A stock analyst wondered whether the mean rate of return of financial, energy, and utility stocks differed over the past 5 years. He obtained a simple random sample of eight companies from each of the three sectors and obtained the 5-year rates of return shown in the accompanying table (in percent). Complete parts (a) through (d) below. Click the icon to view the data table. a) State the null and alternative hypotheses. Choose the correct answer below. DA. Ho: Hinancial =Penergy and H,: the means are different O B. Ho: Hinancial "Penergy =Hutilities and H,: at least one of the means is different OC. Ho: Hinancial "Henergy =Hutilities and H: Hinancial Henergy Hutilities OD. Ho: at least one of the means is different and H,: Hinancial = Henergy "Hutilities b) Normal probability plots indicate that the sample data come from normal populations. Are the requirements to use the one-way ANOVA procedure satisfied? OA. No, because there are k =3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have the same variance. OB. Yes, because there are k = 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have different variances. OC. No, because the largest sample standard deviation is more than twice the smallest sample standard deviation. O D. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have the same variance.

A stock analyst wondered whether the mean rate of return of financial, energy, and utility stocks differed over the past 5 years. He obtained a simple random sample of eight companies from each of the three sectors and obtained the 5-year rates of return shown in the accompanying table (in percent). Complete parts (a) through (d) below. Click the icon to view the data table. a) State the null and alternative hypotheses. Choose the correct answer below. DA. Ho: Hinancial =Penergy and H,: the means are different O B. Ho: Hinancial "Penergy =Hutilities and H,: at least one of the means is different OC. Ho: Hinancial "Henergy =Hutilities and H: Hinancial Henergy Hutilities OD. Ho: at least one of the means is different and H,: Hinancial = Henergy "Hutilities b) Normal probability plots indicate that the sample data come from normal populations. Are the requirements to use the one-way ANOVA procedure satisfied? OA. No, because there are k =3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have the same variance. OB. Yes, because there are k = 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have different variances. OC. No, because the largest sample standard deviation is more than twice the smallest sample standard deviation. O D. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have the same variance.

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.4: Distributions Of Data

Problem 19PFA

Related questions

Question

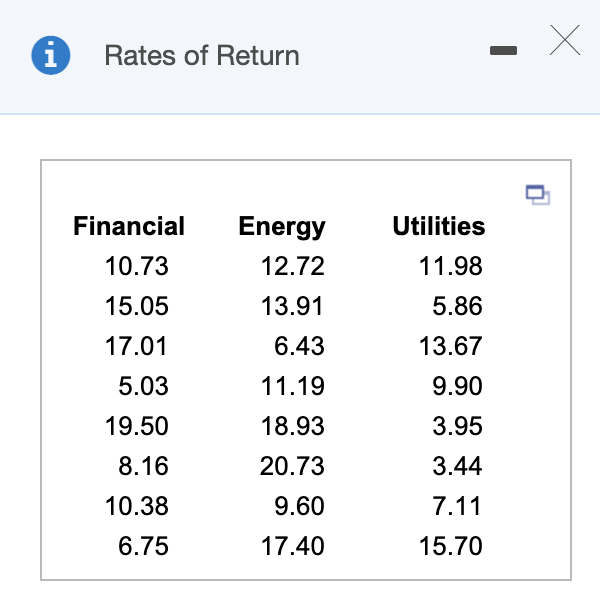

Transcribed Image Text:i

Rates of Return

Financial

Energy

Utilities

10.73

12.72

11.98

15.05

13.91

5.86

17.01

6.43

13.67

5.03

11.19

9.90

19.50

18.93

3.95

8.16

20.73

3.44

10.38

9.60

7.11

6.75

17.40

15.70

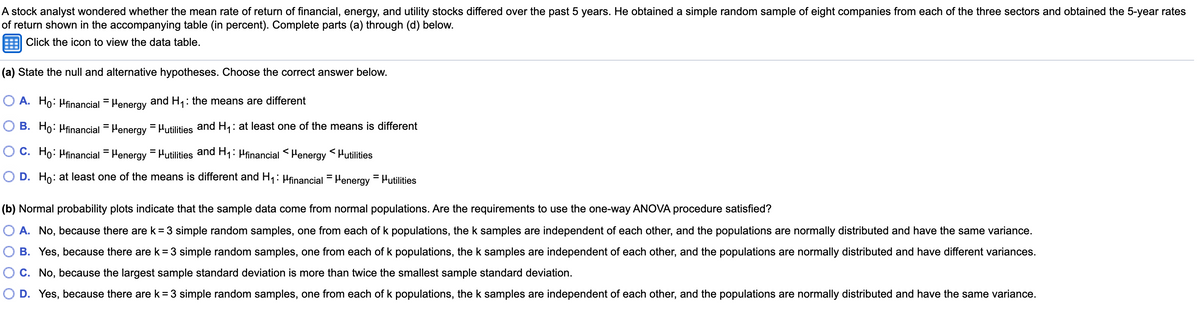

Transcribed Image Text:A stock analyst wondered whether the mean rate of return of financial, energy, and utility stocks differed over the past 5 years. He obtained a simple random sample of eight companies from each of the three sectors and obtained the 5-year rates

of return shown in the accompanying table (in percent). Complete parts (a) through (d) below.

Click the icon to view the data table.

(a) State the null and alternative hypotheses. Choose the correct answer below.

O A. Ho: Hfinancial = Peneray and H,: the means are different

O B. Ho: Hfinancial = Penergy = Hutilities and H1: at least one of the means is different

%3D

%3D

O C. Ho: Hfinancial = Henergy = Hutilities and H,: Hfinancial <Penergy <Hutilities

O D. Ho: at least one of the means is different and H1: Hfinancial = Penergy = Putilities

%3D

(b) Normal probability plots indicate that the sample data come from normal populations. Are the requirements to use the one-way ANOVA procedure satisfied?

O A. No, because there are k=3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have the same variance.

B. Yes, because there are k= 3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have different variances.

O C. No, because the largest sample standard deviation is more than twice the smallest sample standard deviation.

D. Yes, because there are k=3 simple random samples, one from each of k populations, the k samples are independent of each other, and the populations are normally distributed and have the same variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill