Accounting Mint Cleaning Incorporated prepared the following unadjusted trial baland the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Account Titles Debit Credit Cash $38 Accounts Receivable 9. Prepaid Insurance 6 Equipment 80 Accumulated Depreciation $0 Accounts Payable 9. Salaries and Wages Payable Income Tax Payable Common Stock 76 Retained Earnings 4 Sales Revenue 80

Accounting Mint Cleaning Incorporated prepared the following unadjusted trial baland the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Account Titles Debit Credit Cash $38 Accounts Receivable 9. Prepaid Insurance 6 Equipment 80 Accumulated Depreciation $0 Accounts Payable 9. Salaries and Wages Payable Income Tax Payable Common Stock 76 Retained Earnings 4 Sales Revenue 80

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 5PB: Reece Financial Services Co., which specializes in appliance repair services, is owned and operated...

Related questions

Question

Transcribed Image Text:Accounting

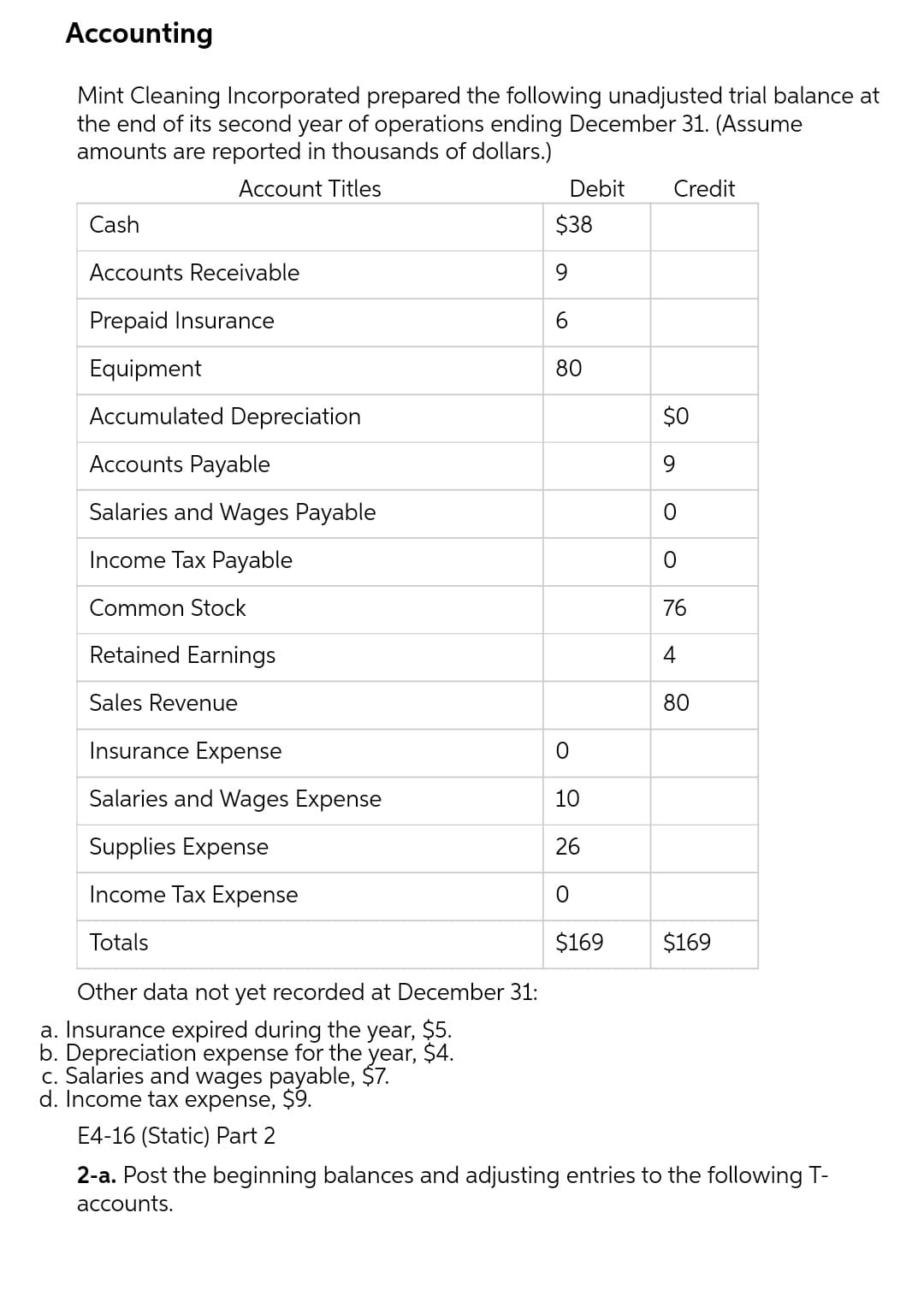

Mint Cleaning Incorporated prepared the following unadjusted trial balance at

the end of its second year of operations ending December 31. (Assume

amounts are reported in thousands of dollars.)

Account Titles

Debit

Credit

Cash

$38

Accounts Receivable

9.

Prepaid Insurance

6.

Equipment

80

Accumulated Depreciation

$0

Accounts Payable

9.

Salaries and Wages Payable

Income Tax Payable

Common Stock

76

Retained Earnings

Sales Revenue

80

Insurance Expense

Salaries and Wages Expense

10

Supplies Expense

26

Income Tax Expense

Totals

$169

$169

Other data not yet recorded at December 31:

a. Insurance expired during the year, $5.

b. Depreciation expense for the year, $4.

c. Salaries and wages payable, $7.

d. Income tax expense, $9.

E4-16 (Static) Part 2

2-a. Post the beginning balances and adjusting entries to the following T-

accounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage