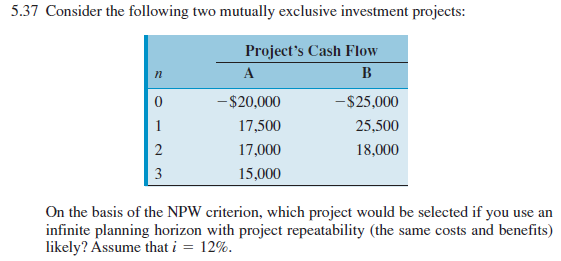

5.37 Consider the following two mutually exclusive investment projects: Project's Cash Flow n A B -$20,000 -$25,000 1 17,500 25,500 2 3 17,000 18,000 15,000 On the basis of the NPW criterion, which project would be selected if you use an infinite planning horizon with project repeatability (the same costs and benefits likely? Assume that i = 12%.

5.37 Consider the following two mutually exclusive investment projects: Project's Cash Flow n A B -$20,000 -$25,000 1 17,500 25,500 2 3 17,000 18,000 15,000 On the basis of the NPW criterion, which project would be selected if you use an infinite planning horizon with project repeatability (the same costs and benefits likely? Assume that i = 12%.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5MC

Related questions

Question

5.37

Transcribed Image Text:5.37 Consider the following two mutually exclusive investment projects:

Project's Cash Flow

A

B

- $20,000

-$25,000

1

17,500

25,500

2

17,000

18,000

3

15,000

On the basis of the NPW criterion, which project would be selected if you use an

infinite planning horizon with project repeatability (the same costs and benefits)

likely? Assume that i = 12%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning