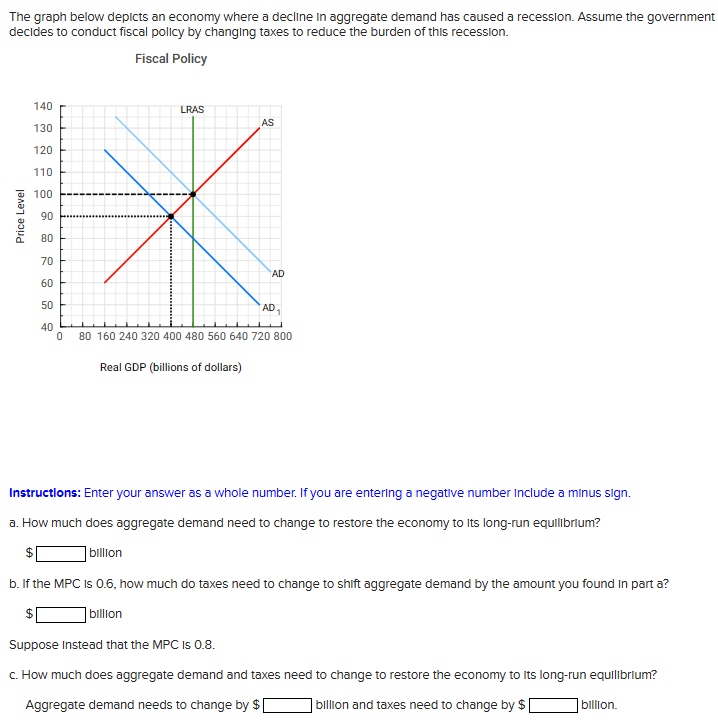

The graph below depicts an economy where a decline in aggregate demand has caused a recession. Assume the government decides to conduct fiscal policy by changing taxes to reduce the burden of this recession. Price Level 140 130 120 110 100 90 90 80 80 28 70 60 50 89 40 0 Fiscal Policy LRAS AS AD AD 80 160 240 320 400 480 560 640 720 800 Real GDP (billions of dollars) Instructions: Enter your answer as a whole number. If you are entering a negative number Include a minus sign. a. How much does aggregate demand need to change to restore the economy to its long-run equilibrium? billion b. If the MPC is 0.6, how much do taxes need to change to shift aggregate demand by the amount you found in part a? $ billion Suppose Instead that the MPC is 0.8. c. How much does aggregate demand and taxes need to change to restore the economy to its long-run equilibrium? Aggregate demand needs to change by $[ billion and taxes need to change by $[ billion.

The graph below depicts an economy where a decline in aggregate

Step by step

Solved in 2 steps