a. Using demand equations what can you say these two goods? Are the complement, substitutes or irrelevant? How do they differ from the standar Cournot model? b. Find the equilibrium prices and quantities. c. Suppose the two firms merge. By doing so, the newly merged firm will act maximize the joint profits Find the joint-profit maximizing price ar quantities. d. Áre the combined profits greater or smaller from merging? That is, is mergir profitable for the firms? e. Are consumers better or worse off with the firms merging? How does th compare to the mergers of Cournot competitore selling substitutes2 What do

a. Using demand equations what can you say these two goods? Are the complement, substitutes or irrelevant? How do they differ from the standar Cournot model? b. Find the equilibrium prices and quantities. c. Suppose the two firms merge. By doing so, the newly merged firm will act maximize the joint profits Find the joint-profit maximizing price ar quantities. d. Áre the combined profits greater or smaller from merging? That is, is mergir profitable for the firms? e. Are consumers better or worse off with the firms merging? How does th compare to the mergers of Cournot competitore selling substitutes2 What do

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter12: Price And Output Determination: Oligopoly

Section: Chapter Questions

Problem 2E

Related questions

Question

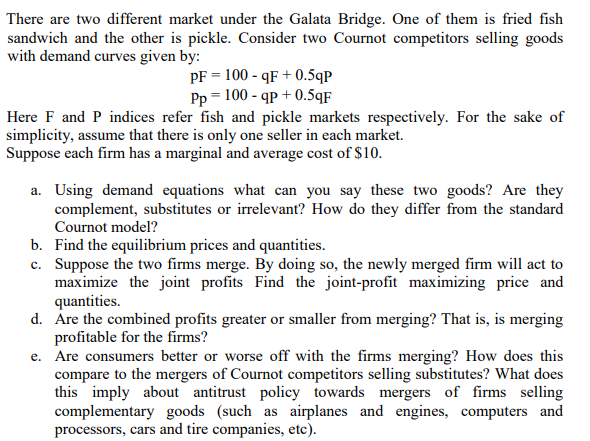

Transcribed Image Text:There are two different market under the Galata Bridge. One of them is fried fish

sandwich and the other is pickle. Consider two Cournot competitors selling goods

with demand curves given by:

PF = 100 - qF + 0.5qP

Pp = 100 - qp + 0.5qF

Here F and P indices refer fish and pickle markets respectively. For the sake of

simplicity, assume that there is only one seller in each market.

Suppose each firm has a marginal and average cost of $10.

a. Using demand equations what can you say these two goods? Are they

complement, substitutes or irrelevant? How do they differ from the standard

Cournot model?

b. Find the equilibrium prices and quantities.

c. Suppose the two firms merge. By doing so, the newly merged firm will act to

maximize the joint profits Find the joint-profit maximizing price and

quantities.

d. Áre the combined profits greater or smaller from merging? That is, is merging

profitable for the firms?

e. Are consumers better or worse off with the firms merging? How does this

compare to the mergers of Cournot competitors selling substitutes? What does

this imply about antitrust policy towards mergers of firms selling

complementary goods (such as airplanes and engines, computers and

processors, cars and tire companies, etc).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Survey of Economics (MindTap Course List)

Economics

ISBN:

9781305260948

Author:

Irvin B. Tucker

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning