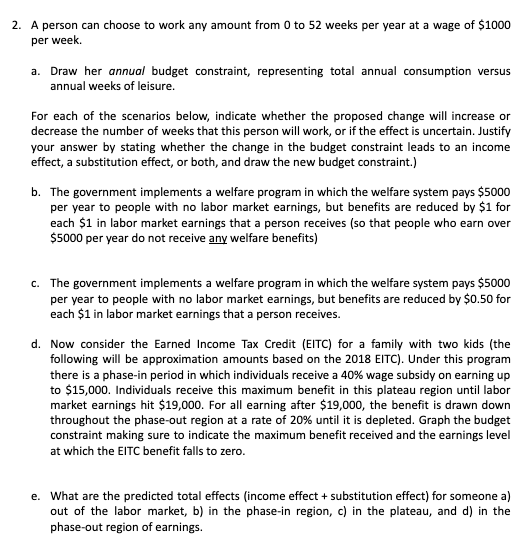

2. A person can choose to work any amount from 0 to 52 weeks per year at a wage of $1000 per week. a. Draw her annual budget constraint, representing total annual consumption versus annual weeks of leisure. For each of the scenarios below, indicate whether the proposed change will increase or decrease the number of weeks that this person will work, or if the effect is uncertain. Justify your answer by stating whether the change in the budget constraint leads to an income effect, a substitution effect, or both, and draw the new budget constraint.) b. The government implements a welfare program in which the welfare system pays $5000 per year to people with no labor market earnings, but benefits are reduced by $1 for each $1 in labor market earnings that a person receives (so that people who earn over $5000 per year do not receive any welfare benefits) c. The government implements a welfare program in which the welfare system pays $5000 per year to people with no labor market earnings, but benefits are reduced by $0.50 for each $1 in labor market earnings that a person receives.

2. A person can choose to work any amount from 0 to 52 weeks per year at a wage of $1000 per week. a. Draw her annual budget constraint, representing total annual consumption versus annual weeks of leisure. For each of the scenarios below, indicate whether the proposed change will increase or decrease the number of weeks that this person will work, or if the effect is uncertain. Justify your answer by stating whether the change in the budget constraint leads to an income effect, a substitution effect, or both, and draw the new budget constraint.) b. The government implements a welfare program in which the welfare system pays $5000 per year to people with no labor market earnings, but benefits are reduced by $1 for each $1 in labor market earnings that a person receives (so that people who earn over $5000 per year do not receive any welfare benefits) c. The government implements a welfare program in which the welfare system pays $5000 per year to people with no labor market earnings, but benefits are reduced by $0.50 for each $1 in labor market earnings that a person receives.

Chapter16: Labor Markets

Section: Chapter Questions

Problem 16.1P

Related questions

Question

2. Part a, b, c

Transcribed Image Text:2. A person can choose to work any amount from 0 to 52 weeks per year at a wage of $1000

per week.

a. Draw her annual budget constraint, representing total annual consumption versus

annual weeks of leisure.

For each of the scenarios below, indicate whether the proposed change will increase or

decrease the number of weeks that this person will work, or if the effect is uncertain. Justify

your answer by stating whether the change in the budget constraint leads to an income

effect, a substitution effect, or both, and draw the new budget constraint.)

b. The government implements a welfare program in which the welfare system pays $5000

per year to people with no labor market earnings, but benefits are reduced by $i for

each $1 in labor market earnings that a person receives (so that people who earn over

$5000 per year do not receive any welfare benefits)

c. The government implements a welfare program in which the welfare system pays $5000

per year to people with no labor market earnings, but benefits are reduced by $0.50 for

each $1 in labor market earnings that a person receives.

d. Now consider the Earned Income Tax Credit (EITC) for a family with two kids (the

following will be approximation amounts based on the 2018 EITC). Under this program

there is a phase-in period in which individuals receive a 40% wage subsidy on earning up

to $15,000. Individuals receive this maximum benefit in this plateau region until labor

market earnings hit $19,000. For all earning after $19,000, the benefit is drawn down

throughout the phase-out region at a rate of 20% until it is depleted. Graph the budget

constraint making sure to indicate the maximum benefit received and the earnings level

at which the EITC benefit falls to zero.

e. What are the predicted total effects (income effect + substitution effect) for someone a)

out of the labor market, b) in the phase-in region, c) in the plateau, and d) in the

phase-out region of earnings.

Expert Solution

Step 1

Given:

Time=0-52 weeks

Wage per week=$1000

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning