EX 10-13 Payroll entries Widmer Company had gross wages of $320,000 during the week ended June 17. The amount of wages subject to social security tax was $320,000, while the amount of wages subject to federal and state unemployment taxes was $48,000. Tax rates are as follows: Obj. 2 Social security Medicare 6.0% 1.5% 5.4% State unemployment Federal unemployment The total amount withheld from employee wages for federal taxes was $64,000. a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. 0.8%

EX 10-13 Payroll entries Widmer Company had gross wages of $320,000 during the week ended June 17. The amount of wages subject to social security tax was $320,000, while the amount of wages subject to federal and state unemployment taxes was $48,000. Tax rates are as follows: Obj. 2 Social security Medicare 6.0% 1.5% 5.4% State unemployment Federal unemployment The total amount withheld from employee wages for federal taxes was $64,000. a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. 0.8%

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.11EX: Payroll tax entries According to a summary of the payroll of Mountain Streaming Co., 120,000 was...

Related questions

Question

100%

EX 10-13 Payroll entries

Transcribed Image Text:Chapter 10 Liabilities: Current, Installment Notes, and Contingencies

525

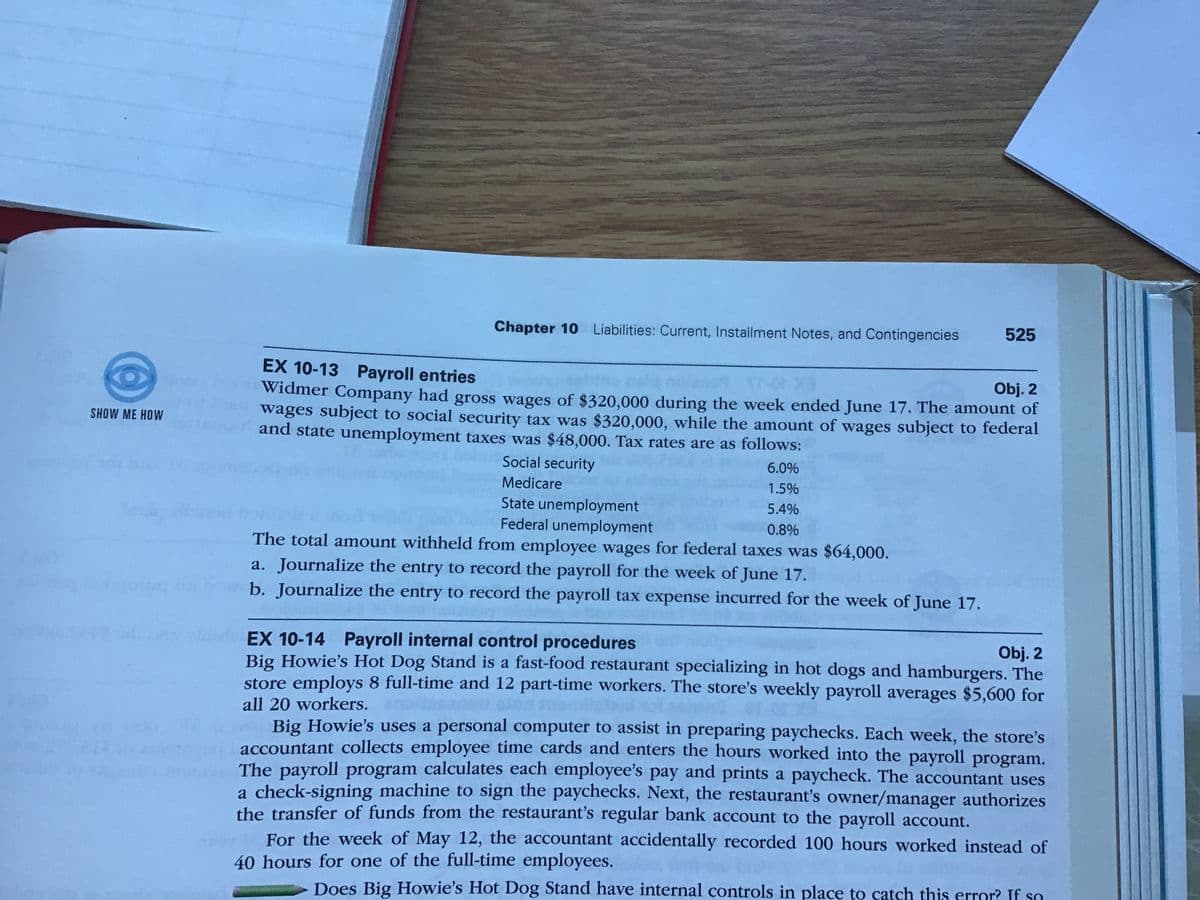

EX 10-13 Payroll entries

Obj. 2

Widmer Company had gross wages of $320,000 during the week ended June 17. The amount of

wages subject to social security tax was $320,000, while the amount of wages subject to federal

and state unemployment taxes was $48,000. Tax rates are as follows:

SHOW ME HOW

Social security

6.0%

Medicare

1.5%

State unemployment

Federal unemployment

The total amount withheld from employee wages for federal taxes was $64,000.

5.4%

0.8%

a. Journalize the entry to record the payroll for the week of June 17.

b. Journalize the entry to record the payroll tax expense incurred for the week of June 17.

dEX 10-14 Payroll internal control procedures

Big Howie's Hot Dog Stand is a fast-food restaurant specializing in hot dogs and hamburgers. The

store employs 8 full-time and 12 part-time workers. The store's weekly payroll averages $5,600 for

Obj. 2

all 20 workers.

Big Howie's uses a personal computer to assist in preparing paychecks. Each week, the store's

accountant collects employee time cards and enters the hours worked into the payroll program.

The payroll program calculates each employee's pay and prints a paycheck. The accountant uses

a check-signing machine to sign the paychecks. Next, the restaurant's owner/manager authorizes

the transfer of funds from the restaurant's regular bank account to the payroll account.

For the week of May 12, the accountant accidentally recorded 100 hours worked instead of

40 hours for one of the full-time employees.

Does Big Howie's Hot Dog Stand have internal controls in place to catch this error? If so

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning