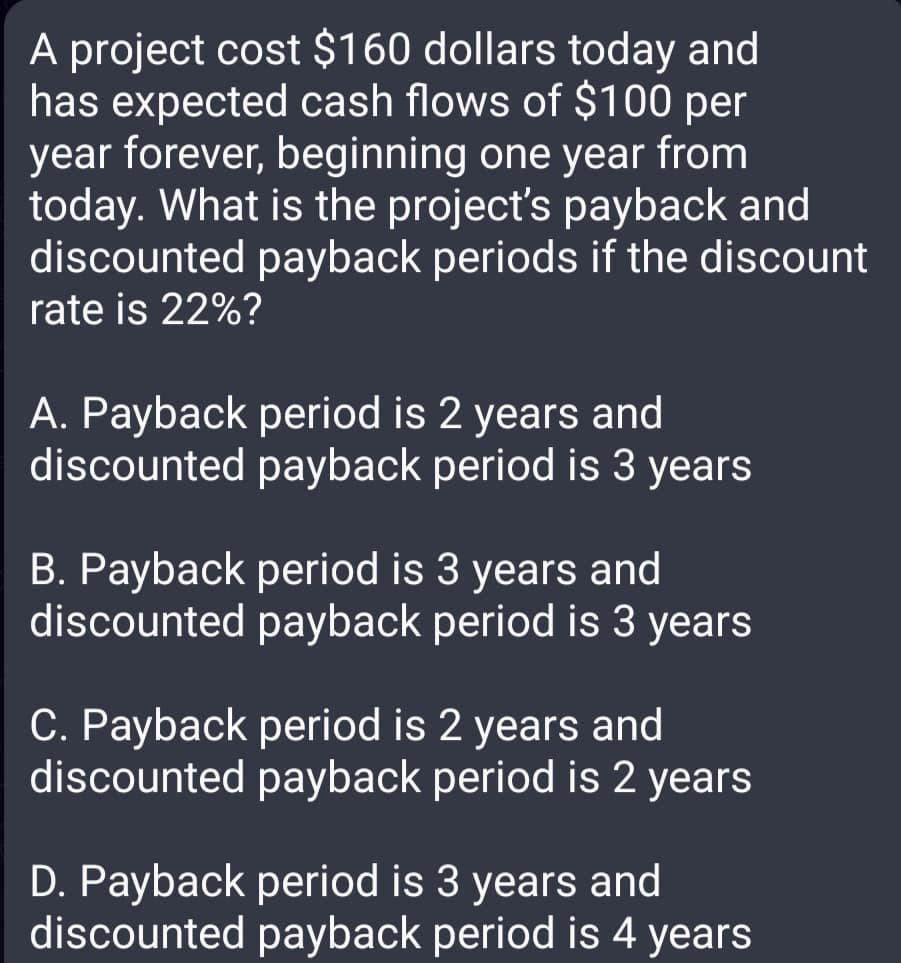

A project cost $160 dollars today and has expected cash flows of $100 per year forever, beginning one year from today. What is the project's payback and discounted payback periods if the discount rate is 22%?

Q: When the interest rate rises, bond values

A: GIVEN the interest rate raise,bond values is

Q: On the following graph, use the black curve (plus symbols) to illustrate the deadweight loss in thes...

A: Deadweight Loss: A deadweight loss is a cost to society created by market inefficiency, which occurs...

Q: Quantity Total Fixed Costs Total Variable Costs (Dollars) (Dollars) 0 180 0 1 180 80 2 180 140 3 180...

A: Solution: (a)Formula used (i) Total cost (TC) = Total fixed cost (TFC)+ Total variable cost (TVC) (i...

Q: Paddy has lots of cousins. With a family reunion in the near future, Paddy decides to collect income...

A:

Q: 4. The total effect of a price change of a commodity is A. O Sustitution effect plus price effect B....

A: Commodity markets can be volatile, with movements that appear to have no rhyme or reason. Commodity ...

Q: 19. Normal profit is A. O Part of total cost B. O Part of economic profit C. O Total revenue minus t...

A: Answer: Normal profit: normal profit occurs when the economic profit is zero. Economic profit refers...

Q: The price of a product is expressed as p, PHP = 10 – 28D where D is the demand. Which of the followi...

A:

Q: Using this diagram calculate : 1) The producer surplus after change 2) The total surplus after the...

A: The amount that a producer gains from selling over the price at which they would otherwise be read...

Q: In the AD/AS model assume 2019 began with potential real GDP = $19.7 trillion, while actual real GDP...

A: 2019:- Potential GDP: $19.7 trillion Actual Real GDP: $19 trillion Price level: 210 Later:- Actual R...

Q: Save if the inverse demand function for toasters is p = 85 - 2Q what is the consumer surplus if the ...

A:

Q: Provide a brief description (1-2 sentences) of the lag effect.

A: The lag effect describes the time lag between the policy apply and the actual effect of the policy o...

Q: A farmer grows a bushel of wheat and sells it to a Miller for $20.00. The Miller turns the wheat int...

A: When a good is manufactured or produced in a factory, cost is incurred and production takes place fo...

Q: Demand and supply microanalysis about Economic graphs?

A: To find : What is demand and supply in economics.

Q: Imagine the following case study where two different countries: Albania and Belize have remained sel...

A: Since you have posted a question with multiple sub parts, we will solve first three subparts for you...

Q: Identify and describe the type of international business of Sushiro.

A: When a good is manufactured, cost analysis takes place for producing that good and process of busin...

Q: Consider the market for CD players, illustrated in the figure to the right. Suppose there are networ...

A: There is a network externality in the market for CD players. hence, the number of CD players demand...

Q: As we grow up, we are told about the virtues of thrift. Those who spend all their income are condemn...

A: Answer: We can analyze the prediction of "those who spend all their income are condemned to end p po...

Q: Which type of worker would earn the high income but has lesser marginal productivity? a.Fashion ...

A: At the marketplace, it can be seen that different occupation provide different range of income to th...

Q: Money prices microanalysis about vouch insurance?

A: Vouch Insurance Vouch Insurance is a new kind of startup insurance firm.Vouch's totally digitally de...

Q: All of the following will cause unemployment except: a.government policies b.stable prices c.qual...

A: Unemployment:- Unemployment refers to people who are qualified for a job and searching for a job and...

Q: Which of the following represents the domestic demand for goods? OC+1+ G- IM/ɛ O C+I+ G+ X + ɛlM O C...

A: The aggregate supply is the total amount of services and commodities that firms in an economic plan ...

Q: In your own opinion, what would happen to an operation or mission in military if there were no commu...

A: Communication is very important for handling the mission in the military. There are many individuals...

Q: Find the point (x,y) that solves the following problem: 1 1 u(х, у) — — In x +-In y s.t. PxX + руҮ —...

A: Given; Utility function; u(x,y)=12In x+13In y Pxx+PYy=m MUx=12×1x =12x MUy=13×1y =13y

Q: Devlin is a computer programmer who earned $30,000 in 2011. But on January 1, 2012 he opened a custo...

A: * SOLUTION :- Based on the given information the answer is (a) the Devlin's opportunity cost is = ...

Q: In the aftermath of the Great Recession, the Beveridge cuve in the US... A. ...has shifted to the ri...

A: The Beveridge curve is a graphical representation of the relationship between the unemployment rate ...

Q: ex pice might change in areas facing population growth

A: To find : How equilibrium price for air travel might change in areas facing population growth.

Q: When Jerry Garcia was alive he bought a house for $500,000 and made a $100,000 down payment. He obta...

A: here we calculate the monthly payments by the following method as follow;

Q: Why are efficiency taxes preferred to regulatory policies as methods remedy externalities?

A: Externalities alludes to circumstances when the impact of creation or utilization of labor and produ...

Q: The the nominal interest rate, the is the quantity of money demanded. O a. more variable; smaller O ...

A: The money demand is a function of the price level, income level, and nominal interest rate. The mone...

Q: The social exclusion approach implies that: a. people who are anti-social are anti-poor and hinder...

A: Social exclusion is a multi-faceted and complex process. This means lacking or being denied resource...

Q: 7. Good X is produced in a competitive market using input A. Explain what would happen to the supply...

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the questio...

Q: Question 38 I Long-term bonds are generally A less risky than short-term bonds and so pay higher int...

A: Long term generally refers to a period of maturity which lies between 10 years to 30 years.

Q: what are the recommendations for vouch insurance?

A: Vouch insurance is a firm that provides insurance for tech startups. Launched in 2019, it presently ...

Q: 29. For a given return on assets, holding other factors constant, Question 29 options: a) a...

A: Return on assets:- Return on assets (ROA) is an economic metric that compares how efficient a busine...

Q: Assuming that your firm is considering investment in a new project with the cash flows shown below. ...

A: Time CF Discount factor @10% Present value 0 - 3500 0.909 - 3500 1 1200 0.826 991.2 2 1350 0....

Q: Which of the following goods would you expect to be perfect substitutes for each other? Gumballs and...

A: Two goods are a perfect substitute for each other when these goods satisfy the consumer's needs in t...

Q: Female and Male labor force participation in the US have similar levels and have followed similar ti...

A: The labor force participation rate calculates the percentage of total working age population partici...

Q: Predict how each of the following events will raise or lower the equilibrium wage and quantity of lu...

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a...

Q: Paul consumes only books and DVDS. At his current consumption bundle, his marginal utility from DVDS...

A: Answer: Given, Marginal utility of book MUB=2Marginal utility of DVD MUD=13PB=$1PD=$12 The equilibri...

Q: Judy lives for two-periods. Her utility from consumption in periods 1 and 2 is given by U(C1,C2)=C1 ...

A:

Q: Greenmail Raider Do not Buy buy Management Raider 10 Management 10 Greenmail No greenmail Raider 15 ...

A: Backward induction is used by the Raider to pick takeover at the final decision node.

Q: In early 2019, the Powerball lottery was advertised as having a payoff of $750,000,000. The winner w...

A: Present value (PV) is the current value of a future amount of cash or stream of incomes given a pred...

Q: 1. What is a monopoly? What are anti-trust laws? How da these relate to the Epic Games vs. Apple law...

A: 1) Monopoly is defined as the single ruler, where there is a high barriers to entry and there is a l...

Q: Suppose that a consumer has $200 to spend on two goods: beer and pretzels. The price of beer is $6.0...

A: Given Price of beer (Pb)=$6 Price of pretzels (Pp)=$3 Pretzels are on x-axis and beer is on y axis....

Q: True or False 1. The future worth of a perpetuity from one (1) to n years is undefined because as n...

A: When talking about perpetuity, it is gheform of investms that is generally meant for infinite time.p...

Q: If there is a decreased demand for a financial asset. its yield will rise its current purchase price...

A: Demand for bonds shows that there exists an inverse relationship between the price of the bond and t...

Q: Suppose that the logging industry in Canada is unregulated, and anyone can cut-down a tree on public...

A: Social cost is the sum of private cost and external cost, if exists.

Q: Illustrate the market demand and market supply curves.

A: Many individuals purchase a particular good. Market demand curve for a good is the addition of the i...

Q: following table, select the amount of each good that each country exports and imports in the boxes a...

A: A country has a comparative advantage in manufacturing that good if the opportunity cost of manufact...

Q: he velocity of money represents: (a) Whether individuals are increasing or decreasing the quantit...

A: The concept of velocity of money and equation of exchanged was proposed by Irving Fisher

Step by step

Solved in 2 steps

- I want you to provide me the Cash Flow diagram of the problem. Only cash flow diagram, the solution is already there. Thanks in advance! The annual estimated cash flow is $140,000. The salvage value will be 12% of the initial price after 5 years. The discount rate (r) is 18% Let us assume the initial price of the doughnut machine be X. PV of cash inflows=PV of cash outflows$140,000×PVAF4,18%+.12X×PVF5,18%=X$140,000×2.69006180465+.12X×0.43710921621=X$376,608.652651=X-0.05245310594$376,608.652651=0.94754689406XX=$397,456.479475 The maximum purchase price of the doughnut machine is $397,456.48.(Need answer ASAP) A man decided to Invest in an equipment worth PHP 12,000,000.00 capital with the following data: Expected revenue - PHP 5.8M/year Cost of Operation and Maintenance - PHP2.4/year Taxes and Insurance. - 2% of the first cost/year Expected earnings is 12% minimum Life of the equipment is 5 years with expected value of PHP1.2M after 5 years a. Determine the desirable investment using ROR method and AW method b. What are the ways and means to make it desirable investment c. In what case we should use the present worth and future worth method of economy study?dont use excel i will 5 upvotes. Assuming a firm’s weighted average cost of capital is 12%, what is the discounted payback period of the following project? Year Net Cash Flow 0 -$375,000 1 $200,000 2 $200,000 3 $350,000 Group of answer choices a. 2.40 years b. 2.15 years c. 2.21 years d. 1.88 years

- A man is considering putting up his own enterprise, where an investment of 800,000Php will be required and will take 15 years to recoup . He estimates his annual sales at 800,000Php along with the following operating costs. Materials ............................. 160,000Php/ yearLabor ............................. 280,000Php/ yearOverhead ............................. (40,000 + 10% of sales) Php/ yearSelling Expense............................. 60,000Php/ yearThe man will give up his regular job paying 216,000 Php per year and devote all his time to the operation of his business, this will result in decreasing his labor cost by 40,000Php per year, material cost by 28,000Php per year and overhead cost by 32,000 Php per year. If the man expects to earn at least 20% of his capital, should he invest? solve in the present worth cost methodA. Project A has a net present value of zero when the discount factor of 20% is used. How much return is the project earning?B. If project A above is earning K150, 000 per year in perpetuity, what is the initial investment cost of the project? C. Company A expects to generate K150, 000 cash flows per year in perpetuity and the risk adjusted discount rate is 20%. What should be the certainty equivalent cash flows when the risk free rate is 10%Consider a proposed project that has the following costs and benefits. Using linear interpolation, what is the project's simple or conventional payback period? Year Costs Benefits 0 $4,000 1 2,000 2 $1,500 3 1,500 4 1,500 5 2,300 6 2,300 A. 6.58 years B. 4.65 years C. 3.98 years D. 5.41 years

- You are considering an open-pit mining operation. The cash flow pattern issomewhat unusual since you must invest in some mining equipment, conductoperations for two years, and then restore the sites to their original condition.You estimate the net cash flows to be as follows: N Cash flow 0 -$1,600,0001 1,500,0002 1,500,0003 -700,000 What is the approximate rate of return of this investment?(a) 25%(b)38%(c) 42%(d)62%An investment project costs $100,000. ll is expected to have an annual net cash flow of $40,000 for 5 years. What is the project's payback period?(a) 2.5 years(b) 3.5 year(c) 4.5 years(d) 5 yearsAssuming monetary benefits of an information system at $85,000 per year, one-time costs of $75,000, recurring costs of $35,000 per year, a discount rate of 12 percent, and a 5-year time horizon, calculate the net present value (NPV) of the system’s costs and benefits. Also calculate the overall return on investment (ROI) of the project and then present a break-even analysis (BEA). At what point does break-even occur?

- Your company is considering the introduction ofa new product line. The initial investment required forthis project is $500,000, and annual maintenance costsare anticipated to be $45,000. Annual operating costswill be directly proportional to the level of productionat $8.50 per unit, and each unit of product can be soldfor $65. If the MARR is 15% and the project has a life of5 years, what is the minimum annual production levelfor which the project is economically viable? With Cash Flow Thank YouMargaret has a project with a £ 28,000 first cost that returns £ 5,000 per year over its 10-year life. It has salvage value of £ 2,900 at the end of 10 years. If the MARR is 11 %, (Use 5 significant figures for your calculations, and round your answers to the nearest dollar. Indicate losses as a negative value.) (a) What is the present worth of this project? (b) What is the annual worth of this project? (c) What is the future worth of this project after 10 years?1 - Assuming an interest rate of 3% per year (effective), calculate the feasibility of each option. You can use either Present Worth Analysis or Equivalent Uniform Worth Analysis. In this part, your calculation should be done without the use of Excel. Show your equations and the results. 2 - Using linear interpolation, calculate the rate of return for each option. Here, your calculation should be implemented using Excel. 3 - Assuming that the initial equipment can be depreciated over the course of 20 years and usingDouble Decline Balance Depreciation, calculate the depreciation schedule for the equipment. 4- Assume a state income tax of 5%. Calculate the after-tax cashflow for each option assuming the depreciation used. Use only the depreciation on question 2.