5. Consider the OLS estimator of a model to explain the stock prices of a FTSE 100 company using 120 observations from 2012 m1 to 2021 m 12, all variables are calculated at the end of the month t: log (stock +) 0.86 + 0.54 log (profit £) - 0.65 log (research t)-1.34 log (marketing &) (1.12) (0.24) (20)

5. Consider the OLS estimator of a model to explain the stock prices of a FTSE 100 company using 120 observations from 2012 m1 to 2021 m 12, all variables are calculated at the end of the month t: log (stock +) 0.86 + 0.54 log (profit £) - 0.65 log (research t)-1.34 log (marketing &) (1.12) (0.24) (20)

College Algebra (MindTap Course List)

12th Edition

ISBN:9781305652231

Author:R. David Gustafson, Jeff Hughes

Publisher:R. David Gustafson, Jeff Hughes

Chapter5: Exponential And Logarithmic Functions

Section5.2: Applications Of Exponential Functions

Problem 50E

Related questions

Question

Transcribed Image Text:G FTSE 100

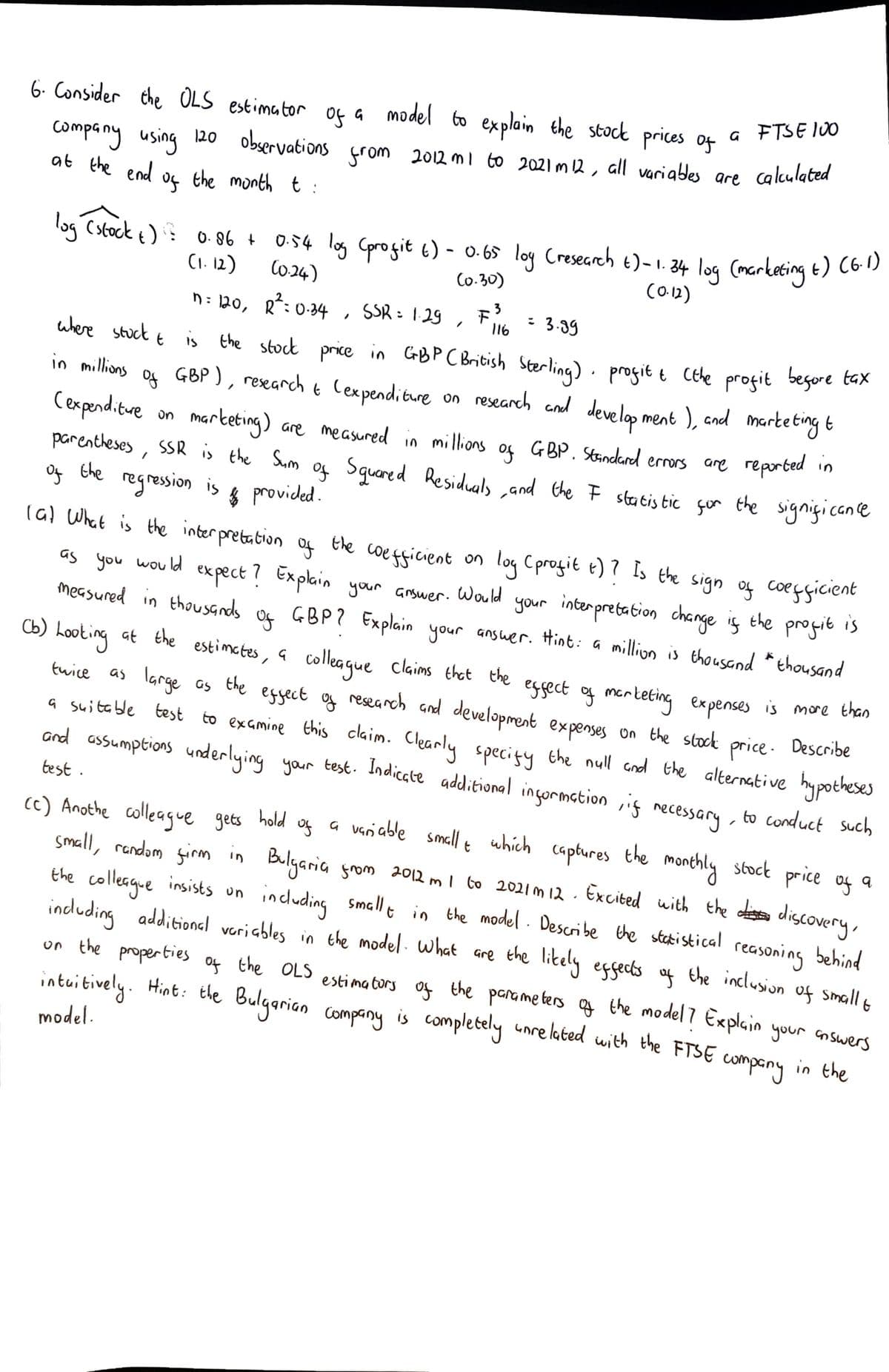

6. Consider the OLS estimator of a model to explain the stock prices of

observations from 2012 m1 to 2021 m 12, all variables are calculated

company using 120

at the end of the month t

log (stock +) 0.86 +

0.86 + 0.54 log (profit 6) - 0.65 log (research t)-1.34 log (marketing 6) (6.1)

(1.12) (0.24)

(0.30)

(0.12)

3

n = 120,

R² = 0.34

SSR = 1.29

F = 3.99

:

/

" 116

where stuck t

the

›

in millions

of

stock price in GBP (British Sterling) profit & (the profit before tax

GBP), research & (expenditure on research and development), and marketing t

marketing) are measured in

parentheses, SSR is the Sum of Squared Residuals, and the I statistic for the significance

GBP. Standard errors are reported in

(expenditure

on

millions

of

of

the

regression is

$

provided.

lat What is the interpretation of the coefficient on

as you would expect? Explain your answer.

log (profit t) 7 Is the sign of coefficient

measured in thousands of GBP? Explain your answer. Hint:

Would

your interpretation change is

(b) Looking at the estimates, a colleague claims that the effect of marketing expenses is more than

GBP? Explain your answer. Hint: a million is thousand *thousand

the

profit is

twice as large as the effect of research and development expenses

a suitable test to examine this claim. Clearly specify the null and the alternative

research and development expenses on the stock price. Describe

and assumptions underlying your test. Indicate additional information, if necessary, to conduct such

hypotheses

test.

(c) Anothe colleague gets

hold

of

t

q

a variable small

small, random firm in Bulgaria

which captures the monthly stock price of

Bulgaria from 2012 m 1 to 2021m 12. Excited with the discovery,

the colleague insists un

including additional variables in the model. What are the likely effects of the inclusion of small t

including smallt in the model. Describe the statistical reasoning behind

on the properties of the OLS estimators of the parameters of the model? Explain your answers

intuitively. Hint: the Bulgarian company is completely unrelated with the FTSE company

model.

in the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage