Q: Carefully explain what is happening in the following market. Indicate the impact if any on demand,…

A: 1. Here, it is given that the University mandates the purchase of principles of economics by all the…

Q: Prediction markets allow traders to bet on future events. One prediction market that is particularly…

A: Given information Utility function U=ln(X+1) Initial wealth=4 Probability of winning=0.5 So, the…

Q: Laramie Company has a variable cost ratio of 0.30. The fixed cost is $176,400 and 21,000 units are…

A: The selling price per unit is the basis when computing the total sales revenue. This amount is…

Q: For an individual the Marginal Rate of Substitution is constant and equal to 1/2 for all…

A: The amount of one product that a customer may give up in exchange for more units of another good…

Q: Jerry James might consider buying a nominal Treasury Bond rather than Treasury Inflation Protected…

A: Treasury Inflation-Protected Securities (TIPS) are one type of debt securities offered by the U.S.…

Q: A decision-maker faces a lottery that gives her a final wealth of 1 dollar with probability 1/4, 3…

A: Given The lottery gives $1 with a probability of 1/4, $3 with a probability of 1/2, and $8 with a…

Q: The following are the duration in minutes of a sample of long-distance phone calls made within the…

A: The relative frequency refers to the frequency for a class or a category and is the ratio of the…

Q: a tax of $10 per ton of coal causes the price, inclusive of the tax, to increase from $60 per ton to…

A: When a tax is imposed by the government, some proportion of it is borne by the consumers while the…

Q: Suppose a company has fixed costs of $31,200 and variable cost per unit of 1 3x + 444 dollars,…

A: Introduction We have given cost and revenue data. Total revenue can be calculated when the price is…

Q: Why should the owner of the crude oil resource be willing to supply it in exactly the right amount?…

A: The link between the price level and overall economic production is aggregate supply. The aggregate…

Q: Total population Employed Number of people below 15 Number of people retired Number of people not…

A: Introduction The unemployment rate can be calculated when unemployed persons are divided by the…

Q: Two charities are collecting old clothes in a county that has three towns along a road, as depicted.…

A: Introduction A strictly dominated strategy is a strategy that ALWAYS delivers a worse outcome than…

Q: The Canadian government has provided export assistance to Bombardier Inc. with its Technology…

A: In the context of economic trade, the term "free market" refers to an unrestricted system in which…

Q: . A firm’s production is represented by the following function: Q = L0.4 K0.6 . The rental rate of…

A: The link between the physical production and the numerous production parameters, or the output to…

Q: uppose that demand is given by: Q = 100-6p and supply is given by: Q = -2 + p Suppose that…

A: Given Demand equation Q=100-6p ...(1) Supply equation: Q=-2+p ....(2) Tax =$10 per…

Q: It refers to the factor or consideration exhibited by a company, service, product or brand as the…

A: At the marketplace, a product is the output produced by a producer using raw material and supply it…

Q: Given a concave PPC and l-curve in country Y for goods A and B, state the conditions for maximum…

A: Introduction Consumption is the amount of money spend on consumer goods & services. Consumption…

Q: You are trying to determine the financial break-even (as we defined in class) market size for the…

A: Financial break-even cash flow is a point at which the cash inflows are equal to cash outflows. This…

Q: 4B Production and distribution of food : Globally, genetically modified crops are being used Select…

A: Developed countries have a high quality of life with high rate of industrialisation, and…

Q: ABC Company sold $10,000 of merchandise to a customer on September 1. The terms were 2/10, n/30.…

A: The discount rate on the credit card is 1% This means the company receives 99% of the charges if…

Q: 1. In Town A there is only one newspaper, Daily Outrage. The demand for the paper depends on the…

A: Price elasticity of demand Price elasticity is a concept used by economists to analyze how changes…

Q: Should be at least three sentences. Use the following sentence starters as a guide. I can…

A: Distinguish between absolute advantage and comparative advantage because absolute advantage and…

Q: Consider the insurance problem from class in which an agent with wealth w dollars has a chance 7 €…

A: Given information Initial wealth=W Chances of loss lies between 0 to 1 Loss amount=l Insurance…

Q: Draw a graph illustrating the determination of the equilibrium exchange rate between the South…

A: Exchange rate refers to the price of one currency in term of another currency. In other words, how…

Q: hand written plzz

A: When all resources are effectively utilized, an economy produces at its natural level. It is…

Q: 5. Find the equivalent present worth of the cash receipts in the accompanying diagram, where i = 8%…

A: Here we will figure out the present value of all these cash flows and then after making comparison…

Q: A great deal of international trade is transshipment trade. (A: intra-industry trade; B:…

A: International trade is economic exchanges that are made between nations. Among the things normally…

Q: 1. What makes economic globalization distinct from internalization? Justify. 2. What are the 2 most…

A: "Since you have asked multiple question,we will solve first question for you.If you want specific…

Q: In Autarka 2 amusement parks, Alfonso's wonderland and Bernice's rides there are 9600 people who…

A: Let, the price of admission at Alfonso's Wonderland be = $PA. The price of admission at Bernice's…

Q: a tax of $10 per ton of coal causes the price, inclusive of the tax, to increase from $60 per ton to…

A: Consumer surplus is the difference between what consumers are ready to pay and what they actually…

Q: Draw a circular flow of diagram and identify the parts of the model that corresponds to the flow of…

A: DISCLAIMER “Since you have asked multiple questions, we will solve the first question for you as…

Q: Question 2: (Product Line) Consider the Product line pricing problem discussed in class. Assume that…

A: It is given that:

Q: 4. Analyzing the effects of a trade deficit You have just been hired by the U.S. government to…

A: When a nation's imports exceed its exports over a given time frame, a trade deficit results. It is…

Q: Suppose the price elasticity of demand is given by E= 90 What quantity level maximizes total…

A: The concept of elasticity is used to study the changes in quantity demanded or supplied due to…

Q: o you think the Heckscher-Ohlin model sufficiently explains trade between countries?

A: Trade theory explains the causes of international trade. It was David Ricardo who invented the term…

Q: Explain how either economic profit or loss minimization could be representative of the short-run…

A: Monopolistically competitive market refers to the market where many sellers and buyers exist in the…

Q: Suppose that a perishable item costs $10 and sells for $16. Any item that is not sold by the end of…

A: Marginal cost refers to the change in total cost that occurs due to the making of one additional…

Q: Kooche Company plans to invest $1,000,000 in projects next year. $700,000 will be provided through…

A: We use the formula for the Weighted Average Cost of Capital (WACC): WACC = (Weightage of equity*cost…

Q: ce; B: trade restrictions; C: currency differences).

A: International trade aims to export and import goods and services with lower barriers on trade…

Q: Louise's utility over baskets of pounds of Kale (K) and heads of Lettuce (L) is U(K,L) = 50K¹/2L¹2.…

A:

Q: A group of companies decided to acquire a state-of-the-art production machine that will cost…

A: Given information: Cost of machine = $300,000Installation charges = $6500The rate of depreciation =…

Q: Machine that cost $150,000 and on which $120,000 of accumulated depreciation has been recorded was…

A: Given is the following information in the question: Cost of machine = $150000 Accumulate…

Q: A consumer has utility u(x₁, x₂) = x₁ + x1x2. Suppose that, because of a shortage of good 1, the…

A: Utility function : u(x1 , x2 ) = x1 + x1x2 Price of good 1 : P1 , Price of good 2 : P2 Income =…

Q: Compute the missing negative differential value Reference Value 100 Positive Differential Value 160…

A: Positive Differentiation Value refers to the monetary value that an opportunity creates for the…

Q: Draw supply and demand graphs for each of the following markets. Be sure to label the axis and…

A: When talking about demand and supply framework, it can be said that it is the representation of a…

Q: 1. A tiny economy only produces baseball bats and sells them in dollars. In 2020, they produced 500…

A: Nominal GDP will be a Gross domestic product that is assessed at the current market costs. Gross…

Q: Rent (per month) Market rent = $1,500- Cent control = $1,000 100 120 E 140 160 180 4.51 Tops 525L…

A: Introduction Price elasticity of demand tells how much price is responsive to demand whereas price…

Q: A U.S. Congressperson wants to reduce the U.S. trade deficit by imposing tariffs on imports. Use a…

A: The IS-LM model is the Keynesian macroeconomic model which states the relationship between market…

Q: 4. Large number of sellers and buyers -plurality -consumer welfare -homogeneity -free entry and exit…

A: Market is the term used to describe the system in which buyers and sellers negotiate a price and…

Q: Compensation for a rise in price Charlie's utility over X and Y is given by U(X,Y)=XY, Px-Py-1 and…

A: Here we are given the well behaved utility function of the consumer and also the budget of the…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

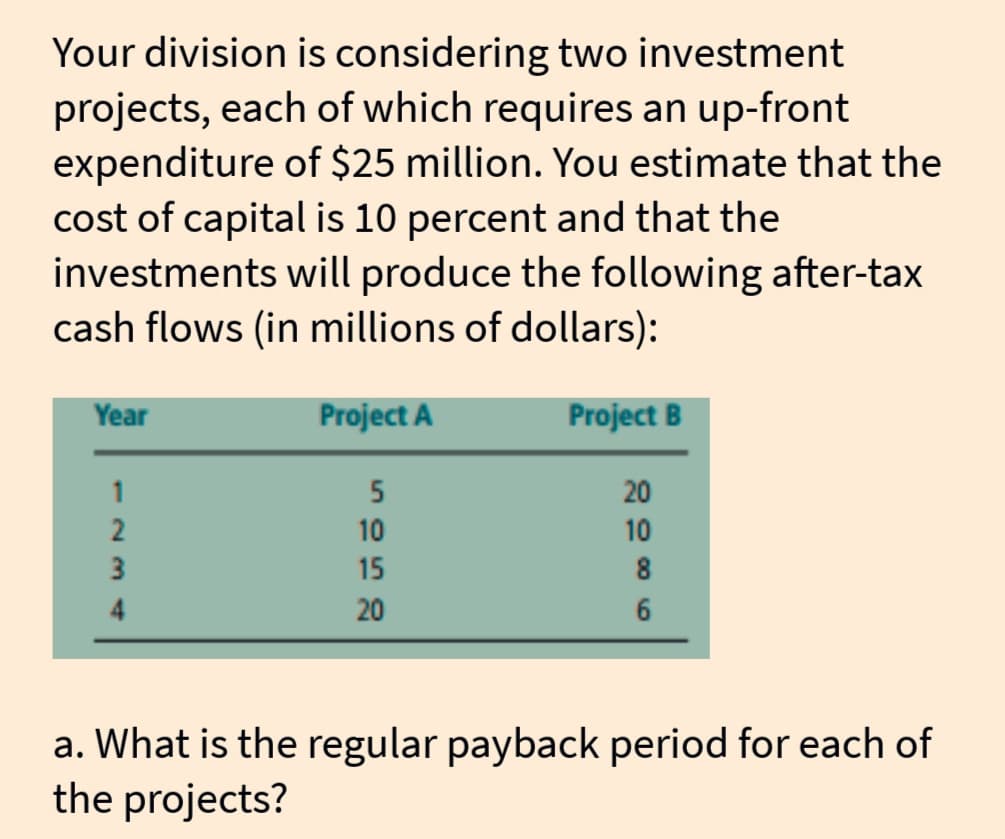

- You've estimated the following cash flows (in $ million) for two mutually exclusive projects: Year Project A Project B 0 -27 -43 1 30 45 2 40 50 What is the crossover rate, i.e., the discount rate at which both projects have the same NPV? What is project A's NPV at the crossover rate? What is project B's NPV at the crossover rate?Horizon value question A project involved initial construction costs of $1.75 million. After 15 years, the useful life of that construction will be over and the facility will be demolished, involving sensitive environmental protections and cleanup. You estimate that 25% of the cost of the facility represents items that could be sold for scrap at 30% of their initial construction cost. You estimate the proper demolition cost of such a facility to be $0.9M. a. What is the NPV of the horizon value if the real discount rate is 0.035? b. If the expected annual rate of inflation is 0.02, what is the nominal horizon value in 15 years?A businessman is considering the purchase of a machine that is expected to be obsolete in 5years. The machine is worthP100,000. The prevailing rate of interest is 15%. His estimate of the annual gross incomes fromthe use of the machine isas follows:Year Income1 20,0002 25,0003 35,0004 30,0005 28,000Total = P138 999Should the businessman purchase the machine?

- A process plant making 5000kg /day of a product selling for $1.75 per kg has annual directproduction costs of $2 million at 100 percent capacity and other fixed costs of $700,000. What isthe fixed charge per kg at the break-even point? If the selling price of the product is increased by10 percent, what is the dollar increase in net profit at full capacity if the income tax rate is 35percent of gross earnings?6 The economic analysis of a project foresees annual investments equal to R$300,000,000.00, over three years of construction, followed by a very long period, which can be considered infinite, with an annual revenue of R$300,000,000.00 and annual operating costs (including taxes) of BRL 120,000,000.00. Obtain the net present value (NPV) of this project, in the year of the first investment, considering the minimum rate of attractiveness equal to 12% per year.Suppose you currently earn taxable income of $100,000 per year. You are subject to an MTR of 50 percent. Currently, your ATR is 35 percent. Calculate your annual tax. Calculate the extra tax that you would pay per year if your annual income increased to $110,000. What is your ATR when your annual income is $110,000?

- Halloween, Inc., is considering a new product launch. The firm expects to have an annual operating cash flow of $9.6 million for the next 9 years. The discount rate for this project is 13 percent for new product launches. The initial investment is $39.6 million. Assume that the project has no salvage value at the end of its economic life. a. What is the NPV of the new product? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) b. After the first year, the project can be dismantled and sold for $26.6 million. If the estimates of remaining cash flows are revised based on the first year’s experience, at what level of expected cash flows does it make sense to abandon the project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)You have been asked by the chief financial officer of your company to estimate what thecompany’s share price will be at the end of four years from today. Your company has recentlypaid a dividend of $1.00 which is expected to grow at 5% p.a. over the foreseeable future. Ifthe company’s required rate of return on equity is 10% your price estimate at the end of year 4will be closest to: A. $20.00.B. $21.00.C. $24.30.D. $25.50.Calculate the net present value (NPV) before tax of investment A: a factory. Base your calculation on the following information: The investment cost is paid in full in quarter 0, and the cost of the factory is 100000. The factory has a lifetime of 20 quarters (5 years) and the value of the factory at the end of quarter 20 is 0 Only Basic jetpacks should be manufactured at the factory throughout its lifetime. There is no investment in research to streamline production or material consumption. Suppose the quarterly demand in the market is constant and given at P = 228 - 0.007 * Q, where P is price and Q is the number of jetpacks in demand. There are 5 competitors in the market (including you), and all sell the same number of jetpacks each quarter at the price of 193 each. You produce as much as you sell. The costs associated with the quarterly production at the factory are given at K = 158 * Q + 20000, where 158 * Q is direct labor cost and materials, and 20000 is quarterly maintenance…

- Given the following cash flows for project X and project Y, Year Project X Project Y 0 -55000 -100000 1 20000 15000 2 13500 17000 3 11000 19000 4 10000 25000 5 9000 30000 6 7500 35000 Calculate the NPV, IRR, MIRR and traditional payback period for each project, assuming a required rate of return of 7 percent If the projects are independent, which project(s) should be selected? If they are mutually exclusive, which project should be selected?You have a project with the net cash flow summarized below. The project is not suitable for direct reinvestment, so incoming revenue will be placed into an external account that yields 2.5%. (The "External Reinvestment Rate" is 2.5%). What is the ERR for this project? (Provide your answers in digits only with 2 decimal places. No comas or pesos or percent.)You invested $100,000 in a project and received $40,000 at n = 1, $40,000 atn = 2, and $30,000 at n = 3 years. You need to terminate the project at the end of year 3. Your interest rate is 10%; what is the project balance at the time of termination?(a) Gain of $10,000(b) Loss of $8,039(c) Loss of $10,700(d) Just break even