Required Propose a Master Budget Plan for Noeled Products Company for the year ending December 31, 2021 which includes 1. Sales Budget 2. Production Budget in units 3. Raw Materials Purchases Budget

Required Propose a Master Budget Plan for Noeled Products Company for the year ending December 31, 2021 which includes 1. Sales Budget 2. Production Budget in units 3. Raw Materials Purchases Budget

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 70APSA: Inventory Costing and LCM Ortman Enterprises sells a chemical used in various manufacturing...

Related questions

Question

Kindly answer the question

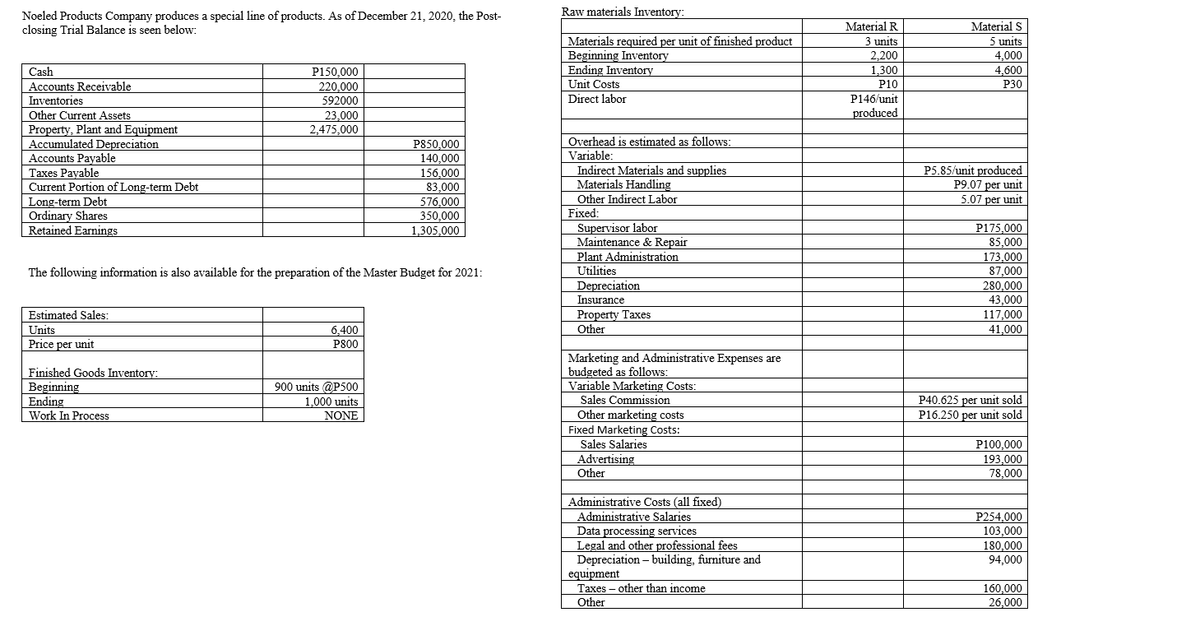

Transcribed Image Text:Raw materials Inventory:

Noeled Products Company produces a special line of products. As of December 21, 2020, the Post-

closing Trial Balance is seen below:

Material S

5 units

4,000

Material R

Materials required per unit of finished product

Beginning Inventory

Ending Inventory

Unit Costs

3 units

2,200

1,300

4,600

P30

Cash

P150.000

Accounts Receivable

220,000

P10

P146/unit

produced

Inventories

592000

Direct labor

Other Current Assets

23,000

Property, Plant and Equipment

Accumulated Depreciation

Accounts Payable

Taxes Payable

Current Portion of Long-term Debt

Long-term Debt

Ordinary Shares

Retained Earnings

2,475,000

Overhead is estimated as follows:

P850,000

140,000

156,000

83,000

Variable:

Indirect Materials and supplies

Materials Handling

P5.85/unit produced

P9.07 per unit

5.07 per unit

576,000

Other Indirect Labor

350,000

Fixed:

Supervisor labor

Maintenance & Repair

Plant Administration

Utilities

1,305,000

P175.000

85,000

173.000

87,000

280,000

43,000

117,000

The following information is also available for the preparation of the Master Budget for 2021:

Depreciation

Insurance

Property Taxes

Other

Estimated Sales:

Units

6,400

P800

41,000

Price per unit

Finished Goods Inventory:

Beginning

Ending

| Work In Process

Marketing and Administrative Expenses are

budgeted as follows:

Variable Marketing Costs:

Sales Commission

900 units @P500

1.000 units

P40.625 per unit sold

Other marketing costs

Fixed Marketing Costs:

Sales Salaries

Advertising

Other

NONE

P16.250 per unit sold

P100,000

193,000

78,000

Administrative Costs (all fixed)

Administrative Salaries

Data processing services

Legal and other professional fees

Depreciation – building, furniture and

equipment

Taxes – other than income

P254,000

103,000

180,000

94,000

160,000

26,000

Other

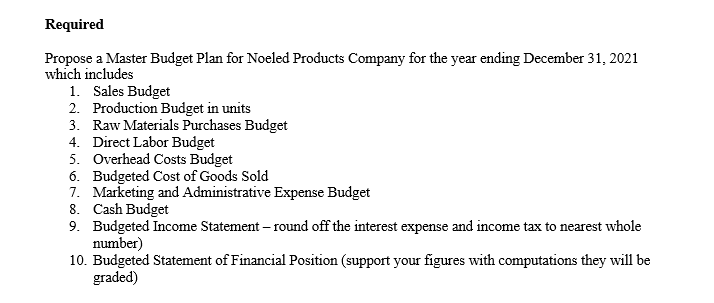

Transcribed Image Text:Required

Propose a Master Budget Plan for Noeled Products Company for the year ending December 31, 2021

which includes

1. Sales Budget

2. Production Budget in units

3. Raw Materials Purchases Budget

4. Direct Labor Budget

5. Overhead Costs Budget

6. Budgeted Cost of Goods Sold

7. Marketing and Administrative Expense Budget

8. Cash Budget

9. Budgeted Income Statement – round off the interest expense and income tax to nearest whole

number)

10. Budgeted Statement of Financial Position (support your figures with computations they will be

graded)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub