Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 7PA

Related questions

Question

Questions number 1, 2, 4 a and b. I do not understand?

Transcribed Image Text:the supply function is Q$ = 4 + 4P, where P is the

price of wheat in dollars per bushel, and Q is the

b. Could this program cost consumers (in terms

quantity in billions of bushels. Find the free-market

what conditions? Illustrate with a diagram.

beans as necessary to keep the price at $1 per pound.

a. Suppose the demand function is QD = 28 – 2P and

Program. To see how the program worked, let's con-

the equilibrium price and quantity, domestic rice

weight loss from each policy. Which policy is the

rice. Illustrate with supply-and-demand diagrams

a subsidy to farmers for each pound of

agricultural program called the Payment-in-Kind

Japanese government likely to prefer? Which policy

production, government revenue or deficit, and dead-

land and to their inability to take advantage of econo-

mies of large-scale production. Analyze two policies

intended to maintain Japanese rice production: (1)

In 1983, the Reagan administration introduced a new

CHAPTER 9 •

The Analysis of Competitive Markets 353

cost consumers less than $50 million per year?

Under what conditions? Again, use a diagram to

illustrate.

or (2) a per-pound tariff on imported

produced,

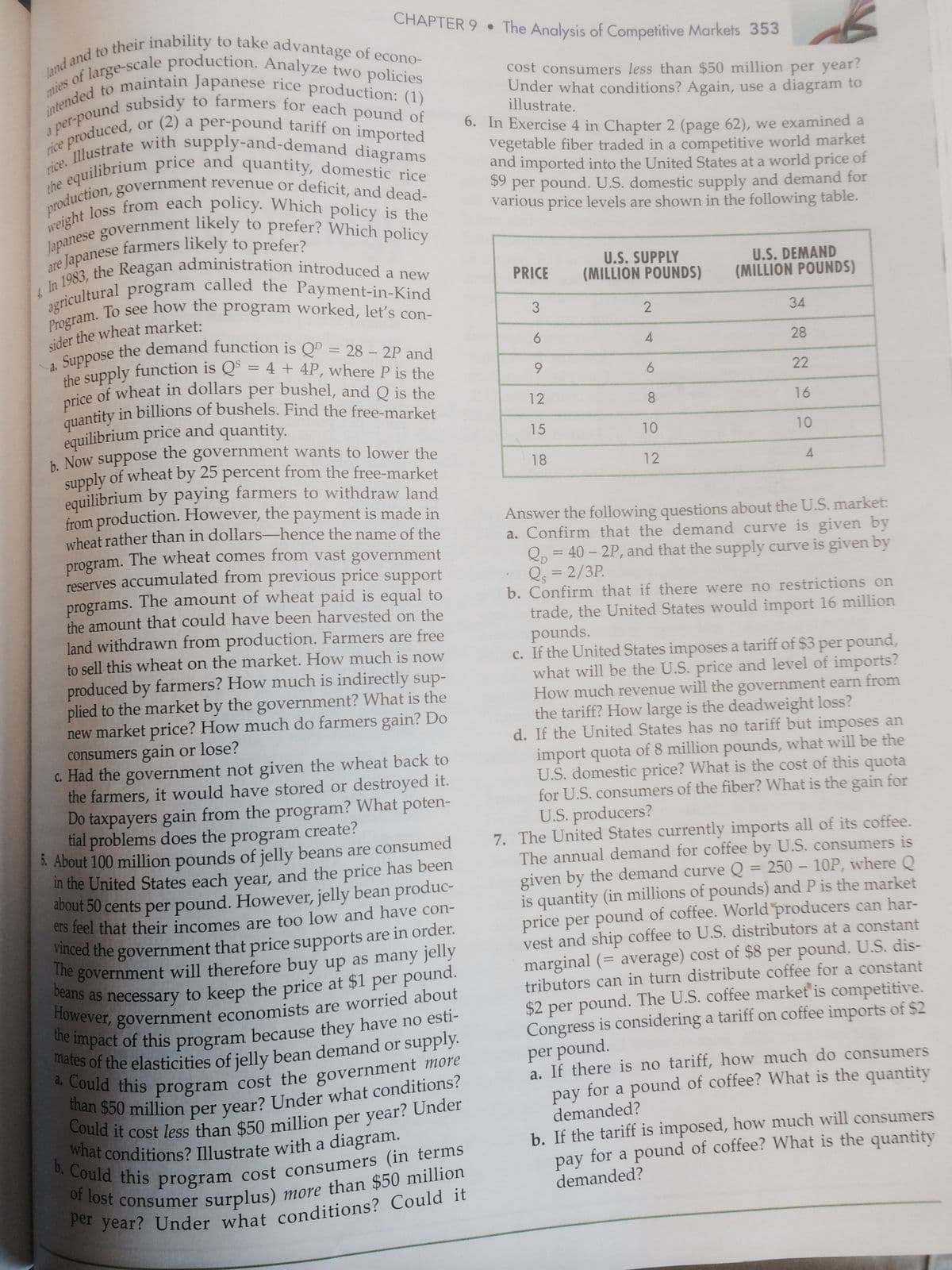

6. In Exercise 4 in Chapter 2 (page 62), we examined a

vegetable fiber traded in a competitive world market

and imported into the United States at a world price of

$9 per pound. U.S. domestic supply and demand for

various price levels are shown in the following table.

rice

farmers likely to prefer?

are Japanese

U.S. SUPPLY

(MILLION POUNDS)

U.S. DEMAND

(MILLION POUNDS)

PRICE

3

34

sider the wheat market:

6.

28

9.

6.

22

12

8.

16

equilibrium price and quantity.

h Now suppose the government wants to lower the

supply of wheat by 25 percent from the free-market

equilibrium by paying farmers to withdraw land

from production. However, the payment is made in

vwheat rather than in dollars-hence the name of the

15

10

10

18

12

4.

Answer the following questions about the U.S. market:

a. Confirm that the demand curve is given by

Qp = 40 – 2P, and that the supply curve is given by

Qs = 2/3P.

b. Confirm that if there were no restrictions on

The wheat comes from vast government

program.

reserves accumulated from previous price support

programs. The amount of wheat paid is equal to

the amount that could have been harvested on the

land withdrawn from production. Farmers are free

to sell this wheat on the market. How much is now

produced by farmers? How much is indirectly sup-

plied to the market by the government? What is the

new market price? How much do farmers gain? Do

%3D

trade, the United States would import 16 million

pounds.

c. If the United States imposes a tariff of $3 per pound,

what will be the U.S. price and level of imports?

How much revenue will the government earn from

the tariff? How large is the deadweight loss?

d. If the United States has no tariff but imposes an

import quota of 8 million pounds, what will be the

U.S. domestic price? What is the cost of this quota

for U.S. consumers of the fiber? What is the gain for

U.S. producers?

7. The United States currently imports all of its coffee.

The annual demand for coffee by U.S. consumers is

given by the demand curve Q = 250 – 10P, where Q

is quantity (in millions of pounds) and P is the market

price per pound of coffee. World producers can har-

vest and ship coffee to U.S. distributors at a constant

marginal (= average) cost of $8 per pound. U.S. dis-

tributors can in turn distribute coffee for a constant

$2 per pound. The U.S. coffee market is competitive.

Congress is considering a tariff on coffee imports of $2

consumers gain or lose?

C. Had the government not given the wheat back to

the farmers, it would have stored or destroyed it.

Do taxpayers gain from the program? What poten-

tial problems does the

3. About 100 million pounds of jelly beans are consumed

in the United States each year, and the price has been

about 50 cents per pound. However, jelly bean produc-

ers feel that their incomes are too low and have con-

program

create?

iced the government that price supports are in order.

he government will therefore buy up as many jelly

per pound.

a. If there is no tariff, how much do consumers

pay for a pound of coffee? What is the quantity

demanded?

b. If the tariff is imposed, how much will consumers

pay for a pound of coffee? What is the quantity

of lost

consumer surplus)

more than $50 million

demanded?

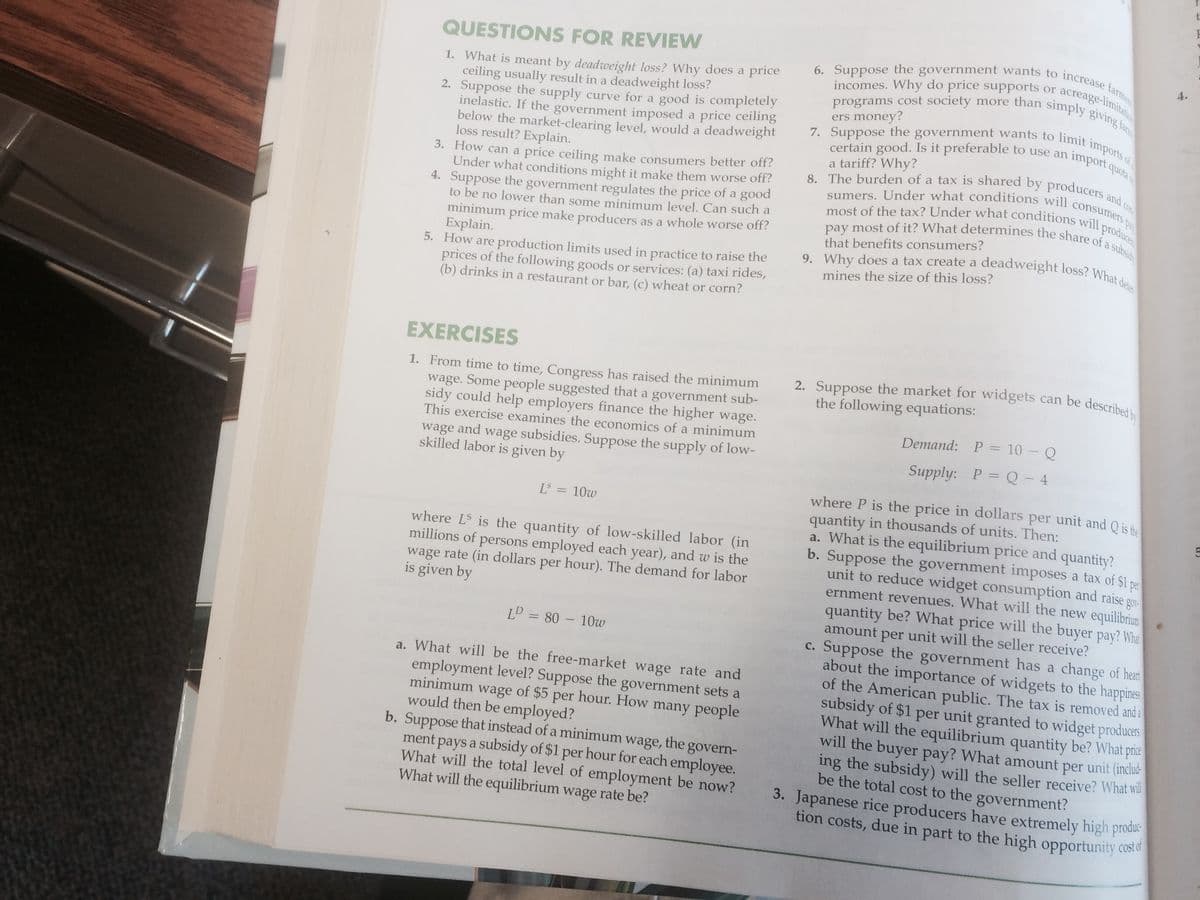

Transcribed Image Text:QUESTIONS FOR REVIEW

4.

incomes. Why do price supports or acreage-limitati

programs cost society more than simply giving fam

certain good. Is it preferable to use an import quota

pay most of it? What determines the share of a subsid

6. Suppose the government wants to increase farme

8. The burden of a tax is shared by producers and con

9. Why does a tax create a deadweight loss? What dete

2. Suppose the market for widgets can be described b

1. What is meant by deadweight loss? Why does a price

ceiling usually result in a deadweight loss?

2. Suppose the supply curve for a good is completely

inelastic. If the government imposed a price ceiling

below the market-clearing level, would a deadweight

loss result? Explain.

3. How can a price ceiling make consumers better off?

Under what conditions might it make them worse off?

4. Suppose the government regulates the price of a good

to be no lower than some minimum level. Can such a

minimum price make producers as a whole worse off?

Explain.

5. How are production limits used in practice to raise the

prices of the following goods or services: (a) taxi rides,

(b) drinks in a restaurant or bar, (c) wheat or corn?

ers money?

7. Suppose the government wants to limit

imports of

a tariff? Why?

consumers

sumers. Under what conditions will

produce

most of the tax? Under what conditions will

that benefits consumers?

mines the size of this loss?

EXERCISES

1. From time to time, Congress has raised the minimum

wage. Some people suggested that a government sub-

sidy could help employers finance the higher wage.

This exercise examines the economics of a minimum

the following equations:

Demand:

P = 10 - Q

wage and wage subsidies. Suppose the supply of low-

skilled labor is given by

Supply: P =

Q- 4

where P is the price in dollars per unit and Q is the

quantity in thousands of units. Then:

a. What is the equilibrium price and quantity?

b. Suppose the government imposes a tax of $1 pa

unit to reduce widget consumption and raise gov-

ernment revenues. What will the new equilibrium

quantity be? What price will the buyer pay? Wha

amount per unit will the seller receive?

Suppose the government has a change of heart

about the importance of widgets to the happines

of the American public. The tax is removed and a

subsidy of $1 per unit granted to widget producers

What will the equilibrium quantity be? What price

will the buyer pay? What amount per unit (includ-

ing the subsidy) will the seller receive? What wil

be the total cost to the government?

3. Japanese rice producers have extremely high produc

tion costs, due in part to the high opportunity coste

L = 10w

where LS is the quantity of low-skilled labor (in

millions of persons employed each year), and w is the

wage rate (in dollars per hour). The demand for labor

is given by

LD

= 80 - 10w

с.

a. What will be the free-market wage rate and

employment level? Suppose the government sets a

minimum wage of $5

would then be employed?

b. Suppose that instead of a minimum wage, the govern-

ment pays a subsidy of $1 per hour for each employee.

What will the total level of employment be now?

What will the equilibrium wage rate be?

per

hour. How many people

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning