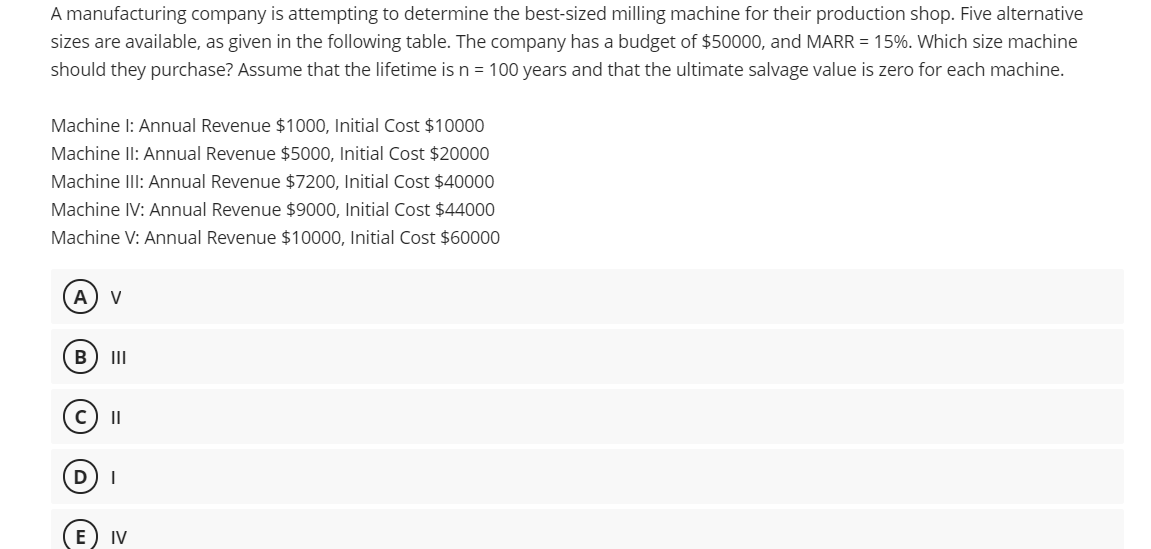

A manufacturing company is attempting to determine the best-sized milling machine for their production shop. Five alternative sizes are available, as given in the following table. The company has a budget of $50000, and MARR = 15%. Which size machine should they purchase? Assume that the lifetime is n = 100 years and that the ultimate salvage value is zero for each machine. Machine I: Annual Revenue $1000, Initial Cost $10000 Machine II: Annual Revenue $5000, Initial Cost $20000 Machine III: Annual Revenue $7200, Initial Cost $40000 Machine IV: Annual Revenue $9000, Initial Cost $44000 Machine V: Annual Revenue $10000, Initial Cost $60000 A) v II II D) I IV

A manufacturing company is attempting to determine the best-sized milling machine for their production shop. Five alternative sizes are available, as given in the following table. The company has a budget of $50000, and MARR = 15%. Which size machine should they purchase? Assume that the lifetime is n = 100 years and that the ultimate salvage value is zero for each machine. Machine I: Annual Revenue $1000, Initial Cost $10000 Machine II: Annual Revenue $5000, Initial Cost $20000 Machine III: Annual Revenue $7200, Initial Cost $40000 Machine IV: Annual Revenue $9000, Initial Cost $44000 Machine V: Annual Revenue $10000, Initial Cost $60000 A) v II II D) I IV

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

ULTIMATE SALVAGE VALUE

Transcribed Image Text:A manufacturing company is attempting to determine the best-sized milling machine for their production shop. Five alternative

sizes are available, as given in the following table. The company has a budget of $50000, and MARR = 15%. Which size machine

should they purchase? Assume that the lifetime is n = 100 years and that the ultimate salvage value is zero for each machine.

Machine I: Annual Revenue $1000, Initial Cost $10000

Machine Il: Annual Revenue $5000, Initial Cost $20000

Machine IlI: Annual Revenue $7200, Initial Cost $40000

Machine IV: Annual Revenue $9000, Initial Cost $44000

Machine V: Annual Revenue $10000, Initial Cost $60000

А

V

B

II

II

D

IV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning