1. Calculate the net amount of cash provided by or used for financing activities for the year. o. Briefly justify why you excluded any of these items in your calculation in part a. . Briefly explain your treatment of interest expense in your calculation in part a.

1. Calculate the net amount of cash provided by or used for financing activities for the year. o. Briefly justify why you excluded any of these items in your calculation in part a. . Briefly explain your treatment of interest expense in your calculation in part a.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.2E

Related questions

Question

Please complete part a, b and c if possible.

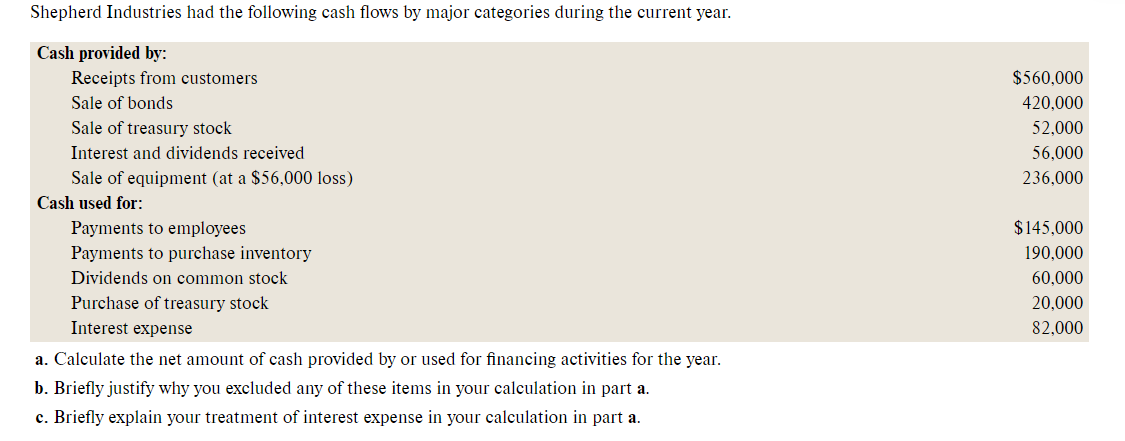

Transcribed Image Text:Shepherd Industries had the following cash flows by major categories during the current year.

Cash provided by:

Receipts from customers

$560,000

Sale of bonds

420,000

Sale of treasury stock

52,000

Interest and dividends received

56,000

Sale of equipment (at a $56,000 loss)

236,000

Cash used for:

Payments to employees

$145,000

Payments to purchase inventory

190,000

Dividends on common stock

60,000

Purchase of treasury stock

20,000

Interest expense

82,000

a. Calculate the net amount of cash provided by or used for financing activities for the year.

b. Briefly justify why you excluded any of these items in your calculation in part a.

c. Briefly explain your treatment of interest expense in your calculation in part a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub