Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets Cash $ 36,740 $ 42,946 $ 44,736 Accounts receivable, net 108,593 74,412 60,238 Merchandise inventory 136,536 96,363 63,531 Prepaid expenses 11,949 11,385 5,020 Plant assets, net 322,735 306,405 273,875 Total assets $ 616,553 $ 531,511 $ 447,400 Liabilities and Equity Accounts payable $ 153,522 $ 89,825 $ 59,647 Long-term notes payable secured by mortgages on plant assets 113,594 125,915 100,853 Common stock, $10 par value 163,500 163,500 163,500 Retained earnings 185,937 152,271 123,400 Total liabilities and equity $ 616,553 $ 531,511 $ 447,400 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable?

Simon Company's year-end balance sheets follow. At December 31 Current Yr 1 Yr Ago 2 Yrs Ago Assets Cash $ 36,740 $ 42,946 $ 44,736 Accounts receivable, net 108,593 74,412 60,238 Merchandise inventory 136,536 96,363 63,531 Prepaid expenses 11,949 11,385 5,020 Plant assets, net 322,735 306,405 273,875 Total assets $ 616,553 $ 531,511 $ 447,400 Liabilities and Equity Accounts payable $ 153,522 $ 89,825 $ 59,647 Long-term notes payable secured by mortgages on plant assets 113,594 125,915 100,853 Common stock, $10 par value 163,500 163,500 163,500 Retained earnings 185,937 152,271 123,400 Total liabilities and equity $ 616,553 $ 531,511 $ 447,400 1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable?

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 4E

Related questions

Question

100%

Simon Company's year-end

| At December 31 | Current Yr | 1 Yr Ago | 2 Yrs Ago | |||||||

| Assets | ||||||||||

| Cash | $ | 36,740 | $ | 42,946 | $ | 44,736 | ||||

| 108,593 | 74,412 | 60,238 | ||||||||

| Merchandise inventory | 136,536 | 96,363 | 63,531 | |||||||

| Prepaid expenses | 11,949 | 11,385 | 5,020 | |||||||

| Plant assets, net | 322,735 | 306,405 | 273,875 | |||||||

| Total assets | $ | 616,553 | $ | 531,511 | $ | 447,400 | ||||

| Liabilities and Equity | ||||||||||

| Accounts payable | $ | 153,522 | $ | 89,825 | $ | 59,647 | ||||

| Long-term notes payable secured by mortgages on plant assets |

113,594 | 125,915 | 100,853 | |||||||

| Common stock, $10 par value | 163,500 | 163,500 | 163,500 | |||||||

| 185,937 | 152,271 | 123,400 | ||||||||

| Total liabilities and equity | $ | 616,553 | $ | 531,511 | $ | 447,400 | ||||

1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.)

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable?

3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable?

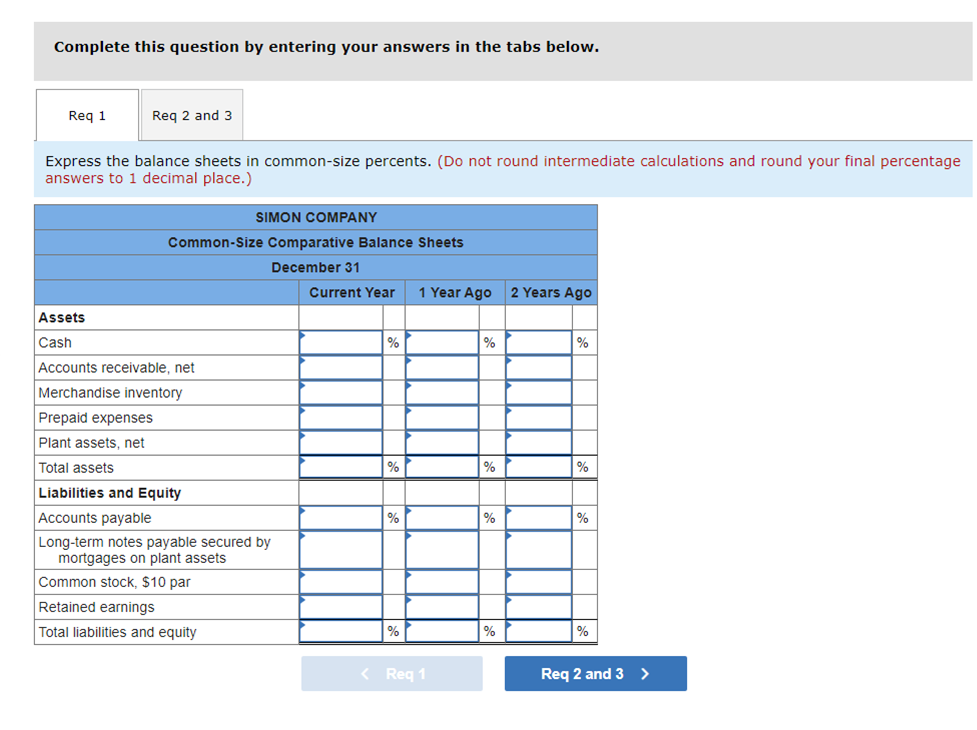

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Reg 2 and 3

Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage

answers to 1 decimal place.)

SIMON COMPANY

Common-Size Comparative Balance Sheets

December 31

Current Year

1 Year Ago

2 Years Ago

Assets

Cash

%

%

%

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

%

%

Liabilities and Equity

Accounts payable

%

%

%

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par

Retained earnings

Total liabilities and equity

%

%

< Req 1

Req 2 and 3 >

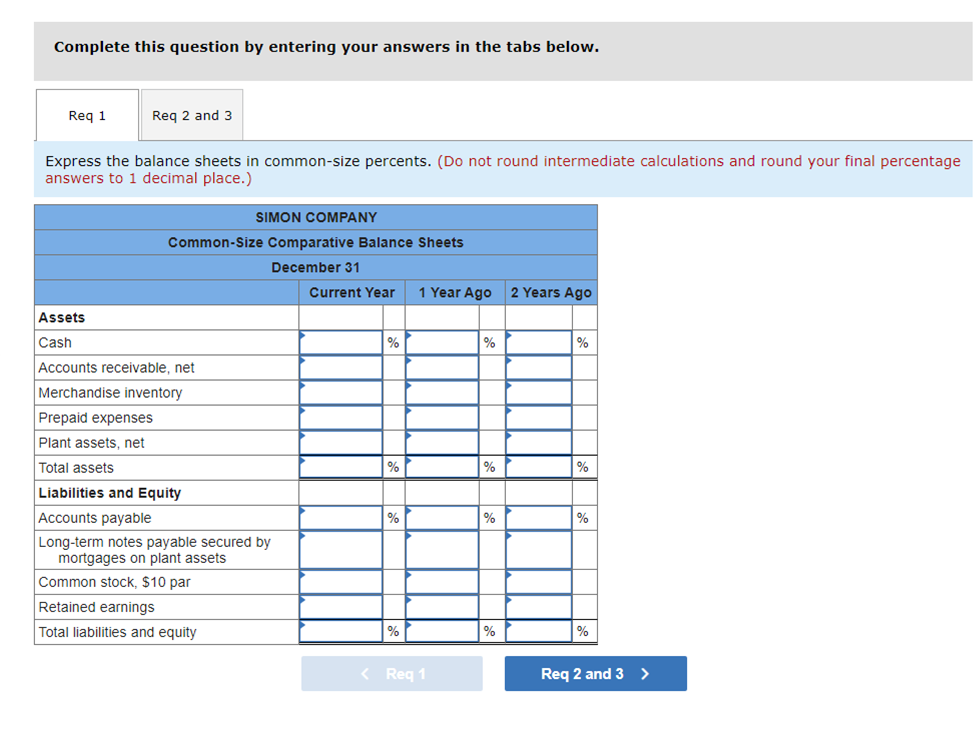

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Reg 2 and 3

Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage

answers to 1 decimal place.)

SIMON COMPANY

Common-Size Comparative Balance Sheets

December 31

Current Year

1 Year Ago

2 Years Ago

Assets

Cash

%

%

%

Accounts receivable, net

Merchandise inventory

Prepaid expenses

Plant assets, net

Total assets

%

%

Liabilities and Equity

Accounts payable

%

%

%

Long-term notes payable secured by

mortgages on plant assets

Common stock, $10 par

Retained earnings

Total liabilities and equity

%

%

< Req 1

Req 2 and 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning