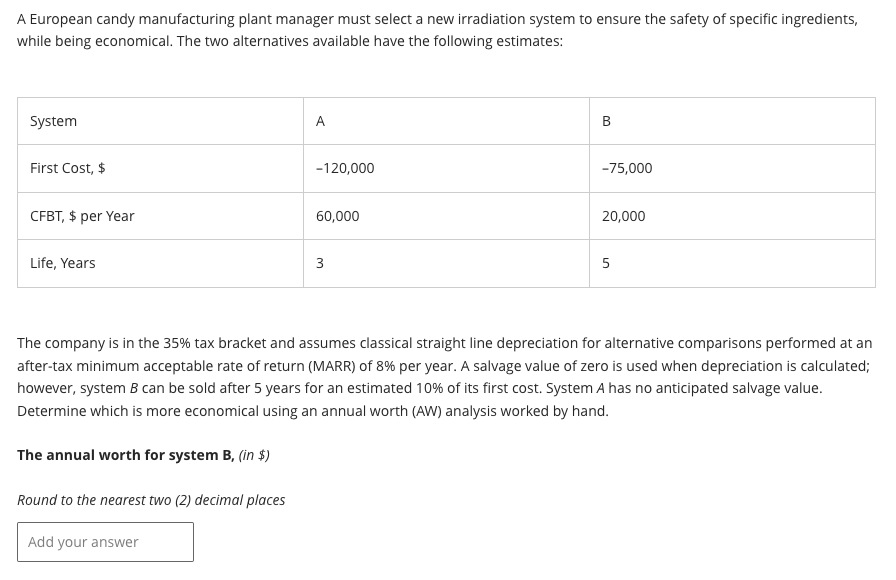

A European candy manufacturing plant manager must select a new irradiation system to ensure the safety of specific ingredients, while being economical. The two alternatives available have the following estimates: System First Cost, $ CFBT, $ per year Life, Years A -120,000 60,000 3 B -75,000 20,000 5

A European candy manufacturing plant manager must select a new irradiation system to ensure the safety of specific ingredients, while being economical. The two alternatives available have the following estimates: System First Cost, $ CFBT, $ per year Life, Years A -120,000 60,000 3 B -75,000 20,000 5

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

4. Help me answer the given question. Do not round off answers while solving, instead just the final answer will be rounded off to two decimal places.

Transcribed Image Text:A European candy manufacturing plant manager must select a new irradiation system to ensure the safety of specific ingredients,

while being economical. The two alternatives available have the following estimates:

System

First Cost, $

CFBT, $ per Year

Life, Years

A

Add your answer

-120,000

60,000

3

B

-75,000

20,000

5

The company is in the 35% tax bracket and assumes classical straight line depreciation for alternative comparisons performed at an

after-tax minimum acceptable rate of return (MARR) of 8% per year. A salvage value of zero is used when depreciation is calculated;

however, system B can be sold after 5 years for an estimated 10% of its first cost. System A has no anticipated salvage value.

Determine which is more economical using an annual worth (AW) analysis worked by hand.

The annual worth for system B, (in $)

Round to the nearest two (2) decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education