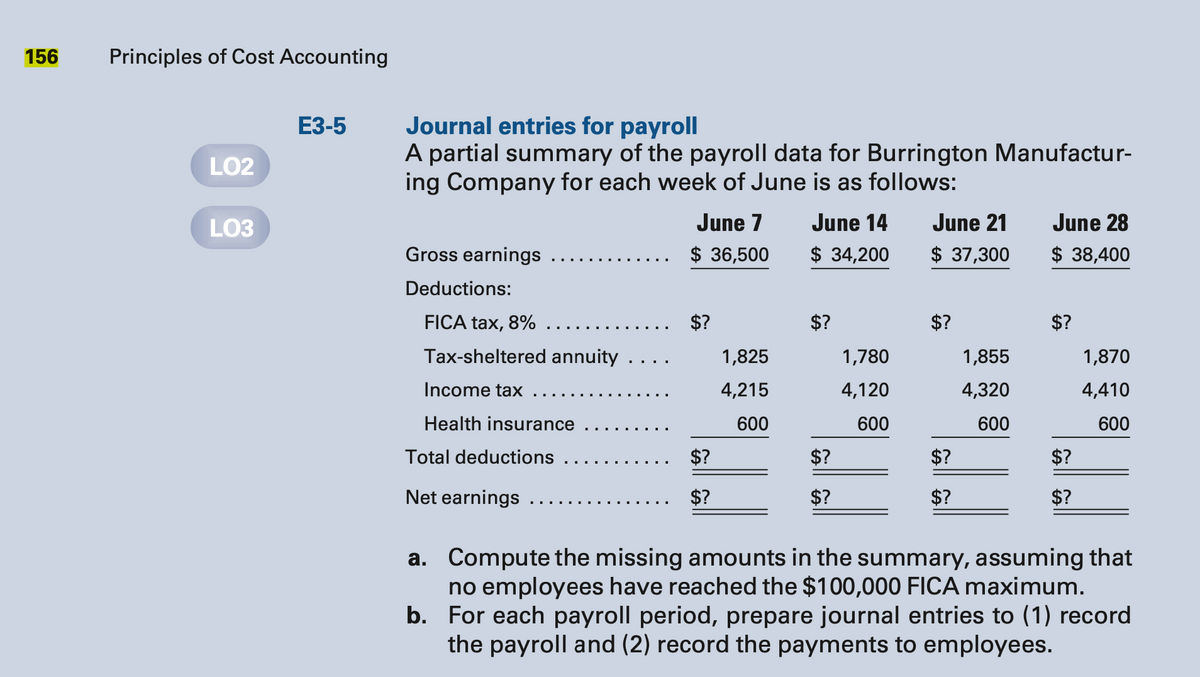

156 Principles of Cost Accounting E3-5 Journal entries for payroll A partial summary of the payroll data for Burrington Manufactur- ing Company for each week of June is as follows: LO2 LO3 June 7 June 14 June 21 June 28 Gross earnings $ 36,500 $ 34,200 $ 37,300 $ 38,400 Deductions: FICA tax, 8% $? $? $? $? Tax-sheltered annuity 1,825 1,780 1,855 1,870 Income tax 4,215 4,120 4,320 4,410 Health insurance 600 600 600 600 Total deductions $? $? $? $? Net earnings $? $? $? $? a. Compute the missing amounts in the summary, assuming that no employees have reached the $100,000 FICA maximum. b. For each payroll period, prepare journal entries to (1) record

156 Principles of Cost Accounting E3-5 Journal entries for payroll A partial summary of the payroll data for Burrington Manufactur- ing Company for each week of June is as follows: LO2 LO3 June 7 June 14 June 21 June 28 Gross earnings $ 36,500 $ 34,200 $ 37,300 $ 38,400 Deductions: FICA tax, 8% $? $? $? $? Tax-sheltered annuity 1,825 1,780 1,855 1,870 Income tax 4,215 4,120 4,320 4,410 Health insurance 600 600 600 600 Total deductions $? $? $? $? Net earnings $? $? $? $? a. Compute the missing amounts in the summary, assuming that no employees have reached the $100,000 FICA maximum. b. For each payroll period, prepare journal entries to (1) record

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.13EX

Related questions

Question

Cost accounting Pag. 156-E3-5

Transcribed Image Text:156

Principles of Cost Accounting

Journal entries for payroll

A partial summary of the payroll data for Burrington Manufactur-

ing Company for each week of June is as follows:

ЕЗ-5

LO2

LO3

June 7

June 14

June 21

June 28

Gross earnings .

$ 36,500

$ 34,200

$ 37,300

$ 38,400

Deductions:

FICA tax, 8%

$?

$?

$?

$?

Tax-sheltered annuity.

1,825

1,780

1,855

1,870

Income tax

4,215

4,120

4,320

4,410

Health insurance

600

600

600

600

Total deductions

$?

$?

$?

$?

Net earnings

$?

$?

$?

$?

a. Compute the missing amounts in the summary, assuming that

no employees have reached the $100,000 FICA maximum.

b. For each payroll period, prepare journal entries to (1) record

the payroll and (2) record the payments to employees.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning