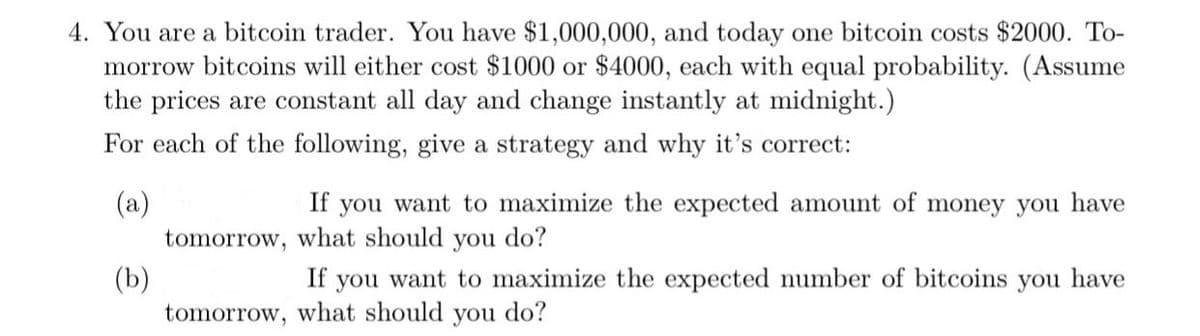

4. You are a bitcoin trader. You have $1,000,000, and today one bitcoin costs $2000. To- morrow bitcoins will either cost $1000 or $4000, each with equal probability. (Assume the prices are constant all day and change instantly at midnight.) For each of the following, give a strategy and why it's correct: (a) If you want to maximize the expected amount of money you have what should you tomorrow, do? (b) tomorrow, what should you do? If you want to maximize the expected number of bitcoins you have

4. You are a bitcoin trader. You have $1,000,000, and today one bitcoin costs $2000. To- morrow bitcoins will either cost $1000 or $4000, each with equal probability. (Assume the prices are constant all day and change instantly at midnight.) For each of the following, give a strategy and why it's correct: (a) If you want to maximize the expected amount of money you have what should you tomorrow, do? (b) tomorrow, what should you do? If you want to maximize the expected number of bitcoins you have

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.5P

Related questions

Question

pleaseplease do this urgently

Transcribed Image Text:4. You are a bitcoin trader. You have $1,000,000, and today one bitcoin costs $2000. To-

morrow bitcoins will either cost $1000 or $4000, each with equal probability. (Assume

the prices are constant all day and change instantly at midnight.)

For each of the following, give a strategy and why it's correct:

(a)

If you want to maximize the expected amount of money you have

what should you do?

tomorrow,

(b)

tomorrow, what should you do?

If

you want to maximize the expected number of bitcoins you have

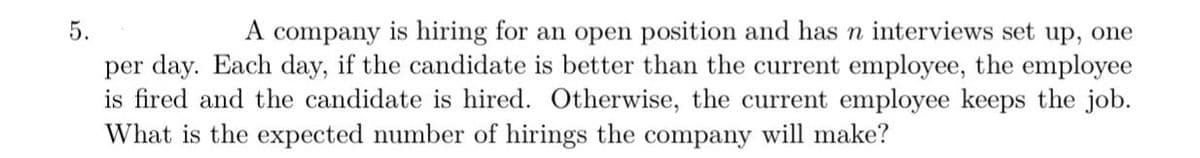

Transcribed Image Text:5.

A company is hiring for an open position and has n interviews set up, one

per day. Each day, if the candidate is better than the current employee, the employee

is fired and the candidate is hired. Otherwise, the current employee keeps the job.

What is the expected number of hirings the company will make?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax