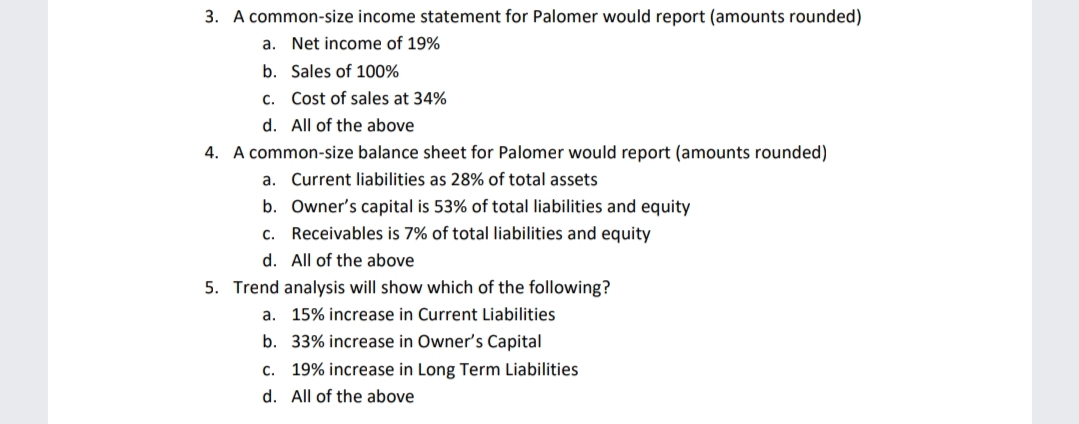

3. A common-size income statement for Palomer would report (amounts rounded) a. Net income of 19% b. Sales of 100% c. Cost of sales at 34% d. All of the above 4. A common-size balance sheet for Palomer would report (amounts rounded) a. Current liabilities as 28% of total assets b. Owner's capital is 53% of total liabilities and equity c. Receivables is 7% of total liabilities and equity d. All of the above 5. Trend analysis will show which of the following? a. 15% increase in Current Liabilities b. 33% increase in Owner's Capital c. 19% increase in Long Term Liabilities All of the above

3. A common-size income statement for Palomer would report (amounts rounded) a. Net income of 19% b. Sales of 100% c. Cost of sales at 34% d. All of the above 4. A common-size balance sheet for Palomer would report (amounts rounded) a. Current liabilities as 28% of total assets b. Owner's capital is 53% of total liabilities and equity c. Receivables is 7% of total liabilities and equity d. All of the above 5. Trend analysis will show which of the following? a. 15% increase in Current Liabilities b. 33% increase in Owner's Capital c. 19% increase in Long Term Liabilities All of the above

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

Transcribed Image Text:3. A common-size income statement for Palomer would report (amounts rounded)

a. Net income of 19%

b. Sales of 100%

c. Cost of sales at 34%

d. All of the above

4. A common-size balance sheet for Palomer would report (amounts rounded)

a. Current liabilities as 28% of total assets

b. Owner's capital is 53% of total liabilities and equity

c. Receivables is 7% of total liabilities and equity

d. All of the above

5. Trend analysis will show which of the following?

a. 15% increase in Current Liabilities

b. 33% increase in Owner's Capital

c. 19% increase in Long Term Liabilities

d. All of the above

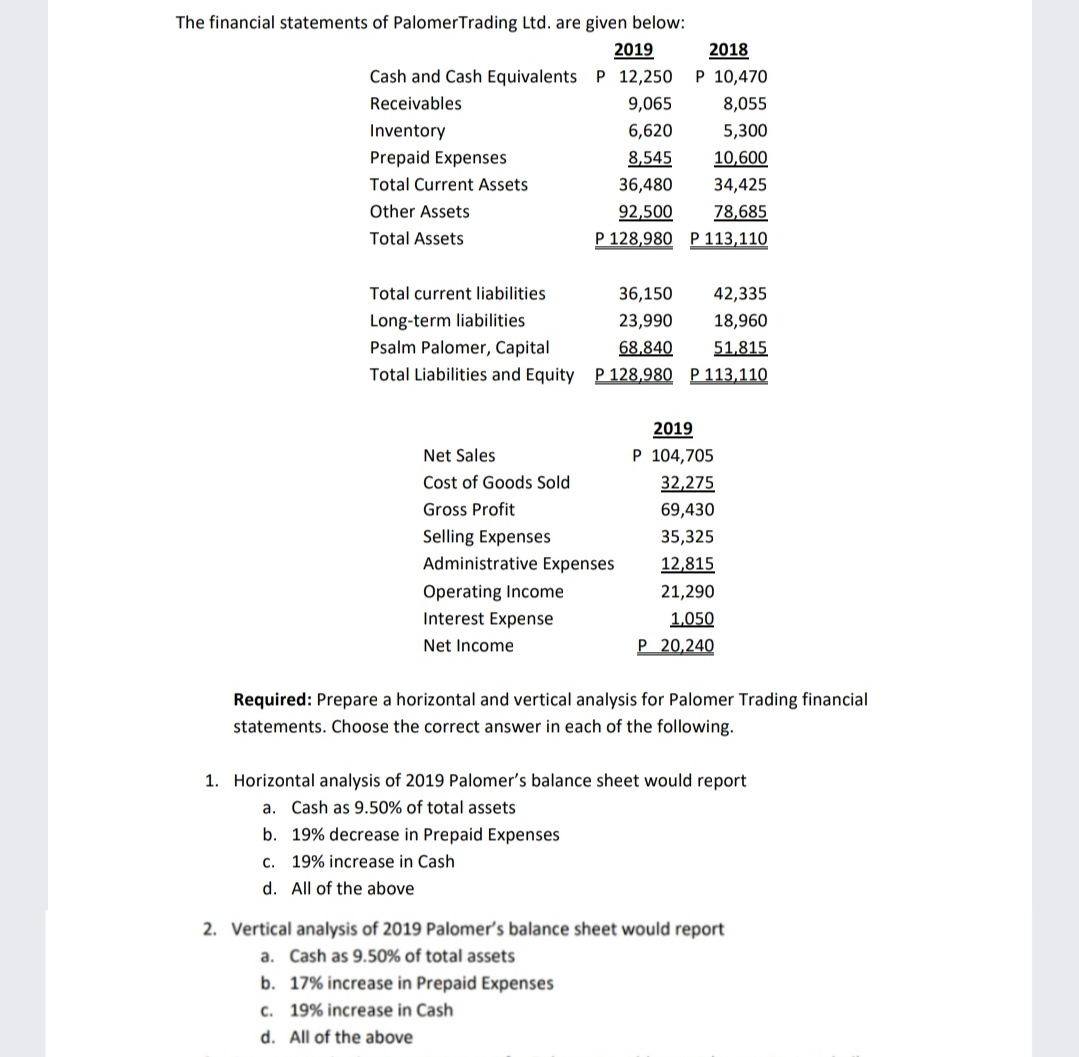

Transcribed Image Text:The financial statements of PalomerTrading Ltd. are given below:

2019

Cash and Cash Equivalents P 12,250

2018

P 10,470

Receivables

9,065

8,055

Inventory

6,620

5,300

Prepaid Expenses

8,545

10,600

Total Current Assets

36,480

34,425

Other Assets

92,500

P 128,980 P 113,110

78,685

Total Assets

Total current liabilities

36,150

42,335

Long-term liabilities

23,990

18,960

Psalm Palomer, Capital

68,840

51,815

Total Liabilities and Equity P 128,980 P 113,110

2019

P 104,705

Net Sales

Cost of Goods Sold

32,275

Gross Profit

69,430

Selling Expenses

35,325

Administrative Expenses

12,815

Operating Income

21,290

Interest Expense

1,050

Net Income

P 20,240

Required: Prepare a horizontal and vertical analysis for Palomer Trading financial

statements. Choose the correct answer in each of the following.

1. Horizontal analysis of 2019 Palomer's balance sheet would report

a. Cash as 9.50% of total assets

b. 19% decrease in Prepaid Expenses

c. 19% increase in Cash

d. All of the above

2. Vertical analysis of 2019 Palomer's balance sheet would report

a. Cash as 9.50% of total assets

b. 17% increase in Prepaid Expenses

c. 19% increase in Cash

d. All of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,