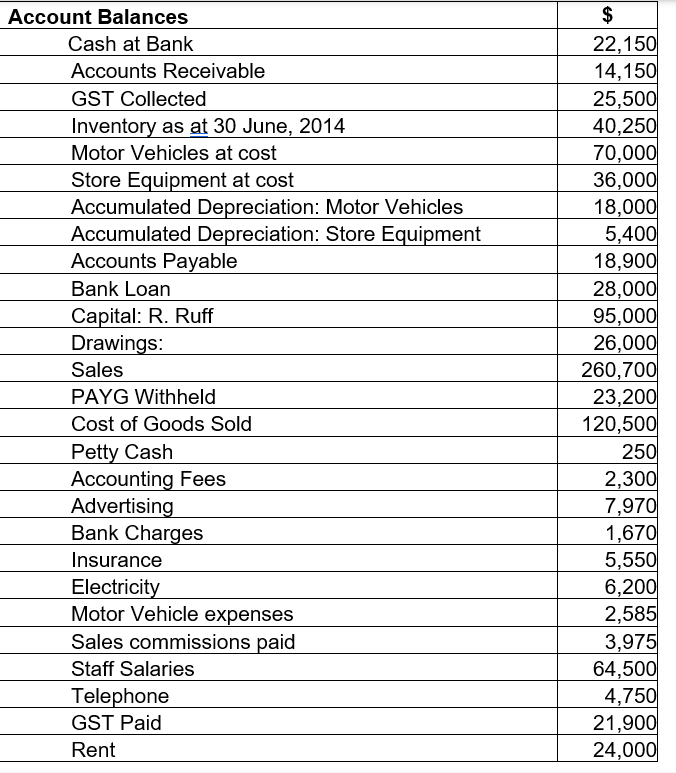

Account Balances Cash at Bank Accounts Receivable GST Collected Inventory as at 30 June, 2014 Motor Vehicles at cost Store Equipment at cost Accumulated Depreciation: Motor Vehicles Accumulated Depreciation: Store Equipment Accounts Payable Bank Loan Capital: R. Ruff Drawings: Sales PAYG Withheld Cost of Goods Sold Petty Cash Accounting Fees Advertising Bank Charges Insurance Electricity Motor Vehicle expenses Sales commissions paid Staff Salaries Telephone GST Paid Rent $ 22,150 14,150 25,500 40,250 70,000 36,000 18,000 5,400 18,900 28,000 95,000 26,000 260,700 23,200 120,500 250 2,300 7,970 1,670 5,550 6,200 2,585 3,975 64,500 4,750 21,900 24,000

Account Balances Cash at Bank Accounts Receivable GST Collected Inventory as at 30 June, 2014 Motor Vehicles at cost Store Equipment at cost Accumulated Depreciation: Motor Vehicles Accumulated Depreciation: Store Equipment Accounts Payable Bank Loan Capital: R. Ruff Drawings: Sales PAYG Withheld Cost of Goods Sold Petty Cash Accounting Fees Advertising Bank Charges Insurance Electricity Motor Vehicle expenses Sales commissions paid Staff Salaries Telephone GST Paid Rent $ 22,150 14,150 25,500 40,250 70,000 36,000 18,000 5,400 18,900 28,000 95,000 26,000 260,700 23,200 120,500 250 2,300 7,970 1,670 5,550 6,200 2,585 3,975 64,500 4,750 21,900 24,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter5: Accounting Systems

Section: Chapter Questions

Problem 16E

Related questions

Question

The following balance day adjustments have NOT been completed:

Depreciation is charged at 10% on cost for both Store Equipment and Motor Vehicles- Salaries owing at balance day are $400

prepare Income Statement for Pets ‘R Us year endng 30th June, 2014

Transcribed Image Text:Account Balances

Cash at Bank

Accounts Receivable

GST Collected

Inventory as at 30 June, 2014

Motor Vehicles at cost

Store Equipment at cost

Accumulated Depreciation: Motor Vehicles

Accumulated Depreciation: Store Equipment

Accounts Payable

Bank Loan

Capital: R. Ruff

Drawings:

Sales

PAYG Withheld

Cost of Goods Sold

Petty Cash

Accounting Fees

Advertising

Bank Charges

Insurance

Electricity

Motor Vehicle expenses

Sales commissions paid

Staff Salaries

Telephone

GST Paid

Rent

$

22,150

14,150

25,500

40,250

70,000

36,000

18,000

5,400

18,900

28,000

95,000

26,000

260,700

23,200

120,500

250

2,300

7,970

1,670

5,550

6,200

2,585

3,975

64,500

4,750

21,900

24,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning