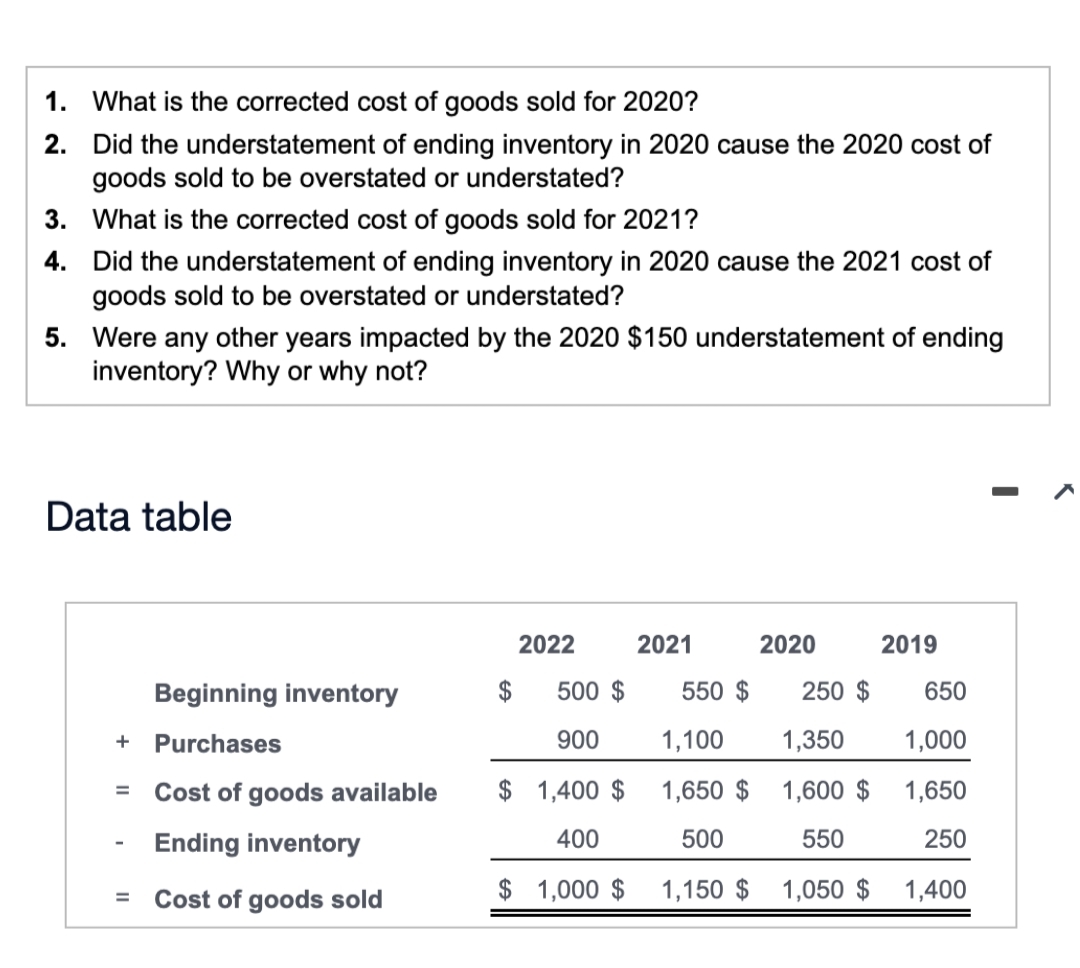

1. What is the corrected cost of goods sold for 2020? 2. Did the understatement of ending inventory in 2020 cause the 2020 cost of goods sold to be overstated or understated? 3. What is the corrected cost of goods sold for 2021? 4. Did the understatement of ending inventory in 2020 cause the 2021 cost of goods sold to be overstated or understated? 5. Were any other years impacted by the 2020 $150 understatement of ending inventory? Why or why not?

1. What is the corrected cost of goods sold for 2020? 2. Did the understatement of ending inventory in 2020 cause the 2020 cost of goods sold to be overstated or understated? 3. What is the corrected cost of goods sold for 2021? 4. Did the understatement of ending inventory in 2020 cause the 2021 cost of goods sold to be overstated or understated? 5. Were any other years impacted by the 2020 $150 understatement of ending inventory? Why or why not?

Chapter10: Inventory

Section: Chapter Questions

Problem 13PB: Company Edgar reported the following cost of goods sold but later realized that an error had been...

Related questions

Question

Please help me to solve this problem

Transcribed Image Text:1. What is the corrected cost of goods sold for 2020?

2.

Did the understatement of ending inventory in 2020 cause the 2020 cost of

goods sold to be overstated or understated?

3. What is the corrected cost of goods sold for 2021?

4.

Did the understatement of ending inventory in 2020 cause the 2021 cost of

goods sold to be overstated or understated?

5. Were any other years impacted by the 2020 $150 understatement of ending

inventory? Why or why not?

Data table

Beginning inventory

+ Purchases

= Cost of goods available

Ending inventory

Cost of goods sold

=

2022

$

500 $

900

$ 1,400 $

400

$1,000 $

2021

550 $

1,100

1,650 $

500

1,150 $

2020

250 $

1,350

1,600 $

550

1,050 $

2019

650

1,000

1,650

250

1,400

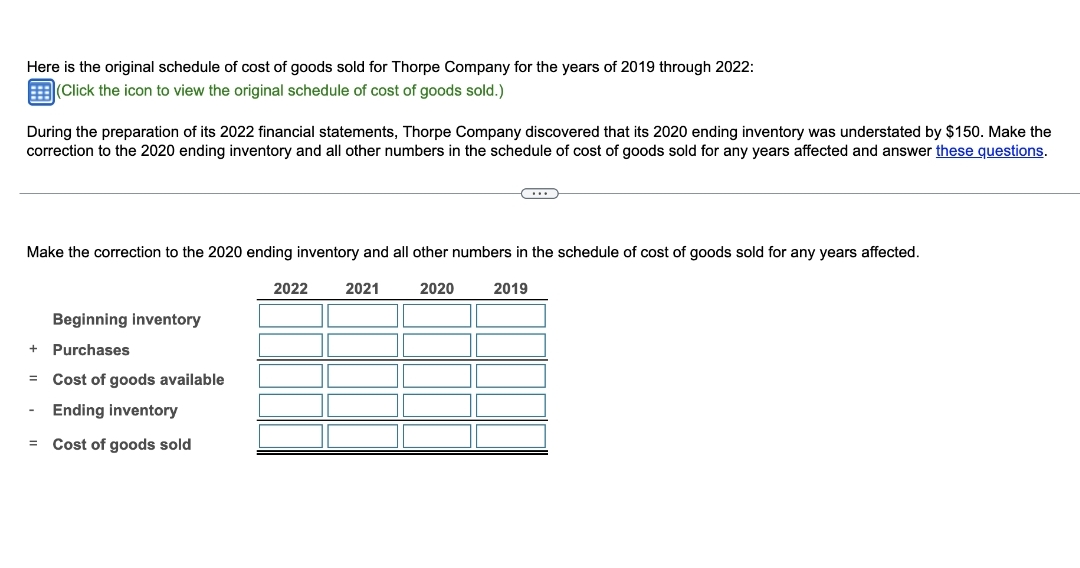

Transcribed Image Text:Here is the original schedule of cost of goods sold for Thorpe Company for the years of 2019 through 2022:

(Click the icon to view the original schedule of cost of goods sold.)

During the preparation of its 2022 financial statements, Thorpe Company discovered that its 2020 ending inventory was understated by $150. Make the

correction to the 2020 ending inventory and all other numbers in the schedule of cost of goods sold for any years affected and answer these questions.

Make the correction to the 2020 ending inventory and all other numbers in the schedule of cost of goods sold for any years affected.

2021

2020

2019

Beginning inventory

Purchases

Cost of goods available

Ending inventory

= Cost of goods sold

+

=

(...)

2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,