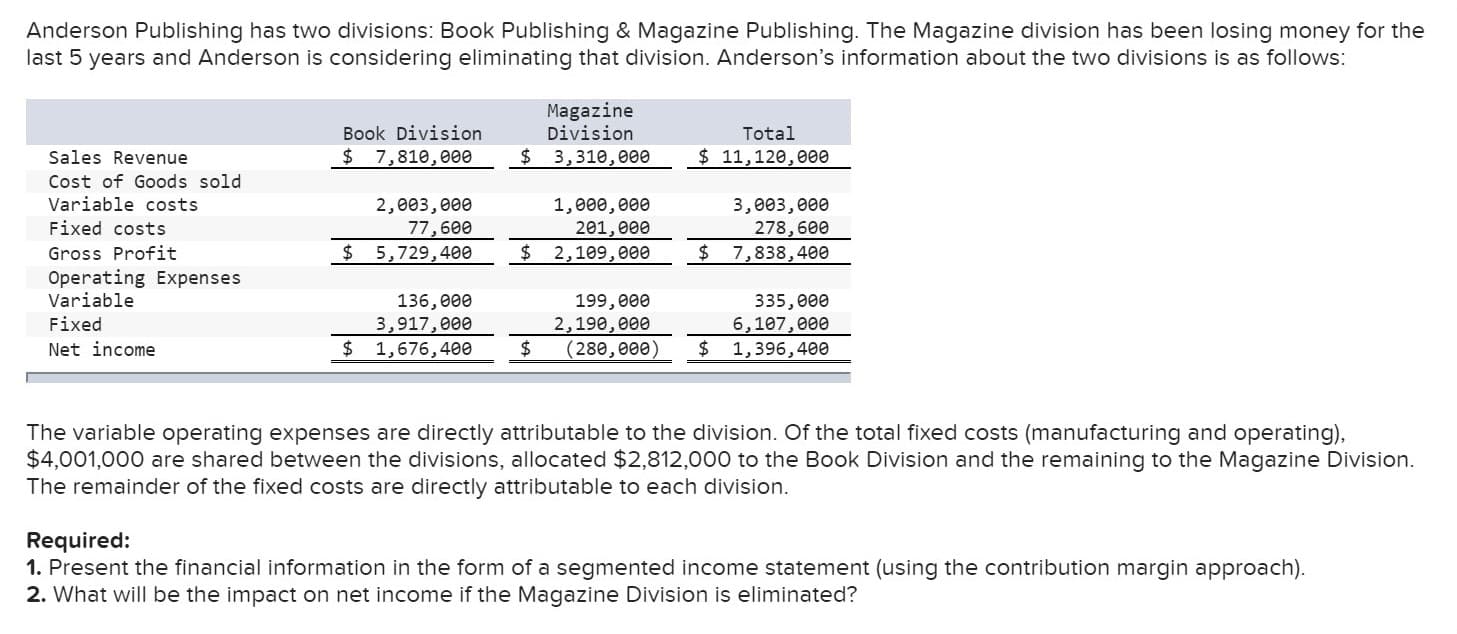

Anderson Publishing has two divisions: Book Publishing & Magazine Publishing. The Magazine division has been losing money for the last 5 years and Anderson is considering eliminating that division. Anderson's information about the two divisions is as follows: Magazine Division Total Book Division $ 7,810,000 $ 3,310,000 $11,120,e00 Sales Revenue Cost of Goods sold Variable costs Fixed costs 3,003,000 278,600 2,003,000 77,600 $ 5,729,400 1,000,000 201,eee 2,109,e0e Gross Profit Operating Expenses Variable $ 7,838,400 136,000 3,917,000 $ 1,676,400 199,000 2,190,000 $ 335,000 6,107,000 $ 1,396,400 Fixed (280,eee) Net income The variable operating expenses are directly attributable to the division. Of the total fixed costs (manufacturing and operating), $4,001,000 are shared between the divisions, allocated $2,812,000 to the Book Division and the remaining to the Magazine Division The remainder of the fixed costs are directly attributable to each division. Required: 1. Present the financial information in the form of a segmented income statement (using the contribution margin approach). 2. What will be the impact on net income if the Magazine Division is eliminated?

Anderson Publishing has two divisions: Book Publishing & Magazine Publishing. The Magazine division has been losing money for the last 5 years and Anderson is considering eliminating that division. Anderson's information about the two divisions is as follows: Magazine Division Total Book Division $ 7,810,000 $ 3,310,000 $11,120,e00 Sales Revenue Cost of Goods sold Variable costs Fixed costs 3,003,000 278,600 2,003,000 77,600 $ 5,729,400 1,000,000 201,eee 2,109,e0e Gross Profit Operating Expenses Variable $ 7,838,400 136,000 3,917,000 $ 1,676,400 199,000 2,190,000 $ 335,000 6,107,000 $ 1,396,400 Fixed (280,eee) Net income The variable operating expenses are directly attributable to the division. Of the total fixed costs (manufacturing and operating), $4,001,000 are shared between the divisions, allocated $2,812,000 to the Book Division and the remaining to the Magazine Division The remainder of the fixed costs are directly attributable to each division. Required: 1. Present the financial information in the form of a segmented income statement (using the contribution margin approach). 2. What will be the impact on net income if the Magazine Division is eliminated?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter24: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 3CMA

Related questions

Question

Transcribed Image Text:Anderson Publishing has two divisions: Book Publishing & Magazine Publishing. The Magazine division has been losing money for the

last 5 years and Anderson is considering eliminating that division. Anderson's information about the two divisions is as follows:

Magazine

Division

Total

Book Division

$ 7,810,000

$ 3,310,000

$11,120,e00

Sales Revenue

Cost of Goods sold

Variable costs

Fixed costs

3,003,000

278,600

2,003,000

77,600

$ 5,729,400

1,000,000

201,eee

2,109,e0e

Gross Profit

Operating Expenses

Variable

$

7,838,400

136,000

3,917,000

$ 1,676,400

199,000

2,190,000

$

335,000

6,107,000

$ 1,396,400

Fixed

(280,eee)

Net income

The variable operating expenses are directly attributable to the division. Of the total fixed costs (manufacturing and operating),

$4,001,000 are shared between the divisions, allocated $2,812,000 to the Book Division and the remaining to the Magazine Division

The remainder of the fixed costs are directly attributable to each division.

Required:

1. Present the financial information in the form of a segmented income statement (using the contribution margin approach).

2. What will be the impact on net income if the Magazine Division is eliminated?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College