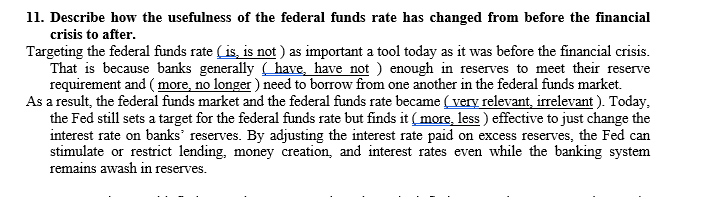

11. Describe how the usefulness of the federal funds rate has changed from before the financial crisis to after. Targeting the federal funds rate (is, is not ) as important a tool today as it was before the financial crisis. That is because banks generally have, have not ) enough in reserves to meet their reserve requirement and ( more, no longer ) need to borrow from one another in the federal funds market. As a result, the federal funds market and the federal funds rate became (very relevant, irrelevant ). Today, the Fed still sets a target for the federal funds rate but finds it (more, less ) effective to just change the interest rate on banks' reserves. By adjusting the interest rate paid on excess reserves, the Fed can stimulate or restrict lending, money creation, and interest rates even while the banking system remains awash in reserves.

11. Describe how the usefulness of the federal funds rate has changed from before the financial crisis to after. Targeting the federal funds rate (is, is not ) as important a tool today as it was before the financial crisis. That is because banks generally have, have not ) enough in reserves to meet their reserve requirement and ( more, no longer ) need to borrow from one another in the federal funds market. As a result, the federal funds market and the federal funds rate became (very relevant, irrelevant ). Today, the Fed still sets a target for the federal funds rate but finds it (more, less ) effective to just change the interest rate on banks' reserves. By adjusting the interest rate paid on excess reserves, the Fed can stimulate or restrict lending, money creation, and interest rates even while the banking system remains awash in reserves.

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter11: The Monetary System

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:11. Describe how the usefulness of the federal funds rate has changed from before the financial

crisis to after.

Targeting the federal funds rate (is, is not ) as important a tool today as it was before the financial crisis.

That is because banks generally have, have not ) enough in reserves to meet their reserve

requirement and ( more, no longer ) need to borrow from one another in the federal funds market.

As a result, the federal funds market and the federal funds rate became (very relevant, irrelevant ). Today,

the Fed still sets a target for the federal funds rate but finds it (more, less ) effective to just change the

interest rate on banks' reserves. By adjusting the interest rate paid on excess reserves, the Fed can

stimulate or restrict lending, money creation, and interest rates even while the banking system

remains awash in reserves.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning