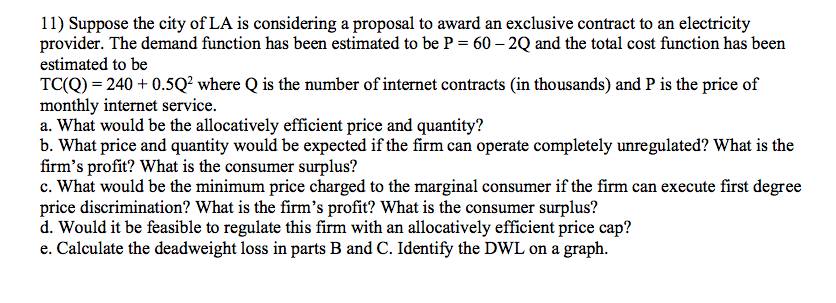

11) Suppose the city of LA is considering a proposal to award an exclusive contract to an electricity provider. The demand function has been estimated to be P = 60 – 2Q and the total cost function has been estimated to be TC(Q) = 240 + 0.5Q² where Q is the number of internet contracts (in thousands) and P is the price of monthly internet service. a. What would be the allocatively efficient price and quantity? b. What price and quantity would be expected if the firm can operate completely unregulated? What is the firm's profit? What is the consumer surplus? c. What would be the minimum price charged to the marginal consumer if the firm can execute first degree price discrimination? What is the firm’'s profit? What is the consumer surplus?

11) Suppose the city of LA is considering a proposal to award an exclusive contract to an electricity provider. The demand function has been estimated to be P = 60 – 2Q and the total cost function has been estimated to be TC(Q) = 240 + 0.5Q² where Q is the number of internet contracts (in thousands) and P is the price of monthly internet service. a. What would be the allocatively efficient price and quantity? b. What price and quantity would be expected if the firm can operate completely unregulated? What is the firm's profit? What is the consumer surplus? c. What would be the minimum price charged to the marginal consumer if the firm can execute first degree price discrimination? What is the firm’'s profit? What is the consumer surplus?

Chapter19: Externalities And Public Goods

Section: Chapter Questions

Problem 19.3P

Related questions

Question

Transcribed Image Text:11) Suppose the city of LA is considering a proposal to award an exclusive contract to an electricity

provider. The demand function has been estimated to be P = 60 – 2Q and the total cost function has been

estimated to be

TC(Q) = 240 + 0.5Q? where Q is the number of internet contracts (in thousands) and P is the price of

monthly internet service.

a. What would be the allocatively efficient price and quantity?

b. What price and quantity would be expected if the firm can operate completely unregulated? What is the

firm's profit? What is the consumer surplus?

c. What would be the minimum price charged to the marginal consumer if the firm can execute first degree

price discrimination? What is the firm’'s profit? What is the consumer surplus?

d. Would it be feasible to regulate this firm with an allocatively efficient price cap?

e. Calculate the deadweight loss in parts B and C. Identify the DWL on a graph.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you