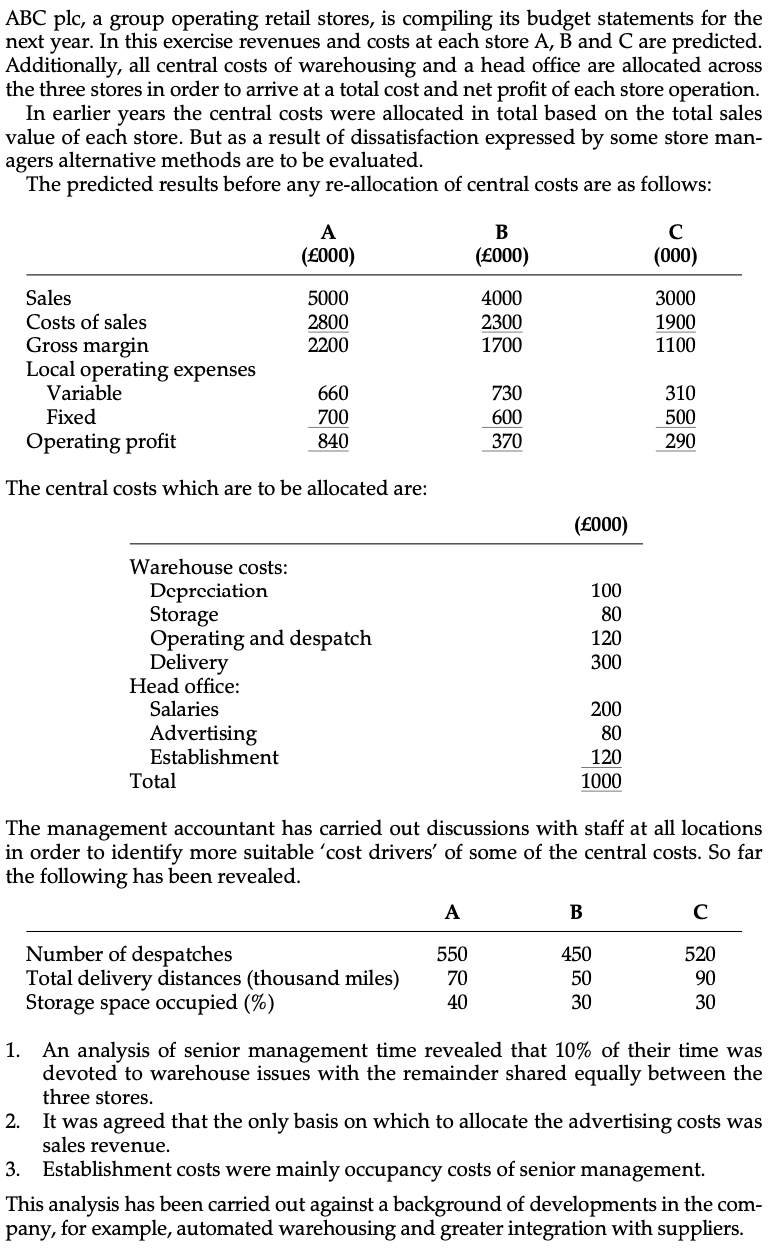

ABC plc, a group operating retail stores, is compiling its budget statements for the next year. In this exercise revenues and costs at each store A, B and C are predicted. Additionally, all central costs of warehousing and a head office are allocated across the three stores in order to arrive at a total cost and net profit of each store operation. In earlier years the central costs were allocated in total based on the total sales value of each store. But as a result of dissatisfaction expressed by some store man- agers alternative methods are to be evaluated. The predicted results before any re-allocation of central costs are as follows: A В (£000) (£000) (000) Sales Costs of sales Gross margin Local operating expenses Variable 5000 4000 2300 1700 3000 1900 1100 2800 2200 660 700 840 730 310 500 290 Fixed 600 Operating profit 370 The central costs which are to be allocated are: (£000) Warehouse costs: Depreciation Storage Operating and despatch Delivery Head office: Salaries 100 80 120 300 200 Advertising Establishment Total 80 120 1000 The management accountant has carried out discussions with staff at all locations in order to identify more suitable 'cost drivers' of some of the central costs. So far the following has been revealed. A В Number of despatches Total delivery distances (thousand miles) Storage space occupied (%) 550 450 520 70 50 90 40 30 30 An analysis of senior management time revealed that 10% of their time was devoted to warehouse issues with the remainder shared equally between the three stores. 1. 2. It was agreed that the only basis on which to allocate the advertising costs was sales revenue. Establishment costs were mainly occupancy costs of senior management. 3. This analysis has been carried out against a background of developments in the com- pany, for example, automated warehousing and greater integration with suppliers.

ABC plc, a group operating retail stores, is compiling its budget statements for the next year. In this exercise revenues and costs at each store A, B and C are predicted. Additionally, all central costs of warehousing and a head office are allocated across the three stores in order to arrive at a total cost and net profit of each store operation. In earlier years the central costs were allocated in total based on the total sales value of each store. But as a result of dissatisfaction expressed by some store man- agers alternative methods are to be evaluated. The predicted results before any re-allocation of central costs are as follows: A В (£000) (£000) (000) Sales Costs of sales Gross margin Local operating expenses Variable 5000 4000 2300 1700 3000 1900 1100 2800 2200 660 700 840 730 310 500 290 Fixed 600 Operating profit 370 The central costs which are to be allocated are: (£000) Warehouse costs: Depreciation Storage Operating and despatch Delivery Head office: Salaries 100 80 120 300 200 Advertising Establishment Total 80 120 1000 The management accountant has carried out discussions with staff at all locations in order to identify more suitable 'cost drivers' of some of the central costs. So far the following has been revealed. A В Number of despatches Total delivery distances (thousand miles) Storage space occupied (%) 550 450 520 70 50 90 40 30 30 An analysis of senior management time revealed that 10% of their time was devoted to warehouse issues with the remainder shared equally between the three stores. 1. 2. It was agreed that the only basis on which to allocate the advertising costs was sales revenue. Establishment costs were mainly occupancy costs of senior management. 3. This analysis has been carried out against a background of developments in the com- pany, for example, automated warehousing and greater integration with suppliers.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 11CE: Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted...

Related questions

Question

Question b

Transcribed Image Text:ABC plc, a group operating retail stores, is compiling its budget statements for the

next year. In this exercise revenues and costs at each store A, B and C are predicted.

Additionally, all central costs of warehousing and a head office are allocated across

the three stores in order to arrive at a total cost and net profit of each store operation.

In earlier years the central costs were allocated in total based on the total sales

value of each store. But as a result of dissatisfaction expressed by some store man-

agers alternative methods are to be evaluated.

The predicted results before any re-allocation of central costs are as follows:

A

В

(£000)

(£000)

(000)

Sales

Costs of sales

Gross margin

Local operating expenses

Variable

5000

4000

3000

2800

2300

1700

1900

2200

1100

660

730

310

600

370

Fixed

700

500

Operating profit

840

290

The central costs which are to be allocated are:

(£000)

Warehouse costs:

Depreciation

Storage

Operating and despatch

Delivery

Head office:

Salaries

100

80

120

300

200

Advertising

Establishment

80

120

Total

1000

The management accountant has carried out discussions with staff at all locations

in order to identify more suitable 'cost drivers' of some of the central costs. So far

the following has been revealed.

A

В

Number of despatches

Total delivery distances (thousand miles)

Storage space occupied (%)

550

450

520

70

50

90

40

30

30

1.

An analysis of senior management time revealed that 10% of their time was

devoted to warehouse issues with the remainder shared equally between the

three stores.

2. It was agreed that the only basis on which to allocate the advertising costs was

sales revenue.

3. Establishment costs were mainly occupancy costs of senior management.

This analysis has been carried out against a background of developments in the com-

pany, for example, automated warehousing and greater integration with suppliers.

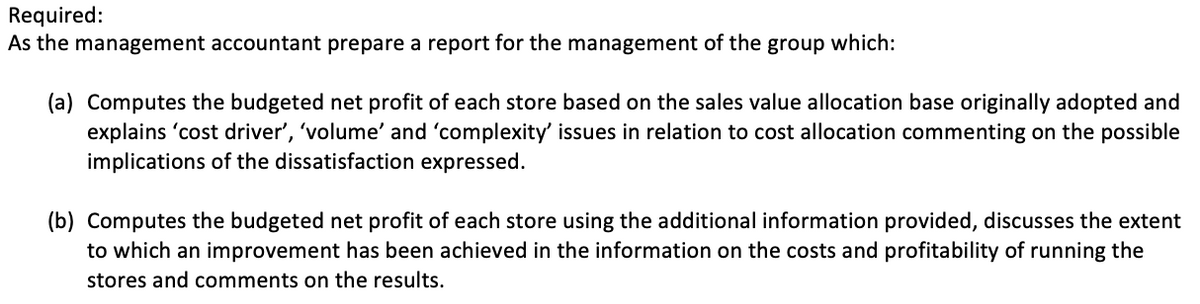

Transcribed Image Text:Required:

As the management accountant prepare a report for the management of the group which:

(a) Computes the budgeted net profit of each store based on the sales value allocation base originally adopted and

explains 'cost driver', 'volume' and 'complexity' issues in relation to cost allocation commenting on the possible

implications of the dissatisfaction expressed.

(b) Computes the budgeted net profit of each store using the additional information provided, discusses the extent

to which an improvement has been achieved in the information on the costs and profitability of running the

stores and comments on the results.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning