a) Liala Ltd acquired all the issued shares of Jordan Ltd on 1 January 2015. The following transactions occurred between the two entities: • On 1 June 2016, Liala Ltd sold inventory to Jordan Ltd for $12,000, this inventory previously costed Liala Ltd $10,000. By 30 June 2016, Jordan Ltd had sold 20% of this inventory to other entities for $3,000. The other 80% was all sold to external entities by 30 June 2017 for $13,000. During the 2016–17 period, Jordan Ltd sold inventory to Liala Ltd for $6,000, this being at cost plus 20% mark-up. Of this inventory, 20 % remained on hand in Liala Ltd at 30 June 2017. The tax rate is 30%. Required: (i) Prepare the consolidation worksheet entries for Liala Ltd at 30 June 2017 in relation to the intragroup transfers of inventory. I (ii) Compute the amount of cost of goods sold to be reported in the consolidated income statement for 2017 relating to the relevant intra-group sales. b) On 1 July 2016, Liala Itd sold an item of plant to Jordan Ltd Ltd for $150,000 when its carrying value in Liala Ltd book was $200,000 (costs $300,000, accumulated depreciation $100,000). This plant has a remaining useful life of five (5) years form the date of sale. The group measures its property plants and equipment using a costs model. Tax rate is 30 percent. Required: Prepare the necessary journal entries in 30 June 2017 to eliminate the intra-group transfer of equipment.

a) Liala Ltd acquired all the issued shares of Jordan Ltd on 1 January 2015. The following transactions occurred between the two entities: • On 1 June 2016, Liala Ltd sold inventory to Jordan Ltd for $12,000, this inventory previously costed Liala Ltd $10,000. By 30 June 2016, Jordan Ltd had sold 20% of this inventory to other entities for $3,000. The other 80% was all sold to external entities by 30 June 2017 for $13,000. During the 2016–17 period, Jordan Ltd sold inventory to Liala Ltd for $6,000, this being at cost plus 20% mark-up. Of this inventory, 20 % remained on hand in Liala Ltd at 30 June 2017. The tax rate is 30%. Required: (i) Prepare the consolidation worksheet entries for Liala Ltd at 30 June 2017 in relation to the intragroup transfers of inventory. I (ii) Compute the amount of cost of goods sold to be reported in the consolidated income statement for 2017 relating to the relevant intra-group sales. b) On 1 July 2016, Liala Itd sold an item of plant to Jordan Ltd Ltd for $150,000 when its carrying value in Liala Ltd book was $200,000 (costs $300,000, accumulated depreciation $100,000). This plant has a remaining useful life of five (5) years form the date of sale. The group measures its property plants and equipment using a costs model. Tax rate is 30 percent. Required: Prepare the necessary journal entries in 30 June 2017 to eliminate the intra-group transfer of equipment.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 25E

Related questions

Question

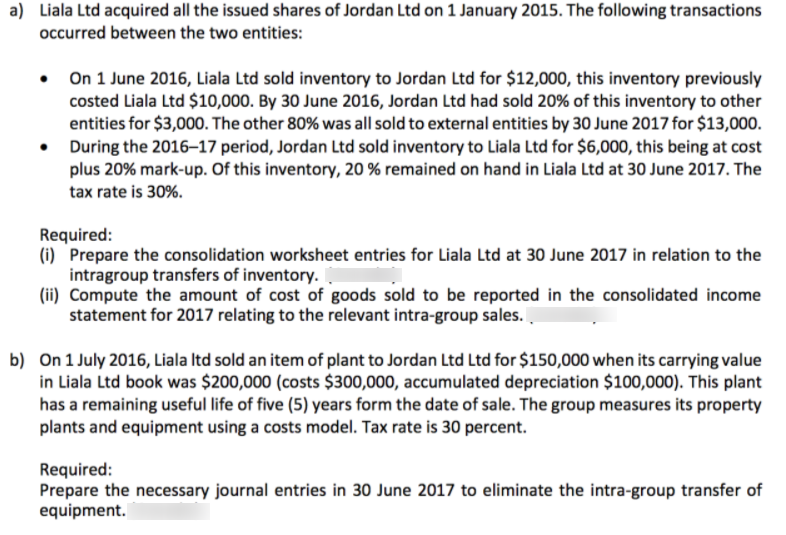

Transcribed Image Text:a) Liala Ltd acquired all the issued shares of Jordan Ltd on 1 January 2015. The following transactions

occurred between the two entities:

• On 1 June 2016, Liala Ltd sold inventory to Jordan Ltd for $12,000, this inventory previously

costed Liala Ltd $10,000. By 30 June 2016, Jordan Ltd had sold 20% of this inventory to other

entities for $3,000. The other 80% was all sold to external entities by 30 June 2017 for $13,000.

During the 2016–17 period, Jordan Ltd sold inventory to Liala Ltd for $6,000, this being at cost

plus 20% mark-up. Of this inventory, 20 % remained on hand in Liala Ltd at 30 June 2017. The

tax rate is 30%.

Required:

(i) Prepare the consolidation worksheet entries for Liala Ltd at 30 June 2017 in relation to the

intragroup transfers of inventory. I

(ii) Compute the amount of cost of goods sold to be reported in the consolidated income

statement for 2017 relating to the relevant intra-group sales.

b) On 1 July 2016, Liala Itd sold an item of plant to Jordan Ltd Ltd for $150,000 when its carrying value

in Liala Ltd book was $200,000 (costs $300,000, accumulated depreciation $100,000). This plant

has a remaining useful life of five (5) years form the date of sale. The group measures its property

plants and equipment using a costs model. Tax rate is 30 percent.

Required:

Prepare the necessary journal entries in 30 June 2017 to eliminate the intra-group transfer of

equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 5 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning