A corporation has a taxable income of $6,120,000. At this income level, the federal income ta would be 80% of taxable income. However, it is customary to deduct taxes paid to one agen deducted, and that state and local taxes are computed in a similar manner. What is the tax li Gauss-Jordan elimination to solve the model. The tax liability of the corporation is% of the taxable income. Round to the nearest hundredth as needed.)

A corporation has a taxable income of $6,120,000. At this income level, the federal income ta would be 80% of taxable income. However, it is customary to deduct taxes paid to one agen deducted, and that state and local taxes are computed in a similar manner. What is the tax li Gauss-Jordan elimination to solve the model. The tax liability of the corporation is% of the taxable income. Round to the nearest hundredth as needed.)

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 32P

Related questions

Question

27 please answer this

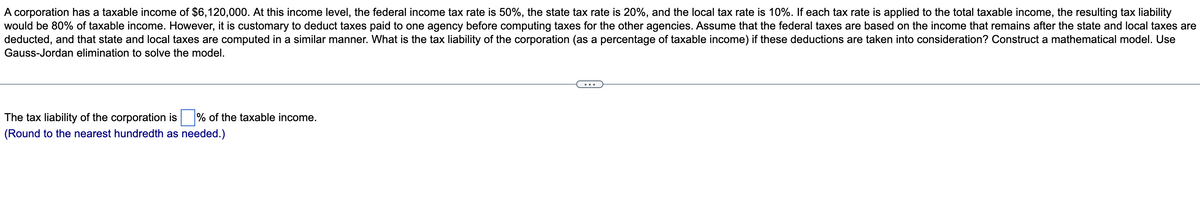

Transcribed Image Text:A corporation has a taxable income of $6,120,000. At this income level, the federal income tax rate is 50%, the state tax rate is 20%, and the local tax rate is 10%. If each tax rate is applied to the total taxable income, the resulting tax liability

would be 80% of taxable income. However, it is customary to deduct taxes paid to one agency before computing taxes for the other agencies. Assume that the federal taxes are based on the income that remains after the state and local taxes are

deducted, and that state and local taxes are computed in a similar manner. What is the tax liability of the corporation (as a percentage of taxable income) if these deductions are taken into consideration? Construct a mathematical model. Use

Gauss-Jordan elimination to solve the model.

The tax liability of the corporation is % of the taxable income.

(Round to the nearest hundredth as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you