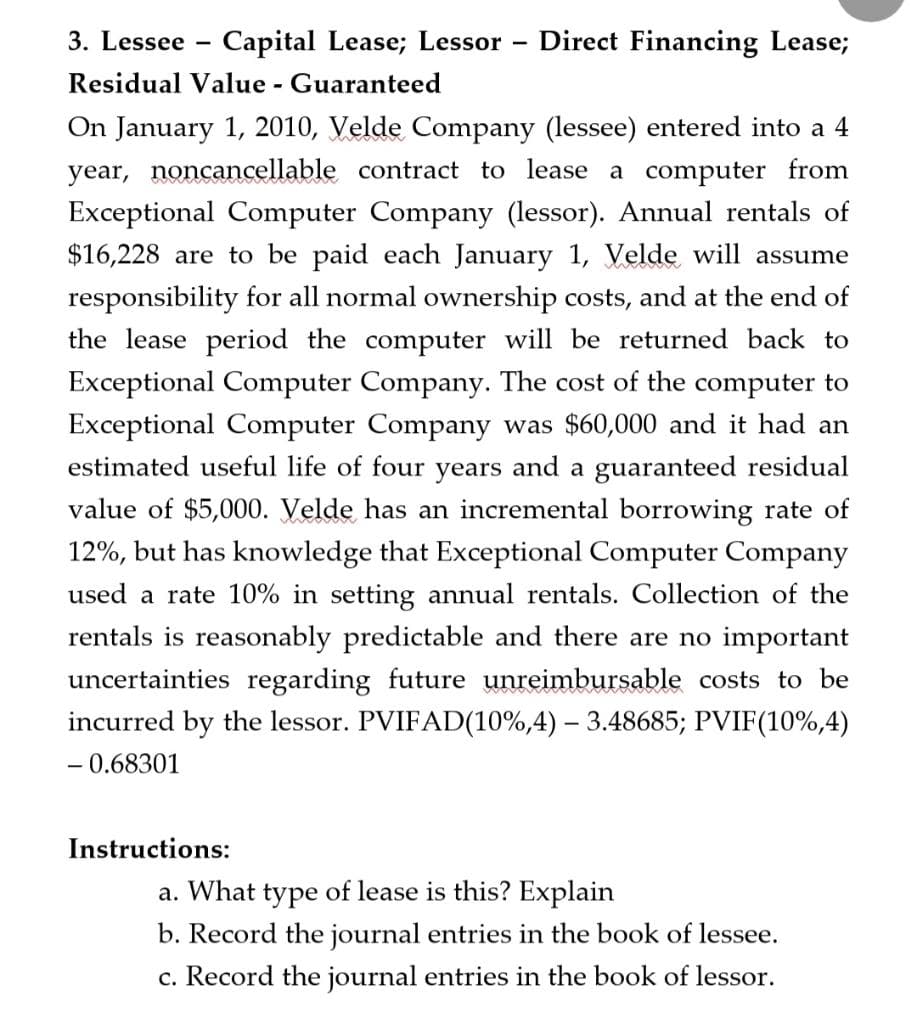

a. What type of lease is this? Explain b. Record the journal entries in the book of lessee. c. Record the journal entries in the book of lessor.

Q: The standard price of materials is $3.6 per pound and the standard quantity allowed for actual…

A: Introduction: Direct materials quantity variation is caused by the difference between both the…

Q: Using the following facts to calculate the Current Ratio, and the Debt Ratio: Ending Total Assets =…

A: The ratio analysis helps to analyze the financial statements of the business on the basis of various…

Q: The following table includes quarterly working capital levels for your firm for the next year.…

A: Working capital is the amount of capital or funds needed for day to day operations of the business.…

Q: On December 31, 2020, Parent company (A) acquired 80% of Subsidiary (B) outstanding common stocks…

A: Journal entry: The first step in accounting is a journal entry, which is used to record a business…

Q: PSMO Company currently uses normal costing method in accumulating the cost of production. The…

A: Manufacturing Cost :— It is the sum of direct material used , direct labour costs & applied…

Q: In 2020 the budget for a machine shop showed overheads of $60,000 and volume of activity of 12,000…

A: Overheads are the all type of indirect costs and expenses being incurred. These costs can not be…

Q: Sept. Dec. 30 31 31 9.2%. Received interest on the Trust bond. Received interest on the Hanna and…

A: Bonds are a financing tool. This is a loan. Company issue bonds to get money and people invest money…

Q: (2) Compute the company’s cash flow on total assets ratio for its fiscal year 2021.

A: Cash flow on Total Assets Ratio = Net Cash flow from Operating Activities/Average Total Assets…

Q: Q1. Divya got tired of teaching accountancy as the job was very strenuous. She decided to start her…

A: Journal Entries :— When transaction occurs then it is recorded as journal entry in books of account.…

Q: True or False Prior years' financial statements are not restated when the prospective approach is…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: ERISA provides for full vesting of the employer's retirement contributions as follows: Select one:…

A: The ERISA was enacted to safeguard employees' retirement money against mismanagement and misuse. It…

Q: 8. The equity sections for Atticus Group at the beginning of the year (January 1) and end…

A: Net Income - Net Income is the amount earned by the company after deducting all the expense whether…

Q: Prepare a monthly flexible selling expenses budget for Stone Company for sales volumes of $300,000,…

A: A flexible budget is prepared on the basis of the budgeted rate and on the basis of different…

Q: A company prepares the master budget by taking each division manager's estimate of revenues and…

A: Managers that use this technique run the risk of underestimating expectations and exceeding them. In…

Q: A company gives each of its 90 employees (assume they were all employed continuously through 2022…

A: Vacation Liability :— It is an accrued liability. When employees unable to used their vacation then…

Q: X Industries electricity costs and machine hours over a nine-month period follow: Month Machine…

A: High low method is one of the method of cost estimation used in business, which shows costs and…

Q: QUESTION 9 Natalie owns a condominium near Cocoa Beach in Florida. This year, she incurs the…

A: Solution:- Given, Natalie Owns a condominium near Cocoa Beach in Florida. Natalie rented out the…

Q: es RTN hold any importan

A: In online transactions are done based on codes and codes are given for the name of bank and area of…

Q: Question 6.4…

A: The Service Department cost can be allocated to the production department by using different…

Q: QUESTION 9 Mark, Inc purchases equipment for $54220. The equipment will be depreciated over 5 years…

A: Annual cash flow is the sum of net operating income and depreciation expenses. Because the…

Q: If Common Stock is $10 par value , 140,000 shares are authorized, and 60,000 shares , if the…

A: Cash dividend payable = $2 x 60,000 = $120,000

Q: Assume that Cane normally produces and sells 67,000 Betas and 87,000 Alphas per year. If Cane…

A: Cost :— The concept of Cost in Management according reffer to the amount paid or amount secrified to…

Q: State two objectives of budgetary planning and control systems

A: “Since you have asked multiple question, we will solve the first question for you. you want any…

Q: Question 1: The following information relates to Grimsley Company: ey ny A DEPARTMENTS Units:…

A: Direct Material Cost - Direct materials costs are the expenses incurred on the raw materials…

Q: Dad’s Diner is a fast-food restaurant that sells burgers and hot dogs in a 1960s environment. The…

A: Lets understand the basics. Overhead incurred needs to be allocated between the products because it…

Q: Ziek Corp. acquired a 30% interest in ZKI Corporation on December 31, 2020 for $2,159,000. During…

A: Investment refers to the assets which are acquired or invested in building the wealth and also save…

Q: What are the principles of federal finance?

A: Federal finance, in simple terms, would means to allocate the source of revenue among all the levels…

Q: OA. Retained Earnings account is debited OB. Retained Earnings account is credited OC. Cash account…

A: The term "retained earnings" refers to the business's accumulated profit after paying out dividends…

Q: Dawson Toys, Limited, produces a toy called the Maze. The company has recently created a standard…

A: Material variances arises when the estimated and actual cost incurred on the material costs is…

Q: Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of…

A: A ledger is a log or list of accounts that keep track of account transfers.

Q: The following information is available for Oriole Company for the year ended December 31, 2022.…

A: Cash Flow Statement is prepared to analysis, measure and interpret the cash inflows and cash…

Q: If a company has sales revenue of $631000, net sales of $500000, and cost of goods sold of $385000,…

A: The gross profit is calculated as difference between sales and cost of goods sold. Gross profit= Net…

Q: Similar operating segments may be combined if the segments have similar economic characteristics.…

A: GAAP specifies that operating segments can be combines provided that these segments have the same…

Q: Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account…

A: A bond is issued by the company for raising finance for the business working. The bond contains a…

Q: C. Cash Flow Statement Prepare a Cash Flow Statement for Red Company for the year ended December 31,…

A: Introduction: A cash flow statement is a financial statement that sums all cash inflows from ongoing…

Q: True or False 7. Corporations that avail of OSD are allowed to deduct the cost of sales or cost of…

A: OSD is also written as optional standard deduction. It is the deduction which is available to both…

Q: 10. Raphael Corporation’s balance sheet shows the following stockholders’ equity section.…

A: Introduction: A shareholder is a person, company, or institution that holds at least one share of…

Q: Sudoku Company issues 19,000 shares of $6 par value common stock in exchange for land and a…

A: If value of land and building value is greater than the par value of common stock then the excess…

Q: The following information has been taken from the perpetual inventory system of Elite Manufacturing…

A: Manufacturing OH Cost :— Manufacturing OH Cost is the Cost which is Incurred to manufacturing the…

Q: 6. Depreciation Problem (DBB METHOD) (Show all formulas and all calculations). Melvin Noble, a…

A: Double Declining Balance Depreciation Method :— It is one of the method of depreciation in which…

Q: Carla Company's standard fixed overhead rate is based on budgeted fixed manufacturing overhead of…

A: The overhead is applied to the production on the basis of pre-determined overhead rate. The…

Q: Why is it important for a business to have good internal controls where payroll is concerned? What…

A: Introduction: Internal control is a technique used by a company's board of directors, management,…

Q: Assume that Cane expects to produce and sell 102,000 Alphas during the current year. One of Cane's…

A: Financial Advantage :— It means there is increase in profit if the current situation is accepted or…

Q: How do you assess the risk of material misstatement associated with the audit of investments?

A: Inherent risk and control risks are part of the risk of material misstatement. There can be a risk…

Q: Kim works at a sports store and needs to determine the selling price for running shoes. The running…

A: Lets understand the basics. There is slight gap between the term gross margin and mark up. Gross…

Q: Carla Company's standard foxed overhead rate is based on budgeted fixed manufacturing overhead of…

A: Overhead Applied :—It is the indirect costs that is applied to production. It is calculated by…

Q: Discontinue a Segment Product Tango has revenue of $195,500, variable cost of goods sold of…

A: Fixed costs remains constant in total.Even though product is discontinued we need to incurr it.

Q: An A-round investor got 20% of the shares of a startup (2 million shares, in return for a €2 million…

A: An A - round investor invested € 2 Million and got 20% shares of a startup. 20% shares is 2 Million…

Q: Beginning inventory, purchases, and sales for Item XJ-56 are as follows: May 1 Beginning…

A: Introduction: Ending inventory is the worth of products still available for purchase and held by a…

Q: Kit Kat Ltd is a company in the chemical industry, situated near the Murray River. Its year end is…

A: IAS 10 - Events After the Reporting Period provides the accounting and disclosure requirements…

Step by step

Solved in 2 steps with 2 images

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.

