a.Prepare the following budgets of Arjuna Sdn Bhd for each of the four quarters for the year ending 31 December 2017. i. Production Budget ( in units) ii. Material Usage Budget (in units) iii. Production Cost Budget (in RMs)

a.Prepare the following budgets of Arjuna Sdn Bhd for each of the four quarters for the year ending 31 December 2017. i. Production Budget ( in units) ii. Material Usage Budget (in units) iii. Production Cost Budget (in RMs)

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 1E: The sales department of Macro Manufacturing Co. has forecast sales for its single product to be...

Related questions

Question

Solve all the questions

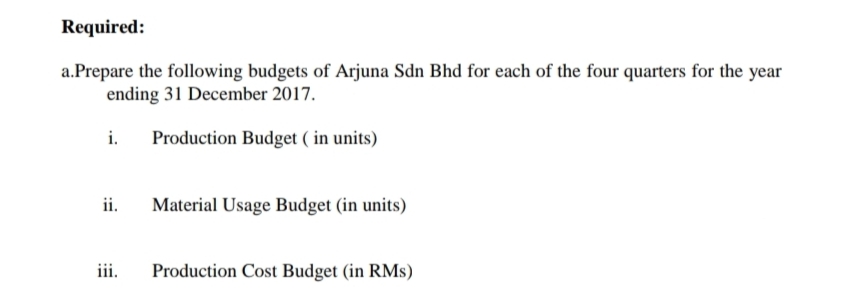

Transcribed Image Text:Required:

a.Prepare the following budgets of Arjuna Sdn Bhd for each of the four quarters for the year

ending 31 December 2017.

i.

Production Budget ( in units)

ii.

Material Usage Budget (in units)

iii.

Production Cost Budget (in RMs)

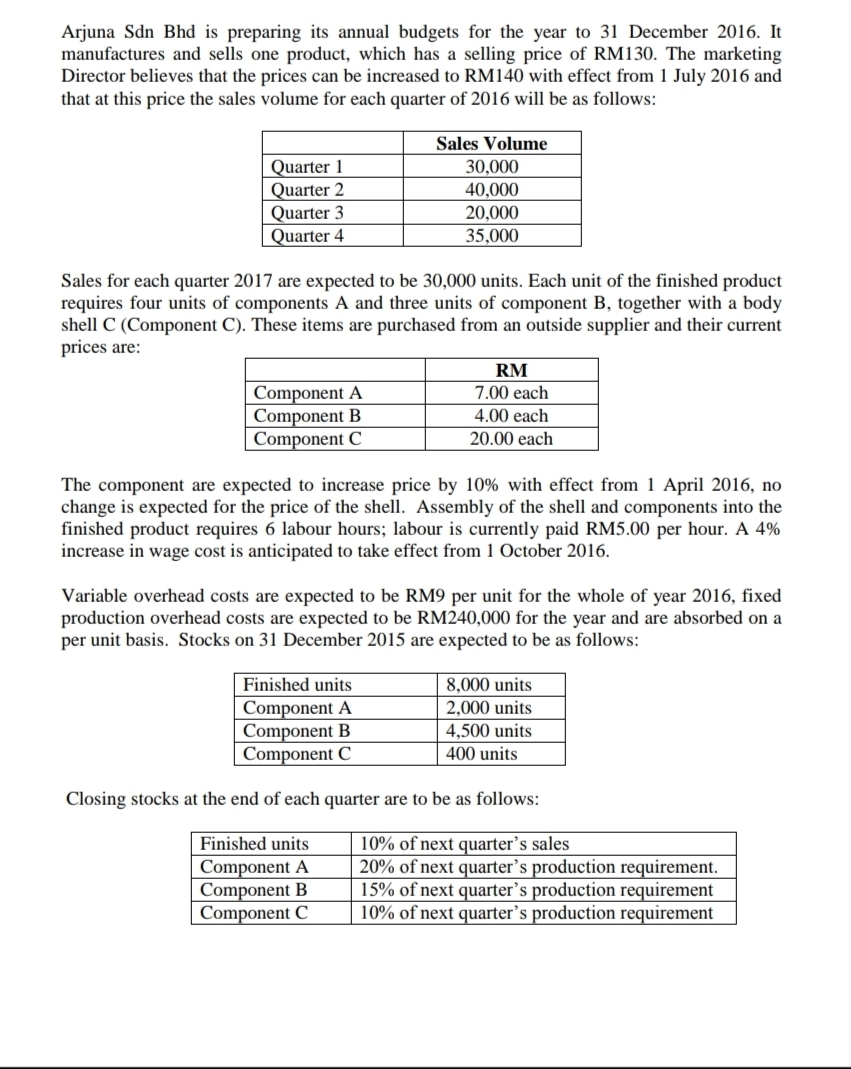

Transcribed Image Text:Arjuna Sdn Bhd is preparing its annual budgets for the year to 31 December 2016. It

manufactures and sells one product, which has a selling price of RM130. The marketing

Director believes that the prices can be increased to RM140 with effect from 1 July 2016 and

that at this price the sales volume for each quarter of 2016 will be as follows:

Sales Volume

Quarter 1

Quarter 2

Quarter 3

Quarter 4

30,000

40,000

20,000

35,000

Sales for each quarter 2017 are expected to be 30,000 units. Each unit of the finished product

requires four units of components A and three units of component B, together with a body

shell C (Component C). These items are purchased from an outside supplier and their current

prices are:

RM

Component A

Component B

Component C

7.00 each

4.00 each

20.00 each

The component are expected to increase price by 10% with effect from 1 April 2016, no

change is expected for the price of the shell. Assembly of the shell and components into the

finished product requires 6 labour hours; labour is currently paid RM5.00 per hour. A 4%

increase in wage cost is anticipated to take effect from 1 October 2016.

Variable overhead costs are expected to be RM9 per unit for the whole of year 2016, fixed

production overhead costs are expected to be RM240,000 for the year and are absorbed on a

per unit basis. Stocks on 31 December 2015 are expected to be as follows:

Finished units

8,000 units

Component A

Component B

Component C

2,000 units

4,500 units

400 units

Closing stocks at the end of each quarter are to be as follows:

10% of next quarter’s sales

20% of next quarter's production requirement.

15% of next quarter’s production requirement

10% of next quarter's production requirement

Finished units

Component A

Component B

Component C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College