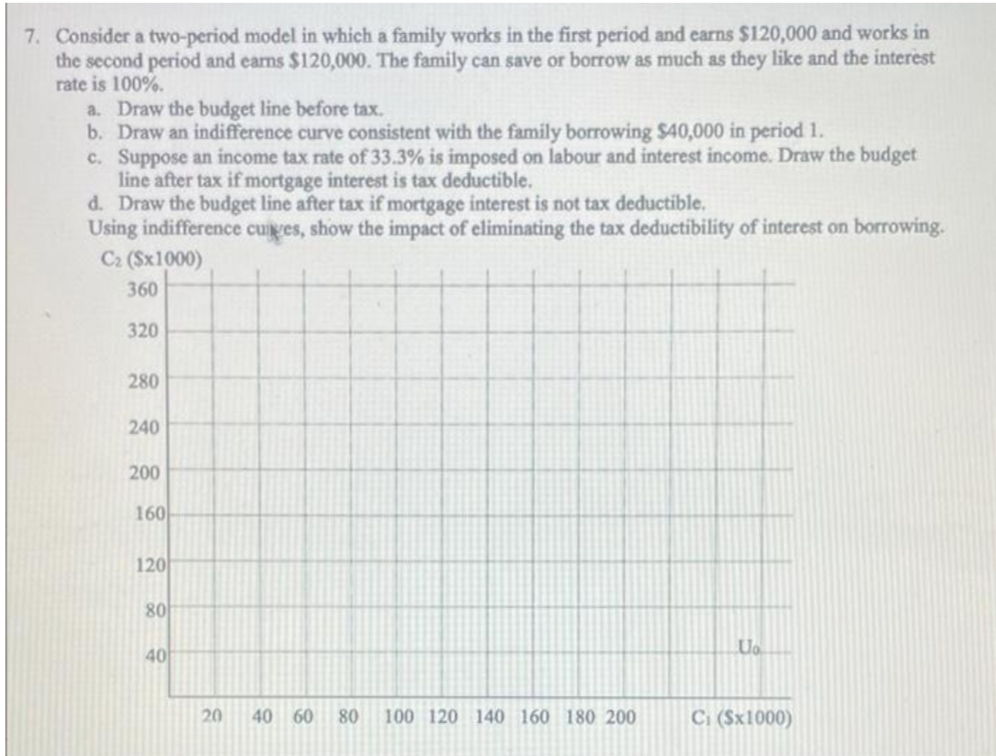

7. Consider a two-period model in which a family works in the first period and earns $120,000 and works in the second period and earns $120,000. The family can save or borrow as much as they like and the interest rate is 100%. a. Draw the budget line before tax. b. Draw an indifference curve consistent with the family borrowing $40,000 in period 1. c. Suppose an income tax rate of 33.3% is imposed on labour and interest income. Draw the budget line after tax if mortgage interest is tax deductible. d. Draw the budget line after tax if mortgage interest is not tax deductible. Using indifference cuiges, show the impact of eliminating the tax deductibility of interest on borrowing. C2 ($x1000)

7. Consider a two-period model in which a family works in the first period and earns $120,000 and works in the second period and earns $120,000. The family can save or borrow as much as they like and the interest rate is 100%. a. Draw the budget line before tax. b. Draw an indifference curve consistent with the family borrowing $40,000 in period 1. c. Suppose an income tax rate of 33.3% is imposed on labour and interest income. Draw the budget line after tax if mortgage interest is tax deductible. d. Draw the budget line after tax if mortgage interest is not tax deductible. Using indifference cuiges, show the impact of eliminating the tax deductibility of interest on borrowing. C2 ($x1000)

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.8P

Related questions

Question

3

Transcribed Image Text:7. Consider a two-period model in which a family works in the first period and earns $120,000 and works in

the second period and earns $120,000. The family can save or borrow as much as they like and the interest

rate is 100%.

a. Draw the budget line before tax.

b. Draw an indifference curve consistent with the family borrowing $40,000 in period 1.

c. Suppose an income tax rate of 33.3% is imposed on labour and interest income. Draw the budget

line after tax if mortgage interest is tax deductible.

d. Draw the budget line after tax if mortgage interest is not tax deductible.

Using indifference cuges, show the impact of eliminating the tax deductibility of interest on borrowing.

C2 ($x1000)

360

320

280

240

200

160

120

80

40

20

40 60

80

100 120 140 160 180 200

C ($x1000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning