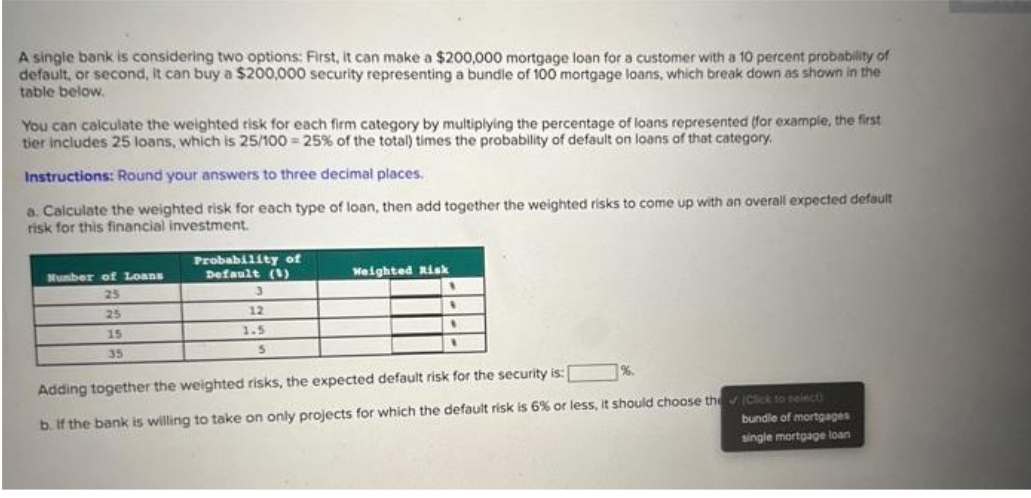

A single bank is considering two options: First, it can make a $200,000 mortgage loan for a customer with a 10 percent probability of default, or second, it can buy a $200,000 security representing a bundle of 100 mortgage loans, which break down as shown in the table below. You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first tier includes 25 loans, which is 25/100 = 25% of the total) times the probability of default on loans of that category. Instructions: Round your answers to three decimal places. a. Calculate the weighted risk for each type of loan, then add together the weighted risks to come up with an overall expected default risk for this financial investment. Number of Loans 25 25 15 35 Probability of Default (1) 3 12 1.5 5 Weighted Risk 1 Adding together the weighted risks, the expected default risk for the security is: b. If the bank is willing to take on only projects for which the default risk is 6% or less, it should choose the Click to select) bundle of mortgages single mortgage loan

A single bank is considering two options: First, it can make a $200,000 mortgage loan for a customer with a 10 percent probability of default, or second, it can buy a $200,000 security representing a bundle of 100 mortgage loans, which break down as shown in the table below. You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first tier includes 25 loans, which is 25/100 = 25% of the total) times the probability of default on loans of that category. Instructions: Round your answers to three decimal places. a. Calculate the weighted risk for each type of loan, then add together the weighted risks to come up with an overall expected default risk for this financial investment. Number of Loans 25 25 15 35 Probability of Default (1) 3 12 1.5 5 Weighted Risk 1 Adding together the weighted risks, the expected default risk for the security is: b. If the bank is willing to take on only projects for which the default risk is 6% or less, it should choose the Click to select) bundle of mortgages single mortgage loan

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter17: Making Decisions With Uncertainty

Section: Chapter Questions

Problem 17.5IP

Related questions

Question

Subject :- Economics

Transcribed Image Text:A single bank is considering two options: First, it can make a $200,000 mortgage loan for a customer with a 10 percent probability of

default, or second, it can buy a $200,000 security representing a bundle of 100 mortgage loans, which break down as shown in the

table below.

You can calculate the weighted risk for each firm category by multiplying the percentage of loans represented (for example, the first

tier includes 25 loans, which is 25/100 = 25% of the total) times the probability of default on loans of that category.

Instructions: Round your answers to three decimal places.

a. Calculate the weighted risk for each type of loan, then add together the weighted risks to come up with an overall expected default

risk for this financial investment.

Number of Loans

25

25

15

35

Probability of

Default (1)

12

1.5

5

Weighted Risk

Adding together the weighted risks, the expected default risk for the security is:

b. If the bank is willing to take on only projects for which the default risk is 6% or less, it should choose the✔ Click to select)

bundle of mortgages

single mortgage loan

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning