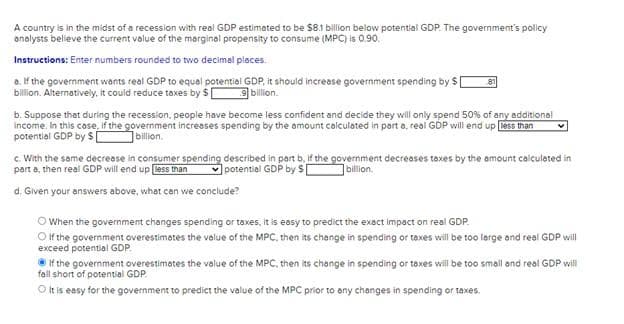

A country is in the midst of a recession with real GDP estimated to be $8.1 billion below potential GDP. The government's policy analysts believe the current value of the marginal propensity to consume (MPC) is 0.90. Instructions: Enter numbers rounded to two decimal places. a. If the government wants real GDP to equal potential GDP, it should increase government spending by S billion. Alternatively, it could reduce taxes by $[ 9 billion. b. Suppose that during the recession, people have become less confident and decide they will only spend 50% of any additional income. In this case, if the government increases spending by the amount calculated in part a, real GDP will end up less than potential GDP by $[ billion. c. With the same decrease in consumer spending described in part b, if the government decreases taxes by the amount calculated in part a, then real GDP will end up less than potential GDP by S billion. d. Given your answers above, what can we conclude? O When the government changes spending or taxes, it is easy to predict the exact impact on real GDP. O if the government overestimates the value of the MPC, then its change in spending or taxes will be too large and real GDP will exceed potential GDP. If the government overestimates the value of the MPC, then its change in spending or taxes will be too small and real GDP will fall short of potential GDP. O It is easy for the government to predict the value of the MPC prior to any changes in spending or taxes.

A country is in the midst of a recession with real GDP estimated to be $8.1 billion below potential GDP. The government's policy analysts believe the current value of the marginal propensity to consume (MPC) is 0.90. Instructions: Enter numbers rounded to two decimal places. a. If the government wants real GDP to equal potential GDP, it should increase government spending by S billion. Alternatively, it could reduce taxes by $[ 9 billion. b. Suppose that during the recession, people have become less confident and decide they will only spend 50% of any additional income. In this case, if the government increases spending by the amount calculated in part a, real GDP will end up less than potential GDP by $[ billion. c. With the same decrease in consumer spending described in part b, if the government decreases taxes by the amount calculated in part a, then real GDP will end up less than potential GDP by S billion. d. Given your answers above, what can we conclude? O When the government changes spending or taxes, it is easy to predict the exact impact on real GDP. O if the government overestimates the value of the MPC, then its change in spending or taxes will be too large and real GDP will exceed potential GDP. If the government overestimates the value of the MPC, then its change in spending or taxes will be too small and real GDP will fall short of potential GDP. O It is easy for the government to predict the value of the MPC prior to any changes in spending or taxes.

Chapter21: Fiscal Policy

Section: Chapter Questions

Problem 20SQ

Related questions

Question

A5

Transcribed Image Text:A country is in the midst of a recession with real GDP estimated to be $8.1 billion below potential GDP. The government's policy

analysts believe the current value of the marginal propensity to consume (MPC) is 0.90.

Instructions: Enter numbers rounded to two decimal places.

a. If the government wants real GDP to equal potential GDP, it should increase government spending by $

billion. Alternatively, it could reduce taxes by $

9 billion.

b. Suppose that during the recession, people have become less confident and decide they will only spend 50% of any additional

Income. In this case, if the government increases spending by the amount calculated in part a, real GDP will end up less than

potential GDP by $ billion.

c. With the same decrease in consumer spending described in part b. If the government decreases taxes by the amount calculated in

part a, then real GDP will end up less than potential GDP by $

billion.

d. Given your answers above, what can we conclude?

O When the government changes spending or taxes, it is easy to predict the exact impact on real GDP.

O if the government overestimates the value of the MPC, then its change in spending or taxes will be too large and real GDP will

exceed potential GDP.

If the government overestimates the value of the MPC, then its change in spending or taxes will be too small and real GDP will

fall short of potential GDP.

O It is easy for the government to predict the value of the MPC prior to any changes in spending or taxes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc