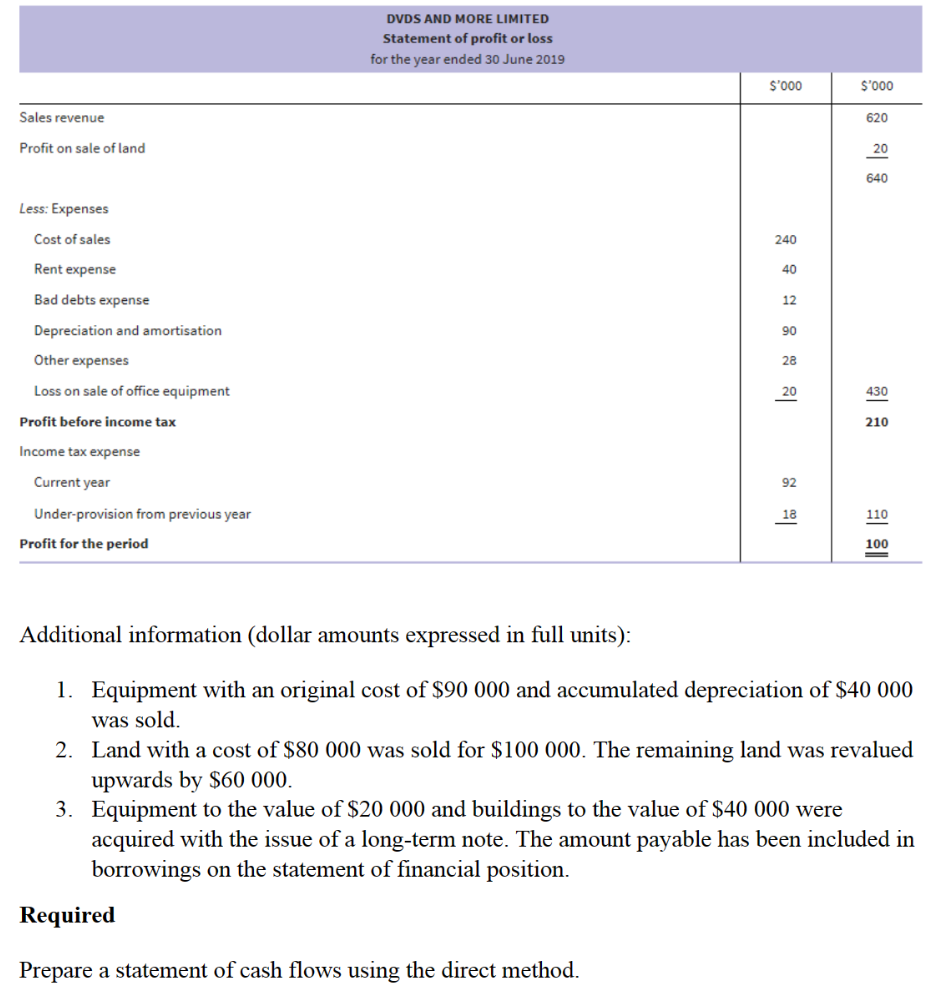

Additional information (dollar amounts expressed in full units): 1. Equipment with an original cost of $90 000 and accumulated depreciation of $40 000 was sold. 2. Land with a cost of $80 000 was sold for $100 000. The remaining land was revalued upwards by $60 000. 3. Equipment to the value of $20 000 and buildings to the value of $40 000 were acquired with the issue of a long-term note. The amount payable has been included in borrowings on the statement of financial position. Required Prepare a statement of cash flows using the direct method.

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Please do not give solution in image format thanku

![PSA11.10 Prepare a statement of cash flows, including asset revaluations, transfer to

reserves, and purchase of assets by issuing debt, using the direct method. [LO3]

The statement of financial position and statement of profit or loss for DVDs and More Limited

is presented as follows.

ASSETS

Current assets

Cash

Accounts receivable

Allowance for doubtful debts

Inventory

Prepaid rent

Total current assets

Non-current assets

Land

Buildings

Accumulated depreciation-buildings

Equipment

Accumulated depreciation-equipment

Patents

Total non-current assets

Total assets

LIABILITIES AND EQUITY

Current liabilities

Accounts payable

Accrued expenses

Income tax payable

Final dividend payable

Total current liabilities

Non-current liabilities

Borrowings

Total liabilities

Equity

Share capital

Revaluation surplus

General reserve

Retained earnings

Total equity

Total liabilities and equity

DVDS AND MORE LIMITED

Statement of financial position

as at 30 June 2019

2019

$'000

165

190

(20)

200

20

555

420

510

(230)

250

(110)

30

870

1385

170

80

92

50

392

310

702

400

108

45

130

683

1385

2018

$'000

80

210

(12)

170

60

508

360

470

(210)

280

(90)

40

850

1318

190

75

45

40

350

410

760

350

48

35

125

558

1318](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fdead88a2-0ef7-48c9-8d78-426ba1780967%2F58d69003-d49e-4023-9e54-f70c2d334cdc%2Fyajhha_processed.png&w=3840&q=75)

Step by step

Solved in 3 steps