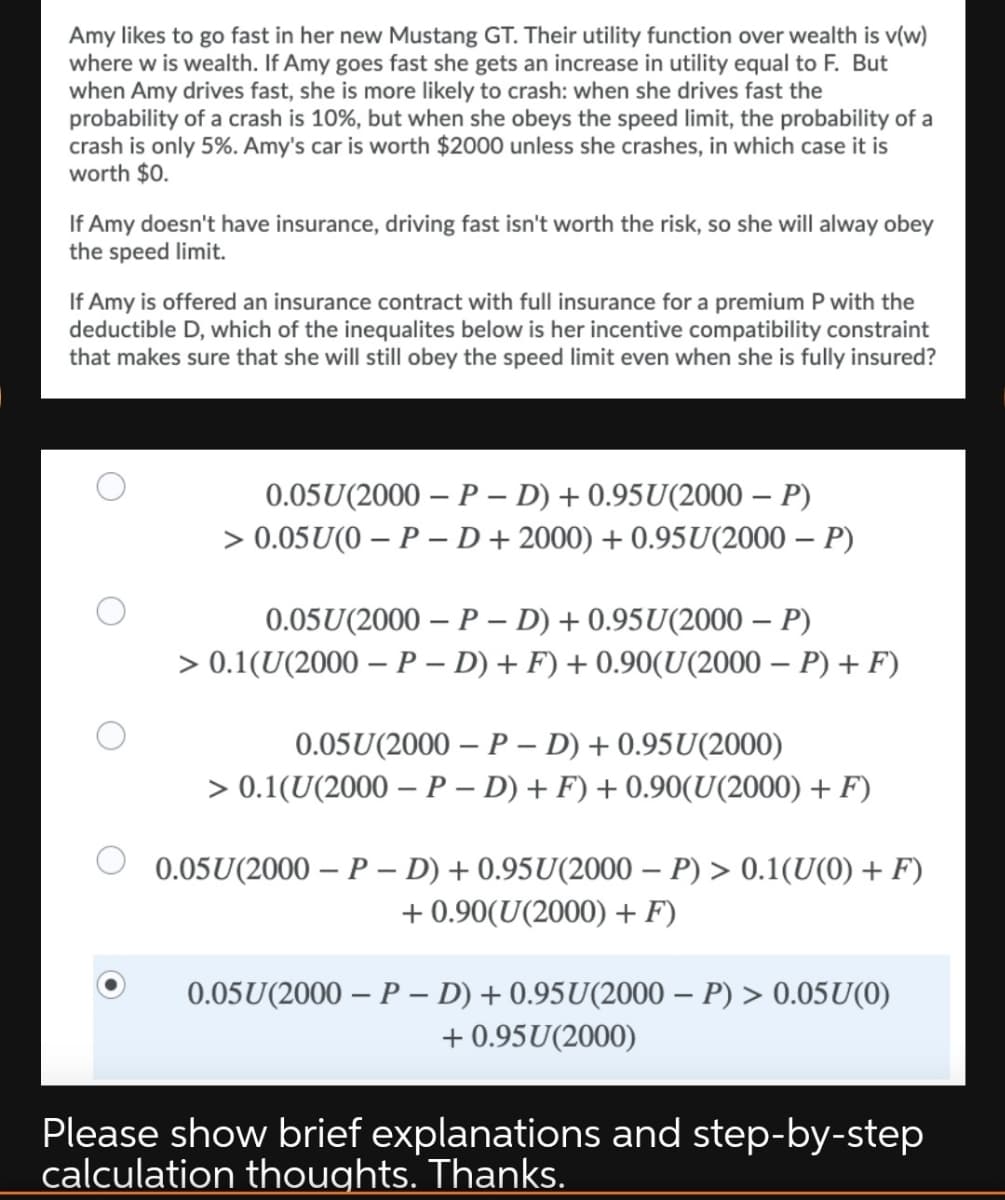

Amy likes to go fast in her new Mustang GT. Their utility function over wealth is v(w) where w is wealth. If Amy goes fast she gets an increase in utility equal to F. But when Amy drives fast, she is more likely to crash: when she drives fast the probability of a crash is 10%, but when she obeys the speed limit, the probability of a crash is only 5%. Amy's car is worth $2000 unless she crashes, in which case it is worth $0. If Amy doesn't have insurance, driving fast isn't worth the risk, so she will alway obey the speed limit. If Amy is offered an insurance contract with full insurance for a premium P with the deductible D, which of the inequalites below is her incentive compatibility constraint that makes sure that she will still obey the speed limit even when she is fully insured?

Amy likes to go fast in her new Mustang GT. Their utility function over wealth is v(w) where w is wealth. If Amy goes fast she gets an increase in utility equal to F. But when Amy drives fast, she is more likely to crash: when she drives fast the probability of a crash is 10%, but when she obeys the speed limit, the probability of a crash is only 5%. Amy's car is worth $2000 unless she crashes, in which case it is worth $0. If Amy doesn't have insurance, driving fast isn't worth the risk, so she will alway obey the speed limit. If Amy is offered an insurance contract with full insurance for a premium P with the deductible D, which of the inequalites below is her incentive compatibility constraint that makes sure that she will still obey the speed limit even when she is fully insured?

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.5P

Related questions

Question

Transcribed Image Text:Amy likes to go fast in her new Mustang GT. Their utility function over wealth is v(w)

where w is wealth. If Amy goes fast she gets an increase in utility equal to F. But

when Amy drives fast, she is more likely to crash: when she drives fast the

probability of a crash is 10%, but when she obeys the speed limit, the probability of a

crash is only 5%. Amy's car is worth $2000 unless she crashes, in which case it is

worth $0.

If Amy doesn't have insurance, driving fast isn't worth the risk, so she will alway obey

the speed limit.

If Amy is offered an insurance contract with full insurance for a premium P with the

deductible D, which of the inequalites below is her incentive compatibility constraint

that makes sure that she will still obey the speed limit even when she is fully insured?

0.05U(2000 – P – D) + 0.95U(2000 – P)

> 0.05U(0 – P – D + 2000) + 0.95U(2000 – P)

0.05U(2000 – P – D) + 0.95U(2000 – P)

> 0.1(U(2000 – P – D) + F) + 0.90(U(2000 – P) + F)

0.05U(2000 – P – D) + 0.95U(2000)

> 0.1(U(2000 – P – D) + F) + 0.90(U(2000) + F)

0.05U(2000 – P – D) + 0.95U(2000 – P) > 0.1(U(0) + F)

+ 0.90(U(2000) + F)

0.05U(2000 – P – D) + 0.95U(2000 – P) > 0.05U(0)

+ 0.95U(2000)

Please show brief explanations and step-by-step

calculation thoughts. Thanks.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning