FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUr... A

LastPass password....

Booking.com

Homework

McAfee Security

Question 10 - Chapter 1 Home X

Amazon.com - Onli... ...LastPass

Saved

Required 1 Required 2

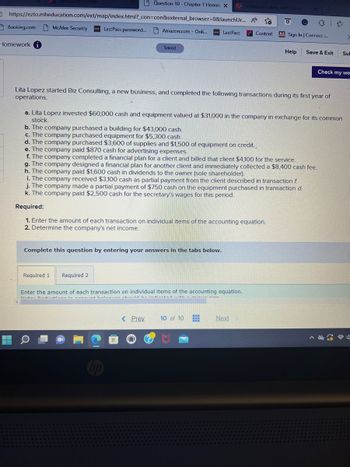

Lita Lopez started Biz Consulting, a new business, and completed the following transactions during its first year of

operations.

Complete this question by entering your answers in the tabs below.

Content

a. Lita Lopez invested $60,000 cash and equipment valued at $31,000 in the company in exchange for its common

stock.

b. The company purchased a building for $43,000 cash.

c. The company purchased equipment for $5,300 cash.

d. The company purchased $3,600 of supplies and $1,500 of equipment on credit.

e. The company paid $870 cash for advertising expenses.

f. The company completed a financial plan for a client and billed that client $4,100 for the service.

g. The company designed a financial plan for another client and immediately collected a $8,400 cash fee.

h. The company paid $1,600 cash in dividends to the owner (sole shareholder).

Sign In | Connect ...

i. The company received $3,100 cash as partial payment from the client described in transaction f.

j. The company made a partial payment of $750 cash on the equipment purchased in transaction d.

k. The company paid $2,500 cash for the secretary's wages for this period.

Required:

1. Enter the amount of each transaction on individual items of the accounting equation.

2. Determine the company's net income.

Enter the amount of each transaction on individual items of the accounting equation.

Mata Daductions in een halangan should be indiented with a minun sinn

Help Save & Exit

< Prev 10 of 10

Next

>

Check my wo

Sul

Transcribed Image Text:nl Booking.com

pter 1 Homework

10

ts

eBook

Ask

Print

eferences

ic

raw

ill

4

U

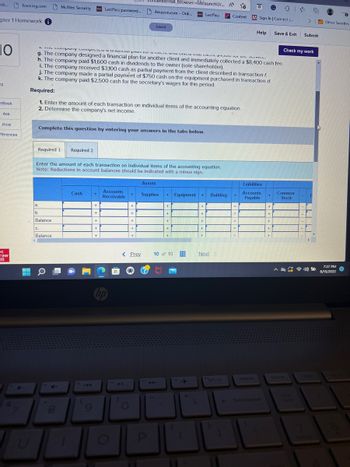

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

a.

1. The Company Compania pro VI CIRI GURLITTO IN URL SLIVELL.

g. The company designed a financial plan for another client and immediately collected a $8,400 cash fee.

h. The company paid $1,600 cash in dividends to the owner (sole shareholder).

i. The company received $3,100 cash as partial payment from the client described in transaction f

j. The company made a partial payment of $750 cash on the equipment purchased in transaction d.

k. The company paid $2,500 cash for the secretary's wages for this period.

Required:

1. Enter the amount of each transaction on individual items of the accounting equation.

2. Determine the company's net income.

Enter the amount of each transaction on individual items of the accounting equation.

Note: Reductions in account balances should be indicated with a minus sign.

b.

Balance

Xternal_browser=0&launchUr... A

McAfee Security ... LastPass password.... Amazon.com - Onli... ... LastPass

C.

Balance

4

Q

4+

Cash

144

(

9

+

+

+

+

+

Accounts

Receivable

10

10 11

O

+

Saved

+ Supplies + Equipment +

+

+

< Prev

+

+

Assets

P

+

+

+

+

10 of 10

112

www

+

+

+

+

+

+

Next

Building

Content M Sign In | Connect...

prt sc

=

=

=

Help

Liabilities

Accounts

Payable

delete

+

+

+

+

Save & Exit

+

+

Common

Stock

>

Check my work

home

Submit

D

"0

Other favorites

7:27 PM

8/15/2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- b.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... 12 Saved 9 Help ces 12-4, 12-51 Part (a): It is said that the Indian who sold Manhattan for $34 was a sharp salesman. If he had put his $34 away at 5% compounded semiannually, it would now be worth more than $4 billion, and he could buy most of the now-improved land back! Assume that this seller invested on January 1, 1701, the $34 he received. (Enter amounts in whole dollars, not in billions. Round final answers to nearest whole dollar amount.) Required: 1. Use Excel to determine the balance of the investment as of December 31, 2021, assuming a 5% interest rate compounded semiannually. (Hint: Use the FV function in Excel.) 2. Use Excel to determine the balance of the investment as of December 31, 2021, assuming an 6% annual interest rate, compounded semiannually. (Hint: Use the FV function in Excel.) 3. What would be the balances for requirements 1 and 2 if interest is…arrow_forwardGive the General ledgerarrow_forwardAlabama A&M AppsAnywhere Content * CengageNOWv2 | Online teachin x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false E Apps M Gmail O YouTube A Maps a News E Reading list Bank Reconciliation and Entries The cash account for Stone Systems at July 31, 20Y5, indicated a balance of $12,700. The bank statement indicated a balance of $15,810 on July 31, 20Y5. Comparing the bank statement and the accompanying canceled checks and memos with the records reveals the following reconciling items: a. Checks outstanding totaled $5,690. b. A deposit of $5,930, representing receipts of July 31, had been made too late to appear on the bank statement. c. The bank had collected $3,080 on a note left for collection. The face of the note was $2,920. d. A check for $500 returned with the statement had been incorrectly recorded by Stone Systems as $550. The check was for the payment of an obligation to Holland Co. for the purchase of office…arrow_forward

- Please help mearrow_forwardA Course in Miracles A New Earth MyNeopost ACTIVE | University.. E https://secure.times... Guide to forecastin.. Assum ework i Saved Required information [The following information applies to the questions displayed below] Troy (single) purchased a home in Hopkinton, Massachusetts, on January 1. 2007 for $265.000. He sold the home on January 1.2019, for $291,900. How much gain must Troy recognize on his home sale in each of the following alternative situations? (Leove no answer blank. Enter zero if applicable.) d. Troy rented out the home from January 1, 2007 through December 31, 2014. He lived in the home as his principal residence from January 1. 2015. through December 31, 2015 He rented out the home from January1.2016. through December 31, 2016, and lived in the home as his principal residence from January 1. 2017. through the date of the sale. Assume accumulated depreciation on the home at the time of sale was SO. (Do not round intermediate calculations. Round your final answer to…arrow_forward1.arrow_forward

- need correct answer with correct and complete working thanksarrow_forwardPlease I need help no plagiarism pleasearrow_forward- Chapter X + mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/q apter 15, 16, and 17 i Saved Help Save & E The following information is for Hulk Gym's first year of operations. Amounts are in millions of dollars. The enacted tax rate is 25%. Accounting income Temporary difference: Prepaid insurance Taxable income Required: Year 2024 $ 220 Future Taxable Amounts Future Amounts 2025 2026 2027 2028 Total (52) $ 13 $ 13 $13 $ 13 $ 52 $ 168 Prepare a compound journal entry to record the income tax expense for the year 2024. in millions (i.e., 10,000,000 should be entered as 10.) Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers View transaction list Journal entry worksheet Record the income taxes. to search 車 10:0 73°F Partly cloudy 4/14 F3 F4 F5 F6 F7 F8 F9 F10 F11 F12 PrtScr Insert Delete Calc E R * Backspacearrow_forward

- MAKE A JOURNAL ENTRYarrow_forwardRequired information [The following information applies to the questions displayed below.] Assume Down, Incorporated, was organized on May 1 to compete with Despair, Incorporated-a company that sells de motivational posters and office products. Down, Incorporated, encountered the following events during its first month of operations. a. Received $60,000 cash from the investors who organized Down, Incorporated b. Borrowed $20,000 cash and signed a note due in two years. c. Ordered equipment costing $16,000. d. Purchased $9,000 in equipment, paying $2,000 in cash and signing a six-month note for the balance. e. Received the equipment ordered in (c). paid for half of it, and put the rest on account.arrow_forwardJay Mercado Photocopying Center July 31,2015 July 1- Mr. Mercado invested cash of P30,000 in the business to be known as JM Photocopying Center. July 1- Mr. Mercado invested a photocopying machine amounting to P30,000 with sales invoice) in his business. July 1- Mr. Mercado invested the following in his business: Cash – P30,000 and Photocopying Equipment P30,000 (with sales invoice). In addition, his Loan Payable of P50,000 would be assumed by the business. July 2 – JM Photocopying Center paid P10,000 for the purchase of bond papers (with sales invoice) July 3 - JM Photocopying Center paid for business permits and licenses amounting to P2,000 (with official receipt). July 10 – Mr. Mercado hired one personnel with a weekly salary of P1,000 to look after the business (with employment contract). July 16 – JM Photocopying Center received P8 ko,000 cash for services rendered (with official receipt). July 17, 24, 31 - JM Photocopying Center paid for the weekly salary for the personnel (with…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education