- Lessee Accounting Issues Sax Company signs a lease agreement dated January 1, 2019, that provides for it to lease computers from Appleton Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires equal rental payments to be made at the end of each year. The computers are not specialized for Sax. 2. The computers have an estimated life of 5 years, a fair value of 300,000, and a zero estimated residual value. 3. Sax agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. The annual payment is set by Appleton at 83,222.92 to earn a rate of return of 12% on its net investment. Sax is aware of this rate. Saxs incremental borrowing rate is 10%. 6. Sax uses the straight-line method to record depreciation on similar equipment. Required: 1. Next Level Examine and evaluate each capitalization criteria and determine what type of lease this is for Sax. 2. Calculate the amount of the asset and liability of Sax at the inception of the lease (round to the nearest dollar). 3. Prepare a table summarizing the lease payments and interest expense. 4. Prepare journal entries for Sax for the years 2019 and 2020.Sales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in E20-8, except that the residual value was guaranteed by Davis Company (the lessee). Required: 1. Assuming that the lease is a sales-type lease, calculate the selling price. 2. Prepare a table summarizing the lease receipts and interest income earned by Edom. 3. Prepare journal entries for Edom tor the years 2019 and 2020.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.Use the information in RE20-3. Prepare the journal entries that Garvey Company would make in the first year of the lease assuming the lease is classified as a finance lease. However, assume that Garvey is now required to make the 65,949.37 payments on January 1 each year and that the fair value at the lease inception is now 275,000 (65,949:37 4:169865).Lessee Accounting Issues Timmer Company signs a lease agreement dated January 1, 2019, that provides for it to lease equipment from Landau Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: The lease is noncancelable and has a term of 5 years. The annual rentals are 83,222.92, payable at the end of each year, and provide Landau with a 12% annual rate of return on its net investment. Timmer agrees to pay all executory costs directly to a third party on December 1 of each year. In 2019, these were insurance, 3,760; property taxes, 5,440. In 2020: insurance, 3,100; property taxes, 5,330. There is no renewal or bargain purchase option. Timmer estimates that the equipment has a fair value of 300,000, an economic life of 5 years, and a zero residual value. Timmers incremental borrowing rate is 16%, it knows the rate implicit in the lease, and it uses the straightline method to record depreciation on similar equipment. Required: 1. Calculate the amount of the asset and liability of Timmer at the inception of the lease. (Round to the nearest dollar.) 2. Prepare a table summarizing the lease payments and interest expense. 3. Prepare journal entries on the books of Timmer for 2019 and 2020. 4. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the present value of next years payment approach to classify the finance lease obligation between current and noncurrent. 5. Next Level Prepare a partial balance sheet in regard to the lease for Timmer for December 31, 2019. Use the change in present value approach to classify the finance lease obligation between current and noncurrent.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Comprehensive Landlord Company and Tenant Company enter into a noncancelable, direct financing lease on January 1, 2019, for nonspecialized equipment that cost the Landlord 280,000 (useful life is 6 years with no residual value). The fair value of the equipment is 300,000. The interest rate implicit in the lease is 14%. The 6-year lease requires 6 equal annual amounts payable each January 1, beginning with January 1, 2019. Tenant pays all executory costs directly to a third party on December 1 of each year. The equipment reverts to the lessor at the termination of the lease. Assume that there are no initial direct costs. Landlord expects to collect all rental payments. Required: 1. Next Level (a) Show how landlord should compute the annual rental amounts, (b) Discuss how the Tenant Company should compute the present value of the lease payments. What additional information would be required to make this computation? 2. Next Level Prepare a table summarizing the lease and interest receipts that would be suitable for Landlord. Under what conditions would this table be suitable for Tenant? 3. Assuming that the table prepared in Requirement 2 is suitable for both the lessee and the lessor, prepare the journal entries for both firms for the years 2019 and 2020. Use the straight-line depreciation method for the leased equipment. The executory costs paid by the lessee are in 2019: insurance, 700 and property taxes, 800; in 2020: insurance, 600 and property taxes, 750. 4. Next Level Show the items and amounts that would be reported on the comparative 2019 and 2020 income statements and ending balance sheets for both the lessor and the lessee, using the change in present value approach.Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on the following terms: 1. Twenty-four lease rentals of 2,950 at the beginning of each month are to be paid by Terrell, and the lease is noncancelable. 2. The cost of the heavy equipment to Ramsey was 55,000. 3. Ramsey uses an implicit interest rate of 18% per year and will account for this lease as a sales-type lease. Required: Prepare journal entries for Ramsey (the lessor) to record the lease contract on March 1, 2019, the receipt of the first two lease rentals, and any interest income for March and April 2019. (Round your answers to the nearest dollar.)