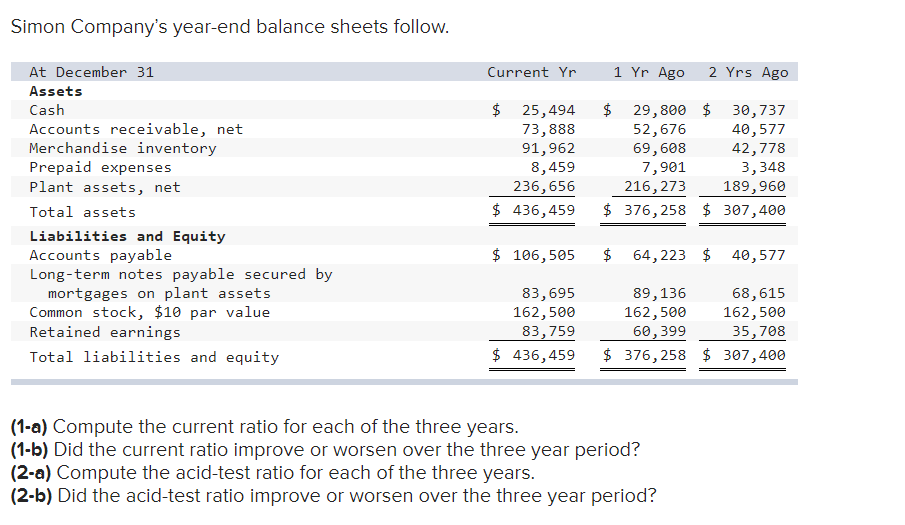

Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets $ 29,800 $ 30,737 $ 25,494 73,888 91,962 8,459 236,656 Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 52,676 69,608 7,901 216, 273 40,577 42,778 3,348 189,960 Total assets $ 436,459 $ 376,258 $ 307,400 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 106,505 $ 64, 223 $ 40,577 83,695 162,500 89,136 162,500 60,399 68,615 162,500 35,708 83,759 Total liabilities and equity $ 436,459 $ 376,258 $ 307,400

Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets $ 29,800 $ 30,737 $ 25,494 73,888 91,962 8,459 236,656 Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 52,676 69,608 7,901 216, 273 40,577 42,778 3,348 189,960 Total assets $ 436,459 $ 376,258 $ 307,400 Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings $ 106,505 $ 64, 223 $ 40,577 83,695 162,500 89,136 162,500 60,399 68,615 162,500 35,708 83,759 Total liabilities and equity $ 436,459 $ 376,258 $ 307,400

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section: Chapter Questions

Problem 1MP

Related questions

Question

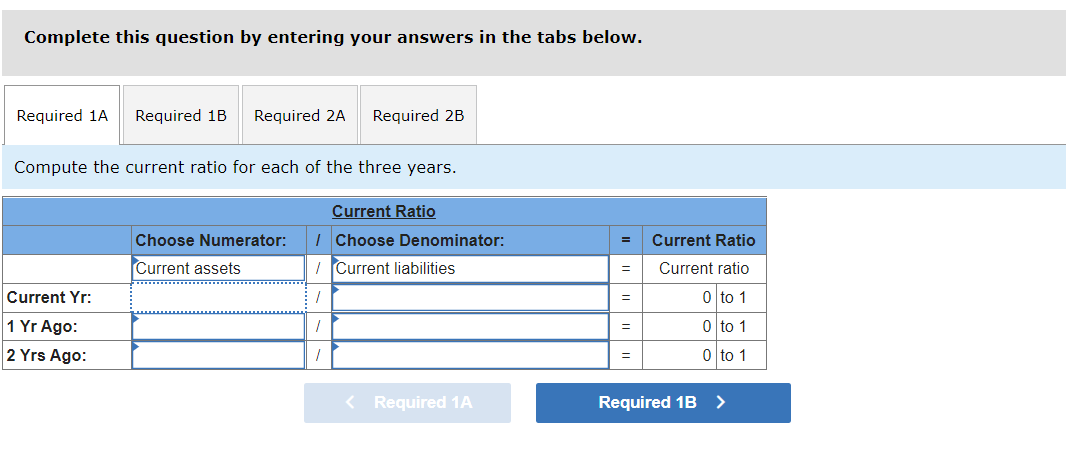

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1A

Required 1B

Required 2A

Required 2B

Compute the current ratio for each of the three years.

Current Ratio

Choose Numerator:

I Choose Denominator:

Current Ratio

Current assets

I Current liabilities

Current ratio

%3D

Current Yr:

0 to 1

%3D

1 Yr Ago:

0 to 1

%3D

2 Yrs Ago:

0 to 1

< Required 1A

Required 1B >

Transcribed Image Text:Simon Company's year-end balance sheets follow.

At December 31

Current Yr

1 Yr Ago

2 Yrs Ago

Assets

$ 25,494

29,800 $

52,676

69,608

7,901

216,273

Cash

$

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

73,888

91,962

8,459

236,656

30,737

40,577

42,778

3,348

189,960

Total assets

$ 436,459

$ 376, 258 $ 307,400

Liabilities and Equity

$ 106,505

64, 223 $ 40,577

Accounts payable

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par value

Retained earnings

$

83,695

68,615

162,500

35,708

$ 376, 258 $ 307,400

89,136

162,500

162,500

83,759

60,399

Total liabilities and equity

$ 436,459

(1-a) Compute the current ratio for each of the three years.

(1-b) Did the current ratio improve or worsen over the three year period?

(2-a) Compute the acid-test ratio for each of the three years.

(2-b) Did the acid-test ratio improve or worsen over the three year period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning