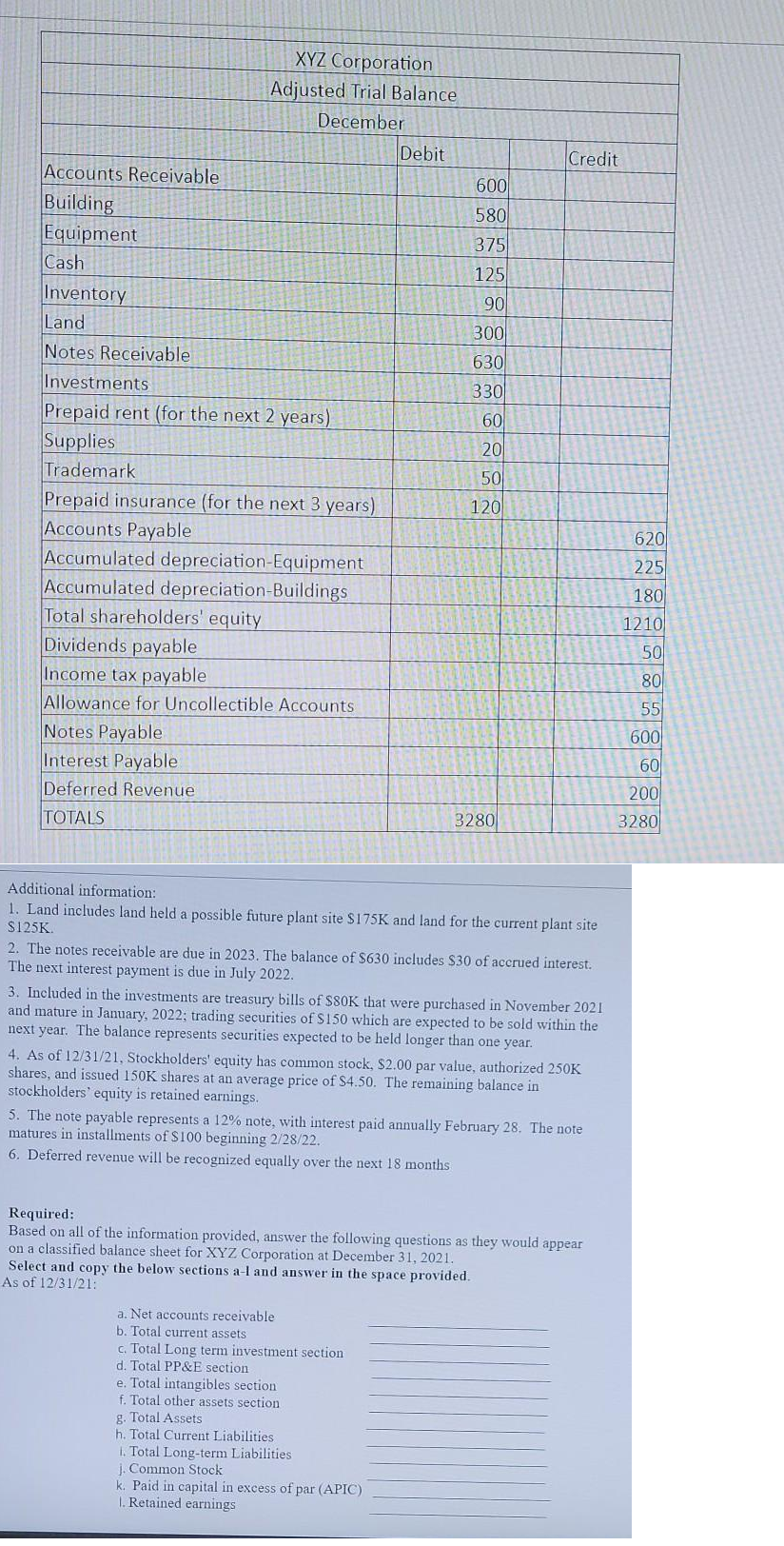

XYZ Corporation Adjusted Trial Balance December Debit Credit Accounts Receivable 600 Building Equipment 580 375 Cash 125 Inventory Land 90 300 Notes Receivable Investments 630 330 Prepaid rent (for the next 2 years) Supplies Trademark 60 20 50 Prepaid insurance (for the next 3 years) Accounts Payable Accumulated depreciation-Equipment Accumulated depreciation-Buildings Total shareholders' equity Dividends payable Income tax payable Allowance for Uncollectible Accounts 120 620 225 180 1210 50 80 55 Notes Payable Interest Payable 600 60 Deferred Revenue 200 TOTALS 3280 3280 Additional information: 1. Land includes land held a possible future plant site $175K and land for the current plant site S125K. 2. The notes receivable are due in 2023. The balance of $630 includes $30 of accrued interest. The next interest payment is due in July 2022. 3. Included in the investments are treasury bills of $80K that were purchased in November 2021 and mature in January, 2022; trading securities of S150 which are expected to be sold within the next year. The balance represents securities expected to be held longer than one year. 4. As of 12/31/21, Stockholders' equity has common stock, $2.00 par value, authorized 250K shares, and issued 150K shares at an average price of $4.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. The note matures in installments of S100 beginning 2/28/22. 6. Deferred revenue will be recognized equally over the next 18 months Required: Based on all of the information provided, answer the following questions as they would appear on a classified balance sheet for XYZ Corporation at December 31, 2021. Select and copy the below sections a-l and answer in the space provided. As of 12/31/21: a. Net accounts receivable b. Total current assets c. Total Long term investment section d. Total PP&E section e. Total intangibles section f. Total other assets section g. Total Assets h. Total Current Liabilities 1. Total Long-term Liabilities j. Common Stock k. Paid in capital in excess of par (APIC) I. Retained earnings

XYZ Corporation Adjusted Trial Balance December Debit Credit Accounts Receivable 600 Building Equipment 580 375 Cash 125 Inventory Land 90 300 Notes Receivable Investments 630 330 Prepaid rent (for the next 2 years) Supplies Trademark 60 20 50 Prepaid insurance (for the next 3 years) Accounts Payable Accumulated depreciation-Equipment Accumulated depreciation-Buildings Total shareholders' equity Dividends payable Income tax payable Allowance for Uncollectible Accounts 120 620 225 180 1210 50 80 55 Notes Payable Interest Payable 600 60 Deferred Revenue 200 TOTALS 3280 3280 Additional information: 1. Land includes land held a possible future plant site $175K and land for the current plant site S125K. 2. The notes receivable are due in 2023. The balance of $630 includes $30 of accrued interest. The next interest payment is due in July 2022. 3. Included in the investments are treasury bills of $80K that were purchased in November 2021 and mature in January, 2022; trading securities of S150 which are expected to be sold within the next year. The balance represents securities expected to be held longer than one year. 4. As of 12/31/21, Stockholders' equity has common stock, $2.00 par value, authorized 250K shares, and issued 150K shares at an average price of $4.50. The remaining balance in stockholders' equity is retained earnings. 5. The note payable represents a 12% note, with interest paid annually February 28. The note matures in installments of S100 beginning 2/28/22. 6. Deferred revenue will be recognized equally over the next 18 months Required: Based on all of the information provided, answer the following questions as they would appear on a classified balance sheet for XYZ Corporation at December 31, 2021. Select and copy the below sections a-l and answer in the space provided. As of 12/31/21: a. Net accounts receivable b. Total current assets c. Total Long term investment section d. Total PP&E section e. Total intangibles section f. Total other assets section g. Total Assets h. Total Current Liabilities 1. Total Long-term Liabilities j. Common Stock k. Paid in capital in excess of par (APIC) I. Retained earnings

Chapter6: Investing And Financing Activities

Section: Chapter Questions

Problem 3.5C

Related questions

Question

Transcribed Image Text:XYZ Corporation

Adjusted Trial Balance

December

Debit

Credit

Accounts Receivable

600

Building

Equipment

580

375

Cash

125

Inventory

Land

90

300

Notes Receivable

Investments

630

330

Prepaid rent (for the next 2 years)

Supplies

Trademark

60

20

50

Prepaid insurance (for the next 3 years)

Accounts Payable

Accumulated depreciation-Equipment

Accumulated depreciation-Buildings

Total shareholders' equity

Dividends payable

Income tax payable

Allowance for Uncollectible Accounts

120

620

225

180

1210

50

80

55

Notes Payable

Interest Payable

600

60

Deferred Revenue

200

TOTALS

3280

3280

Additional information:

1. Land includes land held a possible future plant site $175K and land for the current plant site

S125K.

2. The notes receivable are due in 2023. The balance of $630 includes $30 of accrued interest.

The next interest payment is due in July 2022.

3. Included in the investments are treasury bills of $80K that were purchased in November 2021

and mature in January, 2022; trading securities of S150 which are expected to be sold within the

next year. The balance represents securities expected to be held longer than one year.

4. As of 12/31/21, Stockholders' equity has common stock, $2.00 par value, authorized 250K

shares, and issued 150K shares at an average price of $4.50. The remaining balance in

stockholders' equity is retained earnings.

5. The note payable represents a 12% note, with interest paid annually February 28. The note

matures in installments of S100 beginning 2/28/22.

6. Deferred revenue will be recognized equally over the next 18 months

Required:

Based on all of the information provided, answer the following questions as they would appear

on a classified balance sheet for XYZ Corporation at December 31, 2021.

Select and copy the below sections a-l and answer in the space provided.

As of 12/31/21:

a. Net accounts receivable

b. Total current assets

c. Total Long term investment section

d. Total PP&E section

e. Total intangibles section

f. Total other assets section

g. Total Assets

h. Total Current Liabilities

1. Total Long-term Liabilities

j. Common Stock

k. Paid in capital in excess of par (APIC)

I. Retained earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you