- Property taxes - paid twice a year in April and October 2. The budgeted cash collections in March for the sales made in March is 3. The budgeted cash receipts for the month of April is 4. The budgeted purchases of merchandise for February is 5. The budgeted cash disbursements for operating expenses (other than cost of goods sold) during the month of April is 6. The budgeted cash disbursements to be made in April for merchandise purchases is 7. Assume that the expected cash balance at the beginning of April is P 51,600. How much is the hudgeted cash balance as of April 30? Items 2-7 are based on the following information Pasal Company has just prepared its master budget for the year 2015. Some of the information used in the preparation of such budget is as follows: 1. Budgeted sales: January P 480,000 February 520,000 March 560,000 April 500,000 May 576,000 June 640,000 2. Twenty percent of total sales is cash sales. The collections pattem for the sales on credit is as follows: 30% in the month of sale 40% in the month after the month of sale 25% in the second month after the month of sale 3. Pasol Company's gross margin rate is 60% of sales. 4. Accounts payable arising from merchandise purchases is paid for in the month following the purchase 5. The company desires an inventory at the end of each month equal to 30% of the next month's sales in units. 6. The variable operating expenses (other than cost of goods sold) are 10% of sales and are paid for in the month following the sale. 7. The annual fixed operating expenses are as follows: Depreciation P 336,000 Advertising 576,000 Insurance 144,000 Salaries 864,000 Property taxes 192,000 8. All of the fixed operating expenses are incurred uniformly throughout the year. Cash fixed operating expenses are paid in the month of incurrence, except for: - Insurance – paid quarterly in January, April and July

- Property taxes - paid twice a year in April and October 2. The budgeted cash collections in March for the sales made in March is 3. The budgeted cash receipts for the month of April is 4. The budgeted purchases of merchandise for February is 5. The budgeted cash disbursements for operating expenses (other than cost of goods sold) during the month of April is 6. The budgeted cash disbursements to be made in April for merchandise purchases is 7. Assume that the expected cash balance at the beginning of April is P 51,600. How much is the hudgeted cash balance as of April 30? Items 2-7 are based on the following information Pasal Company has just prepared its master budget for the year 2015. Some of the information used in the preparation of such budget is as follows: 1. Budgeted sales: January P 480,000 February 520,000 March 560,000 April 500,000 May 576,000 June 640,000 2. Twenty percent of total sales is cash sales. The collections pattem for the sales on credit is as follows: 30% in the month of sale 40% in the month after the month of sale 25% in the second month after the month of sale 3. Pasol Company's gross margin rate is 60% of sales. 4. Accounts payable arising from merchandise purchases is paid for in the month following the purchase 5. The company desires an inventory at the end of each month equal to 30% of the next month's sales in units. 6. The variable operating expenses (other than cost of goods sold) are 10% of sales and are paid for in the month following the sale. 7. The annual fixed operating expenses are as follows: Depreciation P 336,000 Advertising 576,000 Insurance 144,000 Salaries 864,000 Property taxes 192,000 8. All of the fixed operating expenses are incurred uniformly throughout the year. Cash fixed operating expenses are paid in the month of incurrence, except for: - Insurance – paid quarterly in January, April and July

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 4P

Related questions

Question

i need help in questions 5-7 that are indicated in the picture below. thank you

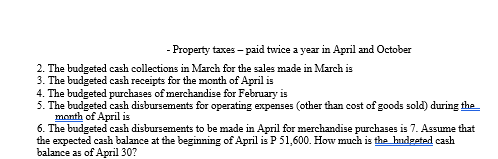

Transcribed Image Text:- Property taxes - paid twice a year in April and October

2. The budgeted cash collections in March for the sales made in March is

3. The budgeted cash receipts for the month of April is

4. The budgeted purchases of merchandise for February is

5. The budgeted cash disbursements for operating expenses (other than cost of goods sold) during the

month of April is

6. The budgeted cash disbursements to be made in April for merchandise purchases is 7. Assume that

the expected cash balance at the beginning of April is P 51,600. How much is the hudgeted cash

balance as of April 30?

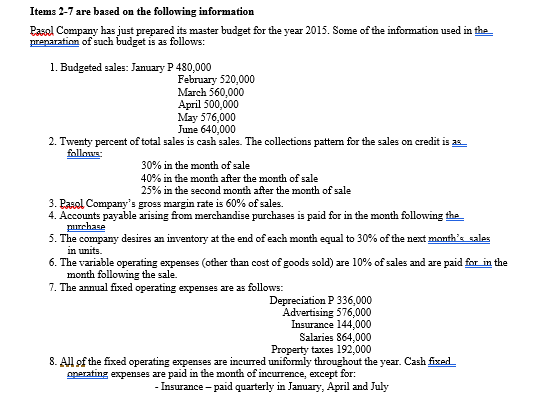

Transcribed Image Text:Items 2-7 are based on the following information

Pasal Company has just prepared its master budget for the year 2015. Some of the information used in the

preparation of such budget is as follows:

1. Budgeted sales: January P 480,000

February 520,000

March 560,000

April 500,000

May 576,000

June 640,000

2. Twenty percent of total sales is cash sales. The collections pattem for the sales on credit is as

follows:

30% in the month of sale

40% in the month after the month of sale

25% in the second month after the month of sale

3. Pasol Company's gross margin rate is 60% of sales.

4. Accounts payable arising from merchandise purchases is paid for in the month following the

purchase

5. The company desires an inventory at the end of each month equal to 30% of the next month's sales

in units.

6. The variable operating expenses (other than cost of goods sold) are 10% of sales and are paid for in the

month following the sale.

7. The annual fixed operating expenses are as follows:

Depreciation P 336,000

Advertising 576,000

Insurance 144,000

Salaries 864,000

Property taxes 192,000

8. All of the fixed operating expenses are incurred uniformly throughout the year. Cash fixed

operating expenses are paid in the month of incurrence, except for:

- Insurance – paid quarterly in January, April and July

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning