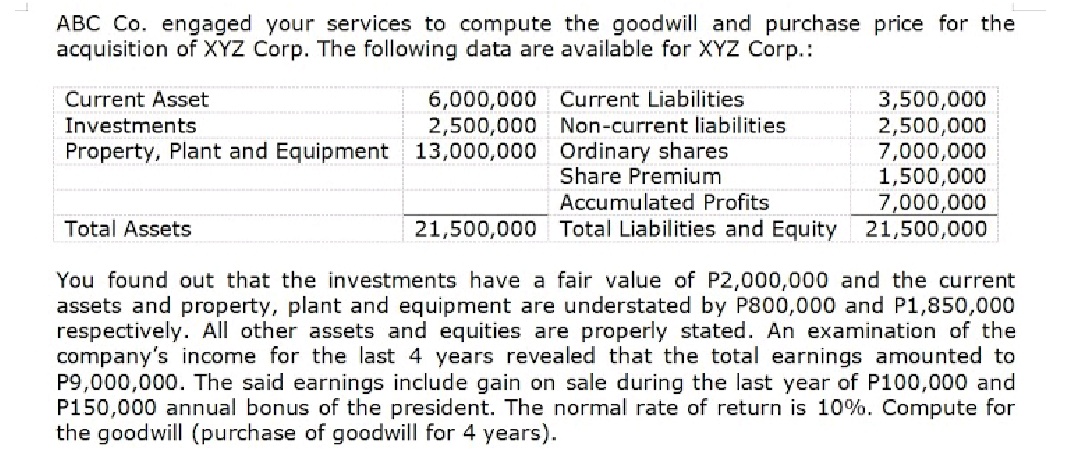

ABC Co. engaged your services to compute the goodwill and purchase price for the acquisition of XYZ Corp. The following data are available for XYZ Corp.: 6,000,000 Current Liabilities 2,500,000 Non-current liabilities Property, Plant and Equipment 13,000,000 Ordinary shares Share Premium 3,500,000 2,500,000 7,000,000 1,500,000 7,000,000 21,500,000 Total Liabilities and Equity 21,500,000 Current Asset Investments Accumulated Profits Total Assets You found out that the investments have a fair value of P2,000,000 and the current assets and property, plant and equipment are understated by P800,000 and P1,850,000 respectively. All other assets and equities are properly stated. An examination of the company's income for the last 4 years revealed that the total earnings amounted to P9,000,000. The said earnings include gain on sale during the last year of P100,000 and P150,000 annual bonus of the president. The normal rate of return is 10%. Compute for the goodwill (purchase of goodwill for 4 vears)

ABC Co. engaged your services to compute the goodwill and purchase price for the acquisition of XYZ Corp. The following data are available for XYZ Corp.: 6,000,000 Current Liabilities 2,500,000 Non-current liabilities Property, Plant and Equipment 13,000,000 Ordinary shares Share Premium 3,500,000 2,500,000 7,000,000 1,500,000 7,000,000 21,500,000 Total Liabilities and Equity 21,500,000 Current Asset Investments Accumulated Profits Total Assets You found out that the investments have a fair value of P2,000,000 and the current assets and property, plant and equipment are understated by P800,000 and P1,850,000 respectively. All other assets and equities are properly stated. An examination of the company's income for the last 4 years revealed that the total earnings amounted to P9,000,000. The said earnings include gain on sale during the last year of P100,000 and P150,000 annual bonus of the president. The normal rate of return is 10%. Compute for the goodwill (purchase of goodwill for 4 vears)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

Transcribed Image Text:ABC Co. engaged your services to compute the goodwill and purchase price for the

acquisition of XYZ Corp. The following data are available for XYZ Corp.:

6,000,000 Current Liabilities

2,500,000 Non-current liabilities

Property, Plant and Equipment 13,000,000 Ordinary shares

Share Premium

3,500,000

2,500,000

7,000,000

1,500,000

7,000,000

21,500,000 Total Liabilities and Equity 21,500,000

Current Asset

Investments

Accumulated Profits

Total Assets

You found out that the investments have a fair value of P2,000,000 and the current

assets and property, plant and equipment are understated by P800,000 and P1,850,000

respectively. All other assets and equities are properly stated. An examination of the

company's income for the last 4 years revealed that the total earnings amounted to

P9,000,000. The said earnings include gain on sale during the last year of P100,000 and

P150,000 annual bonus of the president. The normal rate of return is 10%. Compute for

the goodwill (purchase of goodwill for 4 years).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning