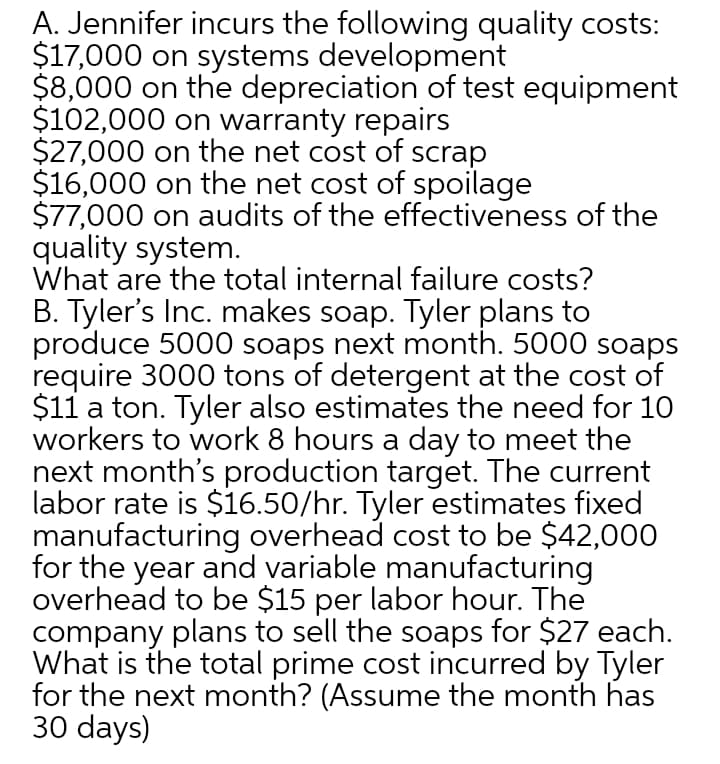

A. Jennifer incurs the following quality costs: $17,000 on systems development $8,000 on the depreciation of test equipment $102,000 on warranty repairs $27,000 on the net cost of scrap $16,000 on the net cost of spoilage $77,000 on audits of the effectiveness of the quality system. What are the total internal failure costs?

A. Jennifer incurs the following quality costs: $17,000 on systems development $8,000 on the depreciation of test equipment $102,000 on warranty repairs $27,000 on the net cost of scrap $16,000 on the net cost of spoilage $77,000 on audits of the effectiveness of the quality system. What are the total internal failure costs?

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter2: Accounting For Materials

Section: Chapter Questions

Problem 16P: Lloyd Industries manufactures electrical equipment from specifications received from customers. Job...

Related questions

Question

Transcribed Image Text:A. Jennifer incurs the following quality costs:

$17,000 on systems development

$8,000 on the depreciation of test equipment

$102,000 on warranty repairs

$27,000 on the net cost of scrap

$16,000 on the net cost of spoilage

$77,000 on audits of the effectiveness of the

quality system.

What are the total internal failure costs?

B. Tyler's Inc. makes soap. Tyler plans to

produce 5000 soaps next month. 5000 soaps

require 3000 tons of detergent at the cost of

$11 a ton. Tyler also estimates the need for 1O

workers to work 8 hours a day to meet the

next month's production target. The current

labor rate is $16.50/hr. Tyler estimates fixed

manufacturing overhead cost to be $42,000

for the year and variable manufacturing

overhead to be $15 per labor hour. The

company plans to sell the soaps for $27 each.

What is the total prime cost incurred by Tyler

for the next month? (Assume the month has

30 days)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning