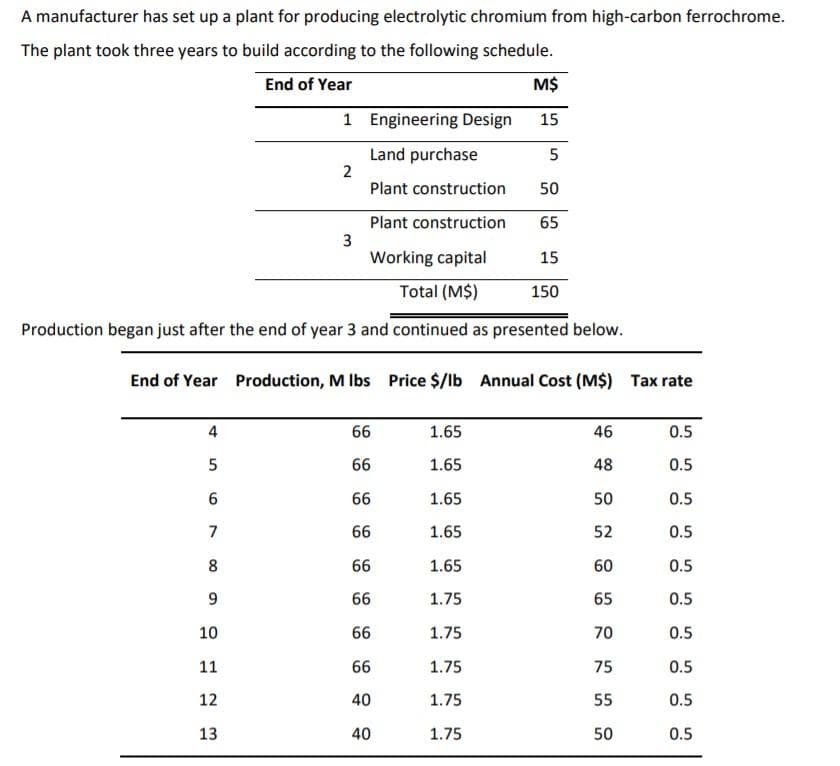

A manufacturer has set up a plant for producing electrolytic chromium from high-carbon ferrochrome. The plant took three years to build according to the following schedule. End of Year M$ 1 Engineering Design 15 Land purchase 2 Plant construction 5 50 Plant construction 65 Working capital 15 Total (M$) 150 Production began just after the end of year 3 and continued as presented below. End of Year Production, M Ibs Price $/lb Annual Cost (M$) Tax rate 4 66 1.65 46 0.5 66 1.65 48 0.5 66 1.65 50 0.5 7 66 1.65 52 0.5 8 66 1.65 60 0.5 66 1.75 65 0.5 10 66 1.75 70 0.5 11 66 1.75 75 0.5 12 40 1.75 55 0.5 13 40 1.75 50 0.5 9,

Assume a simple straight-line

1) Calculate the simple payback period using average annual net cash flow.

2) Calculate the pre-tax

3) Calculate the after-tax NPV for each year from year 0 to year 13.

Step by step

Solved in 4 steps with 5 images