Additional information for 2020: 1. Net income was $25,600.

Q: What would a multi-step vertical analysis income income statement look like for Brea Corporation as…

A: Income statementAs of December 31, 2020 Particulars Amount Sales revenue $762,400 Less: Cost…

Q: Suppose these selected condensed data are taken from recent balance sheets of Tyson Farms (in…

A: Tyson Farm's Current ratio : Current ratio is defined as the current assets is divided by the…

Q: Compute the current ratio for each year and comment on your results.

A: Current Ratio: A current ratio is a liquidity ratio that measures the ability of the company to…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Solution: Ratio Formula Target Walmart (1) Current ratio = CURRENT ASSETS/CURRENT…

Q: The following are the values for the month. Calculate the following ratios based on this data Sales…

A: The debt equity ratio is a financial ratio that indicates the firm's ability to meet out its…

Q: Prepare the common-size financial statement for the entities below and provide a reasoned…

A: Common size analysis of financial statements shows each item as percentage of net sales revenue.…

Q: All sales were on credit. Net cash provided by operating activities for 2022 was $242,000. Capital…

A: As per the honor code, we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit…

Q: QI: Use the following multi-step income statement of Ancho Company to prepare a single-step version.…

A: Income Statement can be prepared as a Single Step Income Statement or as a Multi Step Income…

Q: Herbert Wong has extracted the following information from her income statement and balance sheet for…

A: The days in Accounts Receivable period indicates the days of credit sales. It can be calculated by…

Q: Pare Plumbing Products Ltd. reported the following data in 2018 (in millions): Data table 2018…

A: The question is related to Ratio Analysis. The leverage ratio is calculated with the help of…

Q: The comparative balance sheet of Merrick Equipment Co. for Dec. 31 20Y9 and 20Y8 is: Additional data…

A: The cash flow statement represents the cash inflow and cash outflow of the company due to operating,…

Q: Based on the attached balanced sheet and income statement, Computate the ratios and complete the…

A: (Answers of first 3 parts) Ratio analysis Liquidity Ratios 2021 2020 2019 Industry average…

Q: Using the fiscal year end 2020 annual report for General Mills, Inc. and the figures from the 2020…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Selected hypothetical comparative statement data for the giant bookseller Barnes & Noble are…

A: Ratio analysis helps to analyze the financial statements of the company. The management can take…

Q: Calculate the following ratios for 2020 for Holiday Gifts Galore, Inc.:…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Below are the Income Statement and Balance Sheet for Longborg Corporation for the…

A: The profitability ratios are used to measure the profit earning capacity of the entity, The…

Q: EBIT = 4 million Net income = 2 million Calculate the company’s net profit margin Write the formula…

A: Quick assets includes such current assets that can immediately be converted into cash. However,…

Q: Here are the comparative income statements of Ivanhoe Corporation. IVANHOE CORPORATION Comparative…

A: Under Horizontal analysis, comparison is being made for two years by seeing increase or decrease in…

Q: Here are the comparative income statements of Pharoah Corporation. PHAROAH CORPORATION Comparative…

A: Horizontal analysis is that analysis in which current year figures are compared with previous year…

Q: In 2022, Monty Company had net sales of $906,000 and cost of goods sold of $489,240. Operating…

A: Multi-step Income Statement…

Q: Hel Edison Co. reported the following for the current year: Net sales Cost of goods sold Net income…

A: Average Total assets = (Beginning Total assets + Ending Total assets) / 2 =(60000+68000)/2 = $64,000

Q: The following information was taken from the financial statements of Sunland Company: 2021…

A: Net income is the the difference between sales revenue and all the expenses.

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Planton Company had sales of £480,000 during 2019, all on account. Accounts receivable for the year…

A: Accrual basis: Under accrual basis accounting, revenue and expenses are recognized when they are…

Q: The following data were taken from the financial statements of Howard Corporation for the year ended…

A: Solution:- Introduction:- The following formula used to calculate return on assets as follows;-…

Q: Čardinal Industries had the following operating results for 2018: Sales = $34,621; Cost of goods…

A: a) Calculate the net income as shown below: Resultant table Hence, the net income is $1,132.50.

Q: Suppose selected comparative statement data for the giant bookseller Barnes & Noble are presented…

A: Given the following information: Net sales 2020: $4,800 2019: $5,600 Cost of goods sold 2020:…

Q: The following items were taken from the financial statements of Kramer Manufacturing, Inc., over a…

A: Horizontal analysis is done to evaluate the company's performance over multiple periods.

Q: Using the information below, what is Puppy Company's return on equity for 2019? The following…

A: Return on equity (ROE) refers to the evaluation of the profitability of a company through the…

Q: Using the fiscal year end 2020 annual report for General Mills, Inc. and the figures from the 2020…

A: Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational…

Q: Additional data: Market value of stock at 12/31/21 is $80 per share. Ivanhoe sold 42,000 shares of…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Here are the comparative income statements of Carla Vista Corporation. CARLA VISTA CORPORATION…

A: Horizontal analysis shows all increase or decrease in value from one year to another. Vertical…

Q: Halal Berhad’s comparative financial statements for the years ending 31 December 2020, and 2019, are…

A: Times interest earned ratio is one of the profitability ratio which shows how much earnings are…

Q: Stackhouse Industries had the following operating results for 2020: sales = $54,510; cost of goods…

A: Answer a. Earnings before interest and tax(EBIT) = Sales - Cost of Goods Sold - Depreciation Expense…

Q: Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Here are the comparative income statements of Cullumber Corporation. CULLUMBER CORPORATION…

A: Formula: Increase or decrease = Value of 2022 - value of 2021.

Q: During 2021, Blossom Inc. has the following account balances in Income Statement: Sales…

A: Net Income of the business means difference of incomes and expenses of the business. This can be…

Q: CAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are…

A: Solution:- calculation of ratios as follows under:-

Q: The following items were taken from the financial statements of Kramer Manufacturing, Inc., over a…

A:

Q: Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days…

A: "Since you have Posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: CAN SOMEONE HELP ME WITH THE RATIOS? The comparative statements of Wahlberg Company are…

A: Solution:-d Calculation of Current ratio as follows under:-

Q: Compute the following ratios and measurement for 2020 a. cash flow from operations to current…

A: Cash flow from operations to current liabilities ratio is a financial metric that indicates the…

Q: is the current ratio for 2020 and 2019

A:

Q: I need help on this: The Arctic Company's income statement and comparative balance sheets at…

A:

Q: Current Attempt in Progress Here are the comparative income statements of Oriole…

A: Introduction: Horizontal Analysis Of Income Statement: Horizontal analysis is a method of analysing…

Q: The following are extracted from the financial statements of Shawn Co., for 2019, 2018, and 2017.…

A: Ratio Analysis: Ratio analysis is a system of analysis or comparison of the ratio of the company…

Q: Based on the following ratios and percentages, complete the following Income Statement and Balance…

A: Credit sale=Gross profitGross profit percent×100×80%=$2,100,00035×100×80%=$4,800,000

Q: For 2021, Hamilton Company had Sales of $5,700,000 and Cost of Goods Sold of $3,600,000. For 2020,…

A: Vertical analysis is one of the form of financial statement analysis,under which each item is being…

Q: selected financial statement data (in millions) for 2020 are presented below. Compute liquidity…

A: Average collection period ratio indicates the time within which the amount is collected from debtors…

Q: • The following information is extracted from the 2020 financial statements of two companies working…

A: The current ratio reflects the firm's ability to pay the firm's short-term debt using its current…

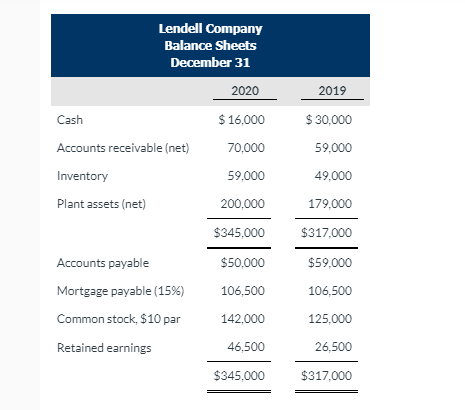

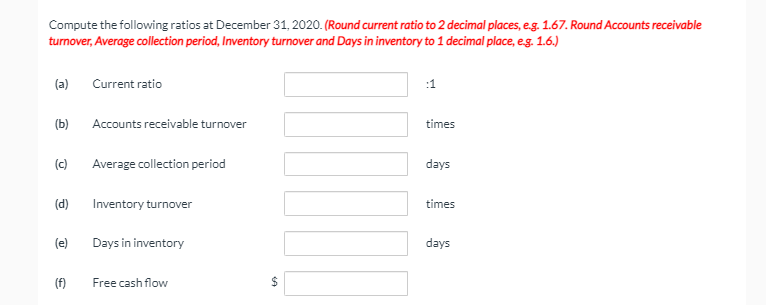

CAN SOMEONE HELP ME FIGURE OUT THE RATIOS BY THE INFORMATION THAT IS GIVIN ?

Additional information for 2020:

| 1. | Net income was $25,600. | |

| 2. | Sales on account were $406,800. Sales returns and allowances amounted to $19,800. | |

| 3. | Cost of goods sold was $199,800. | |

| 4. | Net cash provided by operating activities was $45,700. | |

| 5. | Capital expenditures were $23,600, and cash dividends were $10,200. |

Step by step

Solved in 2 steps

- Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…1. How much is the net share in the profit or loss of the associate (investment income) in 2021? P480,000 P825,000 P420,000 P135,000 2. How much is the carrying amount of the investment as of December 31, 2021? P7,815,000 P8,025,000 P7,680,000 P7,125,000

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).Pax Limited showed the following assets and liabilities in its financial statements at 31 December 2018. DETAILS CARRYING AMOUNT FAIR VALUE PPE 10,000,000 14,000,000 Inventory 4,200,000 4,400,000 Long Term Loans (3,500,000) (3,500,000) Account Payable (2,500,000) (2,500,000) 8,200,000 12,400,000 The current market rate for similar transactions is 8.5% per annum. Chelsea Limited planned to acquire all the assets and liabilities of Pax Limited on 1 July 2018 and agreed to pay R13,400,000 in cash on 1 July 2019 in full settlement of the acquisition. Required: Calculate the purchase consideration. Calculate the goodwill or bargain purchase for this transaction. Prepare the journal entries required in the books of Chelsea Limited relating to this transaction.

- Problem BPeter Senen Corporation provided the following account balances as of September 30, 2020: CashP112,000 Accumulated depreciationP 36,000Accounts Receivable64,000Accounts payable 40,000Finished Goods48,000Income tax payable9,000Work in process 36,000 Share Capital500,000Raw materials 52,000 Retained Earnings207,000Property and Equipment480,000The following transactions occurred during October:1. Materials purchased on account, P150,0002. Materials issued to production: direct materials- P90,000, Indirect materials- P10,000.3. Payroll for the month of October 2020 consisted of the following (also paid during the month):Direct labor P62,000Administrative salariesP16,000Indirect Labor 20,000Sales salaries 30,000Payroll deductions were as follows:Withholding taxes P19,800Phil health contributions P2,000SSS contributions 7,100HDMF contributions 2,0004. Employer contributions for the month were accrued:FactorySellingAdministrativeSSS contributionsP5,700P2,000P1,100Philhealth…tion 8Income statement for the year ended 31 December, 2019 of KKMTN Ghana Ltd2018 2019ȼ ‘000 ȼ ‘000Turnover 420,000 523,600Cost of sales (330,000) (417,200)Gross profit 89,000 106,400Expenses:Administration 44,600 50,200Selling and distribution 15,400 (60,000) 19,600 (69,800)Profit before interest 29,000 36,600Debenture interest - (2,800)Net profit before tax 29,000 33,800Taxation (8,000) (10,000)Net Profit after tax 21,000 23,800Ordinary dividend paid 8,400 9,250Ordinary shares issued 12 million and trading at ȼ3 each as at yesterday onGSE.You are required to compute the following investment ratios:a). Earnings per shareb). Dividend per sharec). Payout ratiod). Price earnings ratioe). Earnings yieldCalculate the proprietary ratio from the following information: Fixed Assets 12,80,000 Current Assets 7,20,000 8% Debentures 5,60,000 10% Mortgage loan 3,30,000 Bank overdraft2,20,000 Trade payabletrade 1,90,000

- PROBLEM 8:Tomas Co. has the following balance sheet as of December 31, 2021.Current assets 180,000.00Fixed assets 120,000.00Total assets 300,000.00Accounts payable 40,000.00Accrued liabilities 20,000.00Notes payable 50,000.00Other Long-term debt 75,000.00Total Equity 115,000.00Total liabilities and equity 300,000.00 In 2021, Tomas Co. reported sales of P1,500,0000, net income of P30,000, and dividends of P18,000. The company expected its sales to increase by 20% by next year and its retention ratio will remain at 40%. Assume that Tomas Co. is operating at full capacity and it uses the AFN approach in determining the amount of external financing needed.How much is the sales for 2022? Using Problem 8, how much is the increase in retained earnings for the purpose of computing the AFN? Using Problem 8, how much external funds needed for the year 2022?Given:Avarege trade receivables of afirm is40.000,average finished goodsis 50.000, cost of goods sold is 200000 and net sales is 250.000. Whatis trade receivables turnover? a. 250.000/40.000b. 40.000/ 200.000c. 40.000/250.000d. 200.000/ 40.000==========5. Activity Ratios are used in the assessment ofa) The financial risk of the companyb) the profitability of the assetsc) the short term debt repayment capacity of the firmd)the efficiency of the asset or the source analyzedGiven:Avarege trade receivables of afirm is40.000,average finished goodsis 50.000, cost of goods sold is 200000 and net sales is 250.000. Whatis trade receivables turnover? a. 250.000/40.000 b. 40.000/ 200.000 c. 40.000/250.000 d. 200.000/ 40.000 ========== 5. Activity Ratios are used in the assessment ofa) The financial risk of the companyb) the profitability of the assetsc) the short term debt repayment capacity of the firm d)the efficiency of the asset or the source analyzed