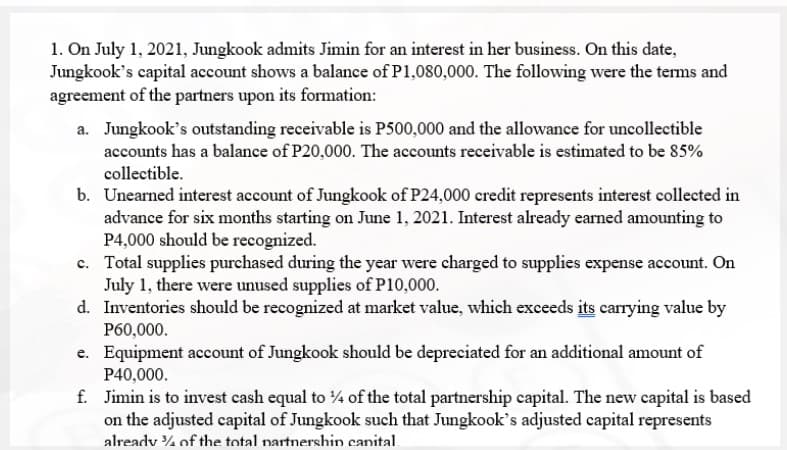

1. On July 1, 2021, Jungkook admits Jimin for an interest in her business. On this date, Jungkook's capital account shows a balance of P1,080,000. The following were the terms and agreement of the partners upon its formation: a. Jungkook's outstanding receivable is P500,000 and the allowance for uncollectible accounts has a balance of P20,000. The accounts receivable is estimated to be 85% collectible. b. Unearned interest account of Jungkook of P24,000 credit represents interest collected in advance for six months starting on June 1, 2021. Interest already earned amounting to

1. On July 1, 2021, Jungkook admits Jimin for an interest in her business. On this date, Jungkook's capital account shows a balance of P1,080,000. The following were the terms and agreement of the partners upon its formation: a. Jungkook's outstanding receivable is P500,000 and the allowance for uncollectible accounts has a balance of P20,000. The accounts receivable is estimated to be 85% collectible. b. Unearned interest account of Jungkook of P24,000 credit represents interest collected in advance for six months starting on June 1, 2021. Interest already earned amounting to

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 4PB

Related questions

Question

How much is the net adjustment to Jungkook, Capital as a result of the foregoing?

Transcribed Image Text:1. On July 1, 2021, Jungkook admits Jimin for an interest in her business. On this date,

Jungkook's capital account shows a balance of P1,080,000. The following were the terms and

agreement of the partners upon its formation:

a. Jungkook's outstanding receivable is P500,000 and the allowance for uncollectible

accounts has a balance of P20,000. The accounts receivable is estimated to be 85%

collectible.

b. Unearned interest account of Jungkook of P24,000 credit represents interest collected in

advance for six months starting on June 1, 2021. Interest already earned amounting to

P4,000 should be recognized.

c. Total supplies purchased during the year were charged to supplies expense account. On

July 1, there were unused supplies of P10,000.

d. Inventories should be recognized at market value, which exceeds its carrying value by

P60,000.

e. Equipment account of Jungkook should be depreciated for an additional amount of

P40,000.

f. Jimin is to invest cash equal to 4 of the total partnership capital. The new capital is based

on the adjusted capital of Jungkook such that Jungkook's adjusted capital represents

already % of the total nartnershin canital.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College