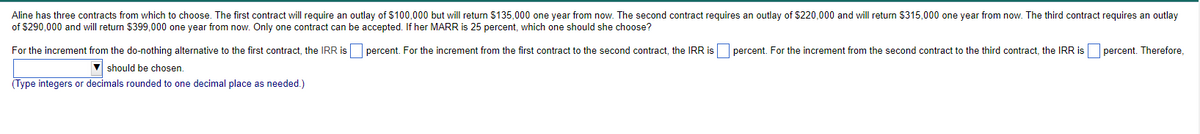

Aline has three contracts from which to choose. The first contract will require an outlay of $100,000 but will return $135,000 one year from now. The second contract requires an outlay of $220,000 and will return $315,000 one year from now. The third contract requires an outlay of $290,000 and will return $399,000 one year from now. Only one contract can be accepted. If her MARR is 25 percent, which one should she choose? percent. For the increment from the first contract to the second contract, the IRR is percent. For the increment from the second contract to the third contract, the IRR is percent. Therefore, For the increment from the do-nothing alternative to the first contract, the IRR is should be chosen. (Type integers or decimals rounded to one decimal place as needed.)

Aline has three contracts from which to choose. The first contract will require an outlay of $100,000 but will return $135,000 one year from now. The second contract requires an outlay of $220,000 and will return $315,000 one year from now. The third contract requires an outlay of $290,000 and will return $399,000 one year from now. Only one contract can be accepted. If her MARR is 25 percent, which one should she choose? percent. For the increment from the first contract to the second contract, the IRR is percent. For the increment from the second contract to the third contract, the IRR is percent. Therefore, For the increment from the do-nothing alternative to the first contract, the IRR is should be chosen. (Type integers or decimals rounded to one decimal place as needed.)

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 92TPC

Related questions

Question

Transcribed Image Text:Aline has three contracts from which to choose. The first contract will require an outlay of $100,000 but will return $135,000 one year from now. The second contract requires an outlay of $220,000 and will return $315,000 one year from now. The third contract requires an outlay

of $290,000 and will return $399,000 one year from now. Only one contract can be accepted. If her MARR is 25 percent, which one should she choose?

percent. For the increment from the first contract to the second contract, the IRR is percent. For the increment from the second contract to the third contract, the IRR is

For the increment from the do-nothing alternative to the first contract, the IRR is

should be chosen.

(Type integers or decimals rounded to one decimal place as needed.)

percent. Therefore,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT