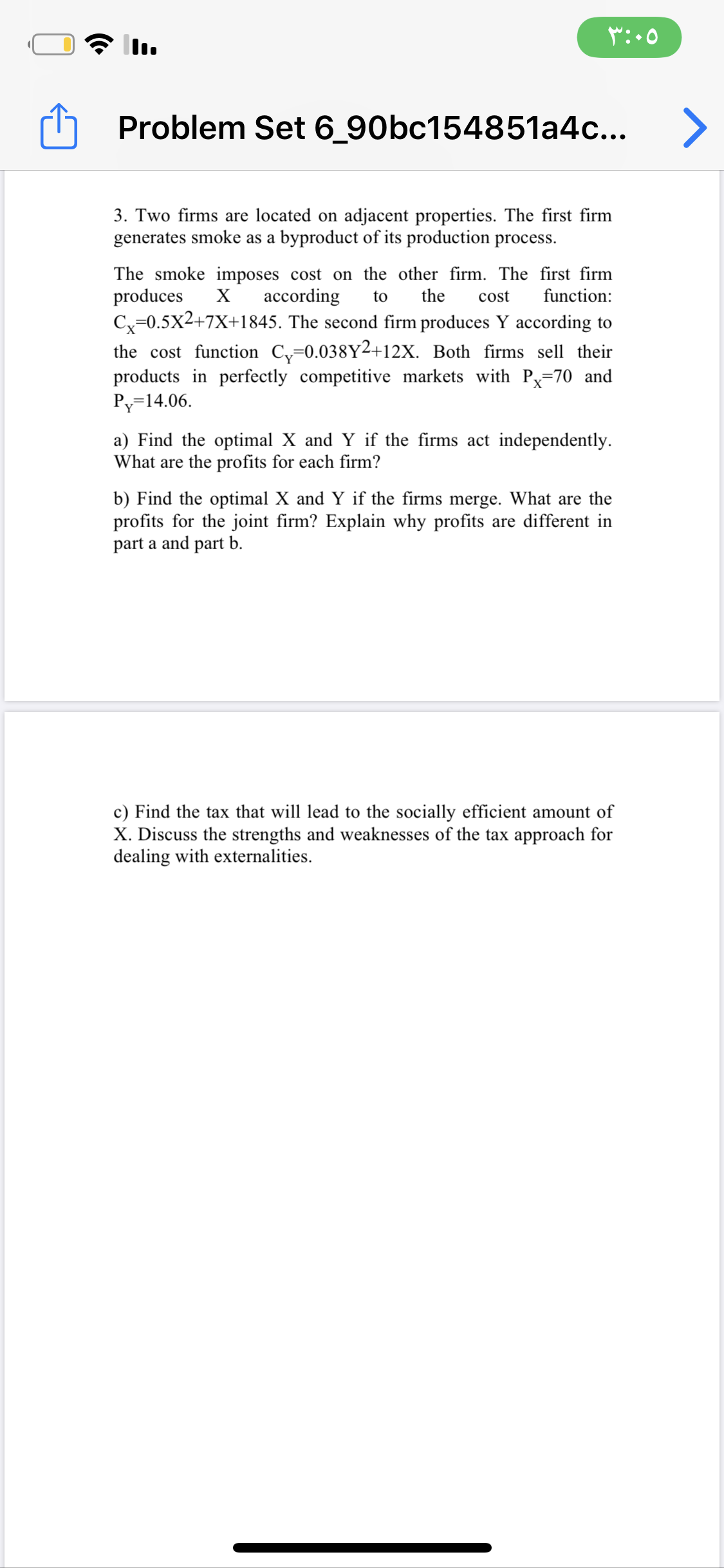

3. Two firms are located on adjacent properties. The first firm generates smoke as a byproduct of its production process. The smoke imposes cost on the other firm. The first firm produces Cx=0.5x2+7X+1845. The second firm produces Y according to the cost function C,=0.038Y2+12X. Both firms sell their products in perfectly competitive markets with Px=70 and Py=14.06. X according to the cost function: a) Find the optimal X and Y if the firms act independently. What are the profits for each firm? b) Find the optimal X and Y if the firms merge. What are the profits for the joint firm? Explain why profits are different in part a and part b. c) Find the tax that will lead to the socially efficient amount of X. Discuss the strengths and weaknesses of the tax approach for dealing with externalities.

3. Two firms are located on adjacent properties. The first firm generates smoke as a byproduct of its production process. The smoke imposes cost on the other firm. The first firm produces Cx=0.5x2+7X+1845. The second firm produces Y according to the cost function C,=0.038Y2+12X. Both firms sell their products in perfectly competitive markets with Px=70 and Py=14.06. X according to the cost function: a) Find the optimal X and Y if the firms act independently. What are the profits for each firm? b) Find the optimal X and Y if the firms merge. What are the profits for the joint firm? Explain why profits are different in part a and part b. c) Find the tax that will lead to the socially efficient amount of X. Discuss the strengths and weaknesses of the tax approach for dealing with externalities.

Chapter19: Externalities And Public Goods

Section: Chapter Questions

Problem 19.1P: A firm in a perfectly competitive industry has patented a newprocess for making widgets. The new...

Related questions

Question

3

Transcribed Image Text:3. Two firms are located on adjacent properties. The first firm

generates smoke as a byproduct of its production process.

The smoke imposes cost on the other firm. The first firm

produces

Cx=0.5x2+7X+1845. The second firm produces Y according to

the cost function C,=0.038Y2+12X. Both firms sell their

products in perfectly competitive markets with Px=70 and

Py=14.06.

X

according

to

the

cost

function:

a) Find the optimal X and Y if the firms act independently.

What are the profits for each firm?

b) Find the optimal X and Y if the firms merge. What are the

profits for the joint firm? Explain why profits are different in

part a and part b.

c) Find the tax that will lead to the socially efficient amount of

X. Discuss the strengths and weaknesses of the tax approach for

dealing with externalities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning