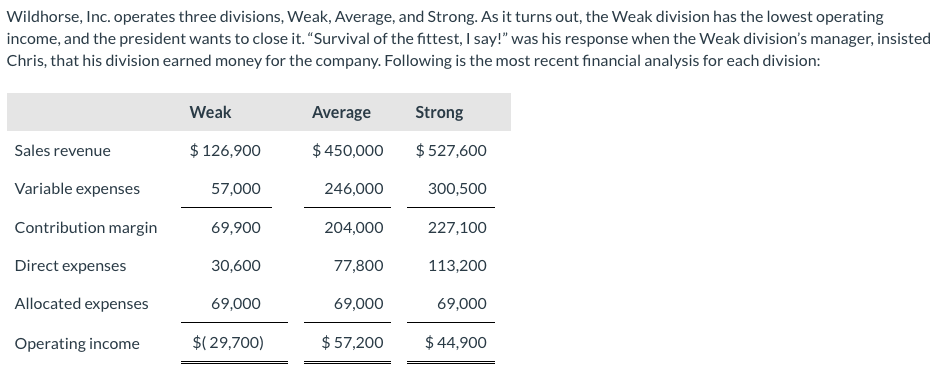

Wildhorse, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the Weak division has the lowest operating income, and the president wants to close it. "Survival of the fittest, I say!" was his response when the Weak division's manager, insisted Chris, that his division earned money for the company. Following is the most recent financial analysis for each division: Weak Average Strong Sales revenue $ 126,900 $ 450,000 $ 527,600 Variable expenses 57,000 246,000 300,500 Contribution margin 69,900 204,000 227,100 Direct expenses 30,600 77,800 113,200 Allocated expenses 69,000 69,000 69,000 Operating income $( 29,700) $ 57,200 $ 44,900

Q: Use share point analysis to determine how much Ben's should increase their administrative…

A: Ben's Tasty Rigatoni sales revenue =$2,560,000 Industry sales = $16,000,000 costs of the goods…

Q: Eacher Wares is a division of a major corporation. The following data are for the latest year of…

A: Hi student Since there are multiple subparts, we will answer only first three subparts. If you want…

Q: Cabell Products is a division of a major corporation. Last year the division had total sales of…

A: Solution:- Calculation of divisional turnover as follows under:-

Q: Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance…

A: Contribution margin = Sales - Variable costs Net Income (Loss )= Contribution margin - Fixed costs

Q: Ceder Products is a division of a major corporation. Last year the division had total sales of…

A: Margin = Net operating income / Total sales

Q: Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for…

A: Contribution Margin: It is the part of sales revenue to cover the fixed costs of the company…

Q: began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for…

A: Given:

Q: The Cook Corporation has two divisions--East and West. The divisions have the following revenues and…

A: Elimination of the west reduces the variable cost and traceable fixed costs but allocated common…

Q: Jan Shumard, president and general manager of Danbury Company, was concerned about thefuture of one…

A: Fixed costs are those costs which will not be changed with change in activity level upto a…

Q: Jacob Products is a division of a major corporation. Last year the division had total sales of…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: The Furniture Company currently has three divisions: Maple, Oak, and Cherry. The oak furniture line…

A: The discontinuity of a segment of the business can be evaluated by measuring the various elements…

Q: Darren Dillard, majority stockholder and president of Dillard, Inc., is working with his top…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: 1 know headquarters wants us to add that new product line," said Dell Havesi, manager of Billings…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Yin-Yang Corporation is composed of three operating divisions. Overall, the Yin-Yang Corporation has…

A: It is stated that Yin-Yang Corporation evaluates its managers on the basis of return on investment.…

Q: Handle Fabrication is a division of a major corporation. Last year the division had total sales of…

A: Solution 1: Total net operating income for division after making additional investment = $2,100,000…

Q: Oriole, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the Weak division…

A: Segment margin is a particular segment's operating income with all the sales revenue and expenses…

Q: Soar Incorporated is considering eliminating its mountain bike division, which reported an operating…

A: Operating Income : The operating income find Total revenue less operating expenses. It does not…

Q: Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for…

A:

Q: Oriole, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the Weak division…

A: Hey there since you have posted multiple questions, we can answer only first question, please…

Q: The Kelsh Company has two divisions--North and South. The divisions have the following revenues and…

A: SOLUTION- OPERATING LOSS OCCURS WHEN A COMPANY'S OPERATING EXPENSES EXCEEDS GROSS PROFITS (OR…

Q: Karim Ahmed, a recent graduate of an accounting program, evaluated the operating performance of…

A: Explanation of Concept Cost is the expenses which have been incurred for production, marketing and…

Q: Terra Company has two divisions, the Retail Division and the Wholesale Division. The following…

A: Return on Investment: Return on investment, often known as ROI, is a mathematical formula that…

Q: Brutus is a division of Madam Medusa's Pawn Shop/Boutique, Inc. Last year, the division generated…

A: For every dollar of sales revenue generated, $0.056 of income is earned. ($609,840 / $3,000,000)…

Q: Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance…

A: Elimination of Division: You may have gotten the impression by now that the elimination procedure is…

Q: %. (a) Compute the return on investment (ROI) for the current year. (Round ROI to 2 decimal places,…

A: Return on Investment (ROI): It establishes the relationship between the net income and the assets or…

Q: before I make any move. Our division’s return on investment (ROI) has led the company for three…

A: Hence, 0.105 % is the profit margin for this year. It is obtained by dividing net operating income…

Q: I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings…

A: Margin= Net operating Income/Sales = 1814600/21100000 = 8.6% Turnover=…

Q: Handle Fabrication is a division of a major corporation. Last year the division had total sales of…

A: Solution 1: Annual operating income of division after making additional investment = $1,820,000 +…

Q: Compute the Office Products Division’s ROI for this year. 2. Compute the Office Products Division’s…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance…

A: Note: In this question, Fixed costs are irrelevant cost in decision making because they will…

Q: Linda Mars, a recent graduate of Bell's accounting program, evaluated the operating performance of…

A: Under marginal costing, costs are divided into fixed and variable costs. Fixed cost is an…

Q: . The Milbam Company has two divisions - East and West. The divisions have the following revenues…

A: Net profit means the difference between the income and expenses. Financial statement means the…

Q: Top management can’t understand why the Leather Division has such a low segment margin when its…

A: What is meant by Contribution? It is the profit that remains after deducting the variable expense…

Q: Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance…

A: Elimination of Division: A division would be eliminated if it is continuously generating loss to the…

Q: I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings…

A: Return on Investment(ROI):-It is performance measures that evaluate investment efficiency in…

Q: Augustus Electrical Company has 2 divisions, one in Georgetown and one in Berbice Guyana and…

A: Return on investment (ROI) is a relative measure to measure a divisional performance in the…

Q: Karim Ahmed, a recent graduate of an accounting program, evaluated the operating performance of…

A: Under Incremental analysis only those eliminates will be consider which will effected if division…

Q: Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for…

A: Contribution margin income statement shows variable costs and fixed costs in such a manner so that…

Q: P2,000,000 P480,000…

A: No, i wont agree with his presentation. because even if we stop the production from southern…

Q: Blue is the controller at the Acme Shoe Company, a large manufacturing company located in Franklin,…

A: Performance appraisal is process in which performance of managers and employees are assessed; and on…

Q: Rice Corporation currently operates two divisions which had operating results last year as follows:…

A: it is given that, If the Troy Division had been eliminated at the beginning of last year, Rice…

Q: You are the division president of Stable Division of Gigabit Inc. Your best friend is the division…

A: 1. Determination of cost allocation method for personal department. It would be appropriate to…

Q: Mindspin Labs Inc. is a manufacturing firm that has experienced strong competition in its…

A: ROI, simply return on investment, seems to be a frequently used metric for calculating the amount of…

Q: When Mr. Ree Active, president and chief executive of Precious Products Inc., first saw the…

A: Sales revenue: It is the revenue earned by a business on selling the goods or providing services to…

Q: The Kelsh Company has two divisions North and South. The divisions have the following revenues and…

A: The question is based on the concept of Financial Management.

Q: “I know headquarters wants us to add that new product line,” said Dell Havasi, manager of Billings…

A: Hence, 10.40 % is the profit margin for this year. It is obtained by dividing net operating income…

Q: Handle Fabrication is a division of a major corporation. Last year the division had total sales of…

A: Average operating assets after investment = $7,300,000 + 700,000 = $8,000,000 Average operating…

Q: Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for…

A: This is a decision making sum in which we have to consider the proposal of the Marketing Department…

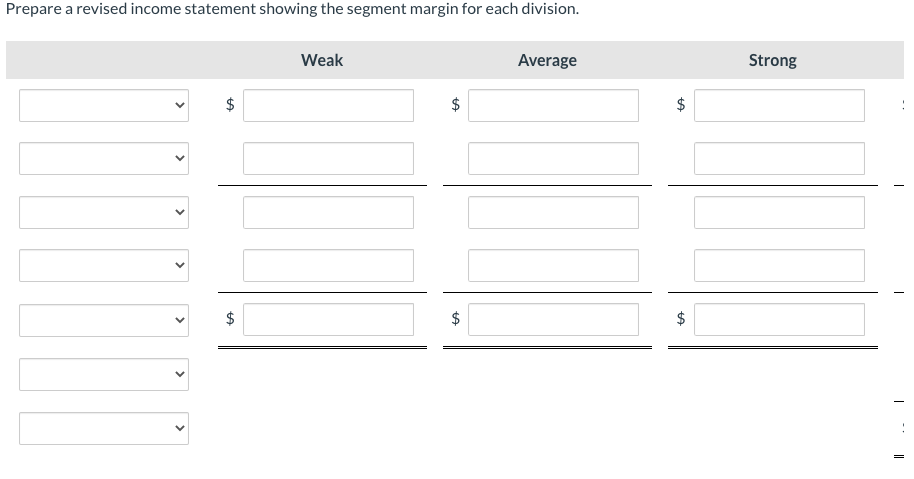

Each drop down option: (Direct Costs, Contribution Margin, Operationg Income, Segment Margin, Variable Exspences, Allocated Exspences, Sales)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

- At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.Dantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)Bill Fremont, division controller and CMA, was upset by a recent memo he received from the divisional manager, Steve Preston. Bill was scheduled to present the divisions financial performance at headquarters in one week. In the memo, Steve had given Bill some instructions for this upcoming report. In particular, Bill had been told to emphasize the significant improvement in the divisions profits over last year. Bill, however, didnt believe that there was any real underlying improvement in the divisions performance and was reluctant to say otherwise. He knew that the increase in profits was because of Steves conscious decision to produce more inventory. In an earlier meeting, Steve had convinced his plant managers to produce more than they knew they could sell. He argued that by deferring some of this periods fixed costs, reported profits would jump. He pointed out two significant benefits. First, by increasing profits, the division could exceed the minimum level needed so that all the managers would qualify for the annual bonus. Second, by meeting the budgeted profit level, the division would be better able to compete for much-needed capital. Bill objected but had been overruled. The most persuasive counterargument was that the increase in inventory could be liquidated in the coming year as the economy improved. Bill, however, considered this event unlikely. From past experience, he knew that it would take at least two years of improved market demand before the productive capacity of the division was exceeded. Required: 1. Discuss the behavior of Steve Preston, the divisional manager. Was the decision to produce for inventory an ethical one? 2. What should Bill Fremont do? Should he comply with the directive to emphasize the increase in profits? If not, what options does he have? 3. Chapter 1 listed ethical standards for management accountants. Identify any standards that apply in this situation.

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?Bannister Company, an electronics firm, buys circuit boards and manually inserts various electronic devices into the printed circuit board. Bannister sells its products to original equipment manufacturers. Profits for the last two years have been less than expected. Mandy Confer, owner of Bannister, was convinced that her firm needed to adopt a revenue growth and cost reduction strategy to increase overall profits. After a careful review of her firms condition, Mandy realized that the main obstacle for increasing revenues and reducing costs was the high defect rate of her products (a 6 percent reject rate). She was certain that revenues would grow if the defect rate was reduced dramatically. Costs would also decline as there would be fewer rejects and less rework. By decreasing the defect rate, customer satisfaction would increase, causing, in turn, an increase in market share. Mandy also felt that the following actions were needed to help ensure the success of the revenue growth and cost reduction strategy: a. Improve the soldering capabilities by sending employees to an outside course. b. Redesign the insertion process to eliminate some of the common mistakes. c. Improve the procurement process by selecting suppliers that provide higher-quality circuit boards. Required: 1. State the revenue growth and cost reduction strategy using a series of cause-and-effect relationships expressed as if-then statements. 2. Illustrate the strategy using a strategy map. 3. Explain how the revenue growth strategy can be tested. In your explanation, discuss the role of lead and lag measures, targets, and double-loop feedback.

- Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.Jarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.Oriole, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the Weak division has the lowest operating income, and the president wants to close it. “Survival of the fittest, I say!” was his response when the Weak division’s manager insisted that his division earned money for the company. Following is the most recent financial analysis for each division: Weak Average Strong Sales revenue $125,200 $349,800 $524,500 Variable expenses 55,000 192,300 302,200 Contribution margin 70,200 157,500 222,300 Direct expenses 32,900 75,100 116,600 Allocated expenses 59,800 59,800 59,800 Operating income $(22,500 ) $22,600 $45,900 (a) Prepare a revised income statement showing the segment margin for each division. Weak Average Strong Total Variable expenseOperating income Contribution margin Direct costs Allocated…

- Oriole, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the Weak division has the lowest operating income, and the president wants to close it. “Survival of the fittest, I say!” was his response when the Weak division’s manager insisted that his division earned money for the company. Following is the most recent financial analysis for each division: Weak Average Strong Sales revenue $125,200 $349,800 $524,500 Variable expenses 55,000 192,300 302,200 Contribution margin 70,200 157,500 222,300 Direct expenses 32,900 75,100 116,600 Allocated expenses 59,800 59,800 59,800 Operating income $(22,500 ) $22,600 $45,900 (a) Your answer is correct. Prepare a revised income statement showing the segment margin for each division. Weak Average Strong Total Variable expenseOperating income…Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance of Dunn Company’s six divisions. Veronica made the following presentation to Dunn’s board of directors and suggested the Percy Division be eliminated. “If the Percy Division is eliminated,” she said, “our total profits would increase by $25,700.” The OtherFive Divisions PercyDivision Total Sales $1,663,000 $100,900 $1,763,900 Cost of goods sold 977,800 76,100 1,053,900 Gross profit 685,200 24,800 710,000 Operating expenses 526,900 50,500 577,400 Net income $158,300 $ (25,700 ) $132,600 In the Percy Division, cost of goods sold is $59,300 variable and $16,800 fixed, and operating expenses are $30,400 variable and $20,100 fixed. None of the Percy Division’s fixed costs will be eliminated if the division is discontinued.Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your…Veronica Mars, a recent graduate of Bell’s accounting program, evaluated the operating performance of Dunn Company’s six divisions. Veronica made the following presentation to Dunn’s board of directors and suggested the Percy Division be eliminated. “If the Percy Division is eliminated,” she said, “our total profits would increase by $27,000.” The OtherFive Divisions PercyDivision Total Sales $1,665,000 $100,000 $1,765,000 Cost of goods sold 978,300 76,600 1,054,900 Gross profit 686,700 23,400 710,100 Operating expenses 528,100 50,400 578,500 Net income $158,600 $ (27,000 ) $131,600 In the Percy Division, cost of goods sold is $60,100 variable and $16,500 fixed, and operating expenses are $29,200 variable and $21,200 fixed. None of the Percy Division’s fixed costs will be eliminated if the division is discontinued.Is Veronica right about eliminating the Percy Division? Prepare a schedule to support your…